The awareness of Generative Artificial Intelligence (GenAI) has exploded since the release of ChatGPT in November 2022, firstly led by consumer-facing applications and further expanding to the investment community and corporates.

After recently spending two weeks on the US West Coast meeting with 60+ companies across the technology sector, the topic of AI dominated the majority of conversations. We expect most businesses will leverage GenAI to achieve cost and productivity improvements, but the ability to monetise GenAI as a revenue driver will be much rarer. Rarer still, are those investment opportunities where stock prices are yet to adequately reflect the opportunity. We believe Contact Centres may represent one such opportunity.

Most of the discussions on our US trip were led by analysts and investors, with the level of interest heavily skewed towards the investment community. Companies did acknowledge an increasing interest by businesses as it becomes a progressively discussed topic in the Boardroom, however commercial application is still nascent. As a result, certainty around the long-term winners and losers is also unclear outside of the well documented names such as NVIDIA and OpenAI/Microsoft.

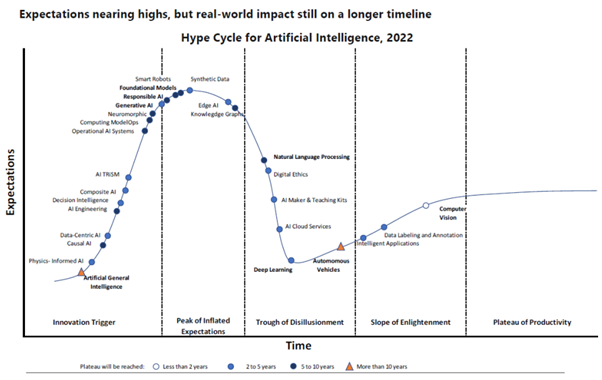

Source: Gartner

Like most technological breakthroughs, GenAI will take time to gather mass adoption and will develop in waves as different companies benefit at different points in time. In the current phase of training and deployment of large language models (LLMs), the hardware manufacturers like NVIDIA are currently seeing high demand. However, the question remains as to how the adoption of GenAI will benefit companies commercially.

The ability to directly monetise GenAI applications appears to be limited across most of the companies we met, with the majority explaining indirect benefits such as Total Addressable Market (TAM) expansion or increasing the mix of premium users by bundling GenAI features into higher priced subscriptions. A key risk to this angle is that GenAI becomes “table stakes” that customers expect but do not need to pay for, as service providers compete for their business. From a cost and efficiency perspective, we anticipate that GenAI will benefit most businesses.

The speed of product innovation around GenAI, whether it be Microsoft’s Co-Pilot or Adobe’s AI Art Generator Firefly has been impressive, but also signals the lower barriers to entry and therefore less product differentiation. The inclusion of GenAI features within existing solutions will likely become standardised and therefore the ability to monetise will be weighted towards those that have a unique moat which GenAI leverages, such as data sets or specialised domain knowledge.

One software example where GenAI can be directly monetised is in Contact Centres. While the digital shift has been in play for a number of years, predominantly the shift from on-premise to cloud-based solutions, GenAI will accelerate the trend by unlocking greater digital solutions. Virtual agents are a clear monetisable opportunity for the leading software vendors, while contact centre customers can reduces costs, increase the efficiency of their contact centres, and enhance the overall customer experience. We have identified Nice Ltd, an Israeli and US-listed player as a market leader that will likely benefit from this trend. We believe that vendors with a leading end-to-end platform will benefit as they complement agent-based technology with an increasing portfolio of digital solutions, all within a single offering.

AI – a dominant topic of conversation

The awareness of Generative Artificial Intelligence (GenAI) has exploded since the release of ChatGPT in November 2022, firstly led by consumer-facing applications and further expanding to the investment community and corporates.

After recently spending two weeks on the US West Coast meeting with 60+ companies across the technology sector, the topic of AI dominated the majority of conversations. We expect most businesses will leverage GenAI to achieve cost and productivity improvements, but the ability to monetise GenAI as a revenue driver will be much rarer. Rarer still, are those investment opportunities where stock prices are yet to adequately reflect the opportunity. We believe Contact Centres may represent one such opportunity.

Most of the discussions on our US trip were led by analysts and investors, with the level of interest heavily skewed towards the investment community. Companies did acknowledge an increasing interest by businesses as it becomes a progressively discussed topic in the Boardroom, however commercial application is still nascent. As a result, certainty around the long-term winners and losers is also unclear outside of the well documented names such as NVIDIA and OpenAI/Microsoft.

Source: Gartner

Like most technological breakthroughs, GenAI will take time to gather mass adoption and will develop in waves as different companies benefit at different points in time. In the current phase of training and deployment of large language models (LLMs), the hardware manufacturers like NVIDIA are currently seeing high demand. However, the question remains as to how the adoption of GenAI will benefit companies commercially.

The ability to directly monetise GenAI applications appears to be limited across most of the companies we met, with the majority explaining indirect benefits such as Total Addressable Market (TAM) expansion or increasing the mix of premium users by bundling GenAI features into higher priced subscriptions. A key risk to this angle is that GenAI becomes “table stakes” that customers expect but do not need to pay for, as service providers compete for their business. From a cost and efficiency perspective, we anticipate that GenAI will benefit most businesses.

The speed of product innovation around GenAI, whether it be Microsoft’s Co-Pilot or Adobe’s AI Art Generator Firefly has been impressive, but also signals the lower barriers to entry and therefore less product differentiation. The inclusion of GenAI features within existing solutions will likely become standardised and therefore the ability to monetise will be weighted towards those that have a unique moat which GenAI leverages, such as data sets or specialised domain knowledge.

One software example where GenAI can be directly monetised is in Contact Centres. While the digital shift has been in play for a number of years, predominantly the shift from on-premise to cloud-based solutions, GenAI will accelerate the trend by unlocking greater digital solutions. Virtual agents are a clear monetisable opportunity for the leading software vendors, while contact centre customers can reduces costs, increase the efficiency of their contact centres, and enhance the overall customer experience. We have identified Nice Ltd, an Israeli and US-listed player as a market leader that will likely benefit from this trend. We believe that vendors with a leading end-to-end platform will benefit as they complement agent-based technology with an increasing portfolio of digital solutions, all within a single offering.

Milford on Newstalk ZB: 10 September 2025

Read MoreMilford on The Hits: 10 Sep 2025

Read MoreMilford Ask Us Anything Broadcast Event, September 2025

Read MoreDisclaimer: Milford is an active manager with views and portfolio positions subject to change. This blog is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to a Financial Adviser. Past performance is not a guarantee of future performance.