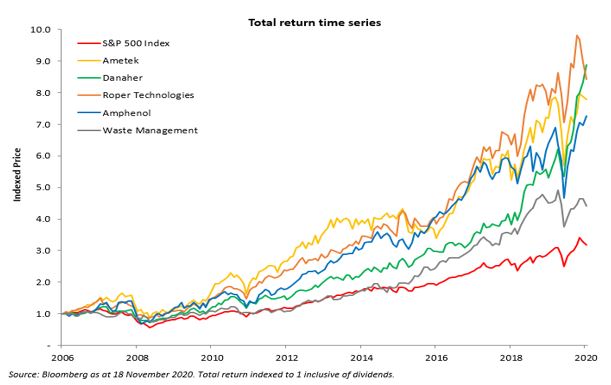

Corporate history is littered with acquisitions gone wrong. But history also unearths companies that have consistently created significant value via acquisitions, with attractive returns attached. Companies can grow in two ways; internally (“organically”), or via acquisition. Many investors prefer companies led by organic growth and some dismiss acquisition-led growth entirely.

At Milford, we aren’t so dismissive but evaluate such stocks with due diligence, seeking acquirers that also have a path to organic growth, and maintain an effective acquisition framework that focuses on quality companies. Whilst complex, we’ve found these investments can be very rewarding.

Organic growth is achieved via investment in product development, sales & marketing, and production facilities. Acquiring another company’s assets is perceived to be riskier. What skeletons will be unearthed? How will the businesses be integrated? What is the right price to pay? Or to maintain the growth narrative, will management complete a deal that is simply a step too far from home?

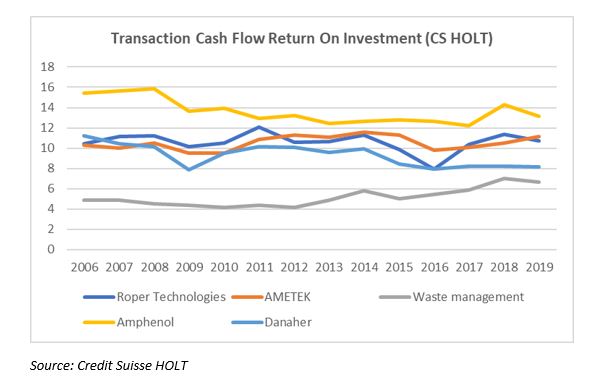

Companies we’ve recently researched include AMETEK, Amphenol, Assa Abloy, Constellation Software, Danaher, Halma, Roper Technologies, TransDigm, and Waste Management.

These companies operate in different industries and approach acquisitions differently, but in our experience successful acquisition strategies have these commonalities:

- Management consistently follow a well-defined process;

- Management can articulate the characteristics of targets;

- Management maintain discipline with return hurdles that are non-negotiable;

- There is deal ownership and accountability;

- The path to value creation and integration is carefully planned;

- A well-developed oversight and reporting framework exists;

- Culture is compatible;

- “Transformational” deals are rare, deal sizes are typically small vs. the size of the acquirer.

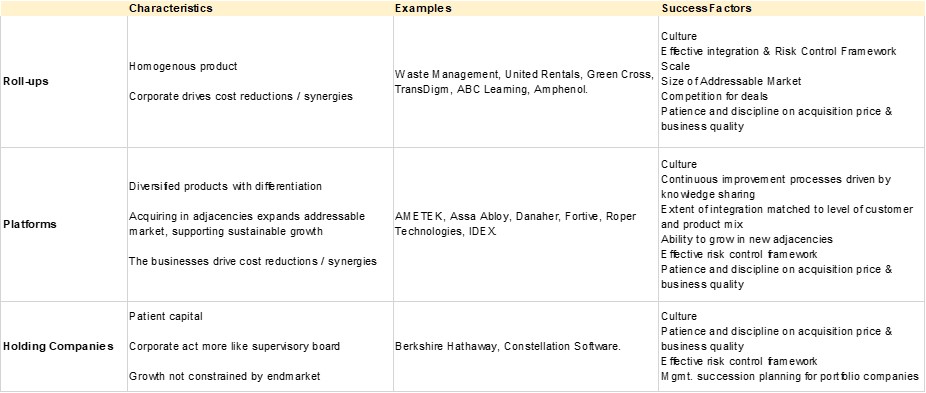

Generally, we can categorise acquirers as Roll-ups, Platforms and Holding Companies. There is no right or wrong category to invest with, but our evaluation of each differs.

Roll-ups

Roll-ups are often similar in their product or service and long-term growth is usually limited by the size of the addressable market. Deal discipline can be harder to maintain as the company grows. Scale benefits and cost cutting are the typical path to value creation; fast, effective integration is paramount and the most successful quickly standardise on a common Enterprise Resource Planning (ERP) system. Done well, roll-ups can be excellent investments, but this category, more than any, has its share of failures (recall ABC Learning’s ill-fated acquisition spree).

Holding Companies

Holding companies (like Warren Buffet’s Berkshire Hathaway) are at the other end of the spectrum; acquired businesses may be entirely unrelated. We find that the holding company’s management is typically not involved operationally but maintains an oversight and advisory role. Acquired companies require strong management and succession planning. Value is created through patience and discipline on acquisition price & business quality. Growth is not constrained by a specific end-market.

Platform Strategies

We see platform strategies as the sweet spot; platformers focus on similar products in existing or adjacent end-markets, which expands the addressable market in a way roll-ups cannot, enabling more sustainable long-term growth. Many successful platformers target giants-in-their-niche where scale is leveraged creating pricing power and sustainable competitive advantage. The most successful platforms have developed continuous improvement processes that leverage knowledge sharing, and balance benefits of autonomy and accountability against potential cost savings, which diminish as the product offering and customer base becomes more varied. AMETEK is a less well-known diversified industrial company; it typically acquires instrumentation companies in existing and adjacent markets and integrates more than others, but the businesses (not corporate) identify savings and other efficiencies. This contrasts with Roper Technologies which acquires software companies with lower overlap; acquired companies are usually maintained as standalone entities. Value creation relies on incentive structures and Socratic coaching methods to invigorate growth and cash generation.

Lastly, to be scalable and manage risks, reporting lines must be well-designed, accountability preserved, incentives well-structured and financial controls robust. Amphenol is a manufacturer of critical connectors, which have countless applications across many end-markets. An example would be the connection of electronic aircraft systems, where reliability and performance under vibration and extreme temperatures is crucial. Failure is not an option. Amphenol does not force businesses onto one ERP but employs a rigorous control environment across its businesses. A monthly roll-up of accounts is consolidated at corporate with strict review procedures and a low materiality threshold for investigation. The model appears scalable as new acquisitions are made.

Investing with these types of companies requires careful investigation and evaluation. We believe spending time with management to build trust in the individual processes around acquisitions, integration and risk management is crucial. These are complex investments, but we’ve found the effort involved can deliver rewarding long-term results.