The economic recovery from the COVID pandemic has been much better than anyone predicted. Global consumption is expected to boom on the back of a successful vaccine rollout and inflation is a real possibility. Too much inflation eventually drives interest rates higher, which has widespread implications for asset prices and may drive a changing of the guard across equity markets.

We are seeing signs of inflation already:

- Freight costs are higher, whether by land, sea or air

- Semiconductor shortages are playing havoc with automotive supply chains

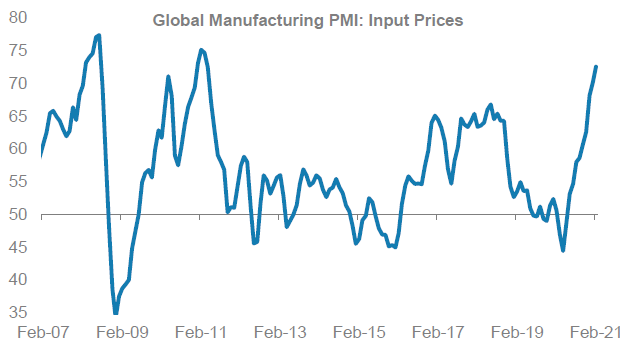

- Manufacturing firms are pointing to higher prices paid for inputs

- Commodity prices are rising after years of under investment

- Oil is back around $60 despite a large part of the world still in lockdown.

Manufacturers facing rising input costs (Over 50 indicates expansion)

Source: Markit, Morgan Stanley Research.

This is in a large part driven by either 1) speculative activity positioning for inflation, or 2) physical supply chain tightness following the 2020 destocking of inventories (as companies focused on cash generation during the pandemic). But warning signs are there, and we are now faced with the prospect that improving demand adds fuel to the inflation fire as we move through 2021 and beyond:

- A vaccine-driven reopening is underway in the US and Europe.

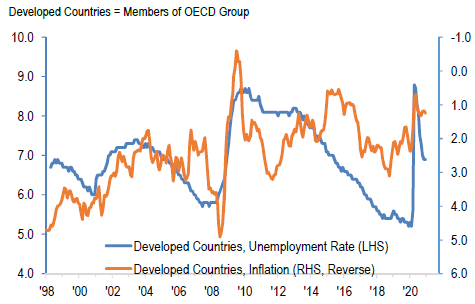

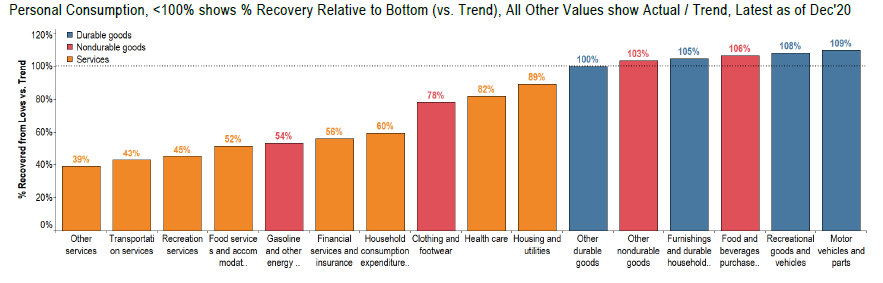

- This should unleash significant pent-up demand for physical consumption. Significant US job losses are in COVID-sensitive industries and these jobs should come back as people return to restaurants, sporting events, gyms, vacations, in-person trade shows and more.

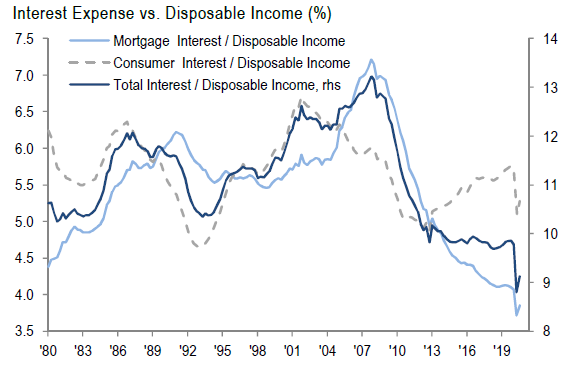

- There is cash to splash; US households are in the best shape in decades; debt servicing ratios are at 40-year lows and US$11.3T in household cash reserves are a record. Add to that the wealth effect from rising stock prices and increasing home equity.

- Hugely supportive fiscal stimulus and low interest rates add further impetus.

There are always risks. We could face a curve ball from ongoing virus mutations. But the combination of supply-side tightness and quickly improving demand leaves inflation a real possibility.

Consumer debt servicing is at 40-year lows

Unemployment is falling quickly

Sources: J.P. Morgan US Equity Strategy & Global Quantitative Research

Consumption of services is still well-below pre-pandemic levels

Source: J.P. Morgan US Equity Strategy & Global Quantitative Research, BEA

Inflation has implications for interest rates (which have been in a downward trend for 40 years), should it surprise in its magnitude and duration. Inflation and higher interest rates have negative implications for asset prices as future cash flows are no longer as valuable. But improving economies also bode well for the earnings growth of traditionally more cyclical companies, many of which are also inflation beneficiaries. These cyclical companies usually trade at a lower multiple of earnings than companies with higher earnings growth. However, in a world of low growth that discount expanded significantly as market participants were willing to pay a higher premium for growth. When earnings growth becomes more plentiful growth loses its scarcity premium, helping the relative valuations of companies leveraged to a recovery.

The sustainability of all this is key. Some of the demand impulses are akin to the jolt we might get from our morning flat white; the buzz fades over time. Deflationary forces including demographics, globalisation and technology have been present for decades. However, we can make the case that globalisation peaked prior to the pandemic and in the pandemic’s wake corporate management teams are rethinking and diversifying supply chains which trades efficiency for surety of supply and nationalism. This is inherently inflationary. But it isn’t all one direction. Technology will continue to provide productivity improvements to help offset, despite the possibility that those productivity improvements become more incremental than we’ve seen in the past 20 years.

We continue to focus our research effort on good quality companies. We see exciting prospects in parts of the “old economy” but we are of course also excited by those companies that combine both secular tailwinds with reasonable valuations. Unfortunately, these are scarcer than they once were. The free ride on expanding valuations may be running out of steam.