We often tell investors “it is about time in the market rather than timing the markets”.

One of our Senior Investment Analysts, Stephanie Perrin recently wrote about the acceleration of growth in e-commerce due to COVID-19, noting Amazon’s dominance in this space and the company’s 75% share price appreciation since the lows of March 2020.

Active portfolio managers face a dilemma when seeking to generate above average returns for clients. All Milford portfolios with an exposure to growth assets have a recommended investment time horizon of at least three years, higher risk portfolios have a recommended time horizon of five years or more. Milford’s Aggressive KiwiSaver Fund has a recommended investment time horizon of 15 years.

Despite acknowledging the recommended investment time horizons for our funds, as investors, most of us struggle to avoid comparing returns month by month or even week by week. So we ask Portfolio Managers to deliver superior returns, which requires them to discover nuggets of value not yet priced in the market, we tell them they have three to five years (or more) to realise those superior returns and then we expect to see that value reflected each month or week in investment balances. It is a tough ask!

Started by Jeff Bezos in 1994 and at times run from the boot of his car, Amazon listed on the share market in 1997 with a price of $18 per share. Time does not permit a full description of Amazon’s business model but it now includes online books, logistics, artificial intelligence and cloud computing.

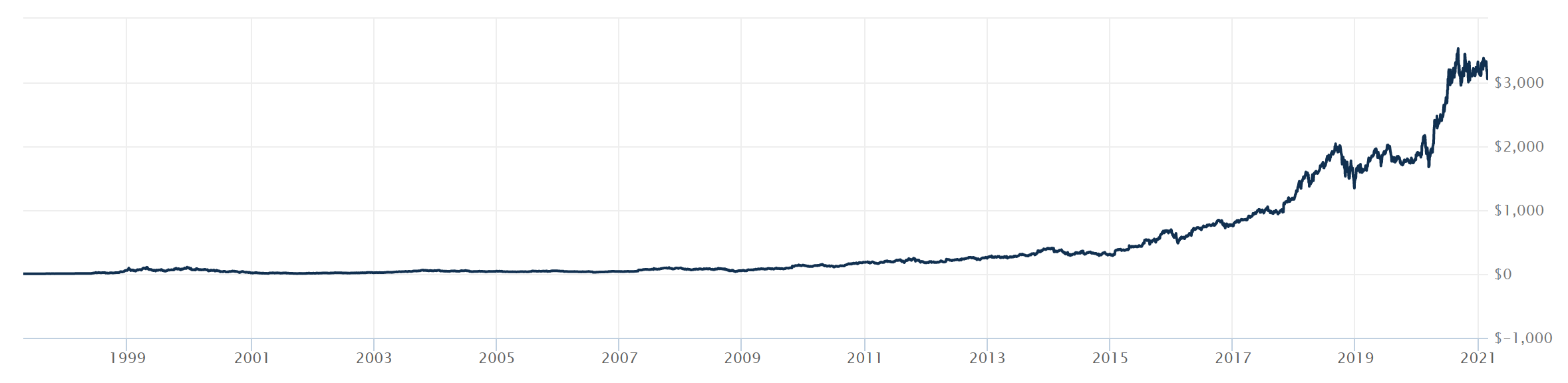

Amazon share price since IPO

Source: Barron’s

The chart above shows Amazon’s share price since listing. The real risk for investors would have been to sell too early during one of the flat periods on the chart. It is hard to identify businesses with an ability to grow their value over decades, short term performance expectations can make it even harder to hold on to them when you do. This is something our Portfolio Managers are adept at doing, the depth of research the team undertakes on each investment gives them the conviction to see the long-term view and to achieve results for investors.