When it comes to sustainable investing, it can seem at times like there are three teams on the field. In truth, there are only ever two. Team Sustainability (the A Team), who believe companies with sustainable practices or tailwinds will, over time, deliver better operational outcomes that lead to higher shareholder returns.

Our opposing team (the B Team) are made up of genuine non-believers and those players who simply lack the capability. But just as infighting within a political party provides fodder for its opponents, critiques by Team Sustainability’s own players against one another provide much ammunition to the negative camp.

For example, investment managers that endorse zero holdings in businesses with the potential to cause harm are critical of approaches founded on engagement. They argue any exposure increases portfolio risk, and implicitly condones unsustainable business operations and practices.

The counter-argument, put forward by sustainable investors who actively drive positive change through engagement, is that divesting harmful businesses does nothing to change or reduce the actual harm caused. It only transfers ownership of the problem, relinquishes stewardship to shareholders who care less (the B Team), and forfeits a manager’s capacity to influence outcomes.

But despite the apparent infighting, not only are all members of Team Sustainability working to bring about the same outcomes – our approaches complement one another beautifully.

Engagement-oriented shareholders, like Milford, use our influence to work with company management, Boards and policy makers to transition businesses towards more sustainable models. As active shareholders, we exercise our proxy voting rights to clearly communicate our expectations regarding environmental, social and governance factors.

The recent heritage breach at Rio Tinto provides an excellent example. Milford quickly concluded the company’s early response was inadequate and amounted to a cultural failure, rather than simply a shortcoming relating to policy or execution. To the board, we formally communicated our expectation that heritage standards be immediately strengthened across all divisions. And that executive remuneration be negatively impacted to reflect the severity of the breach of the company’s social licence to operate.

Because Milford also owned shares in BHP, we exercised our proxy votes in favour of the heritage protection and climate change resolutions put forward by the Australasian Centre for Corporate Responsibility (ACCR). Progress was swift and satisfying. BHP immediately commenced discussions with the Heritage Alliance (formed by Australian Land Councils and Indigenous leaders) and committed to such extensive undertakings ahead of the AGM, the resolutions were withdrawn.

Milford, together with other like-minded shareholders, could not have had that impact had we not owned the stock.

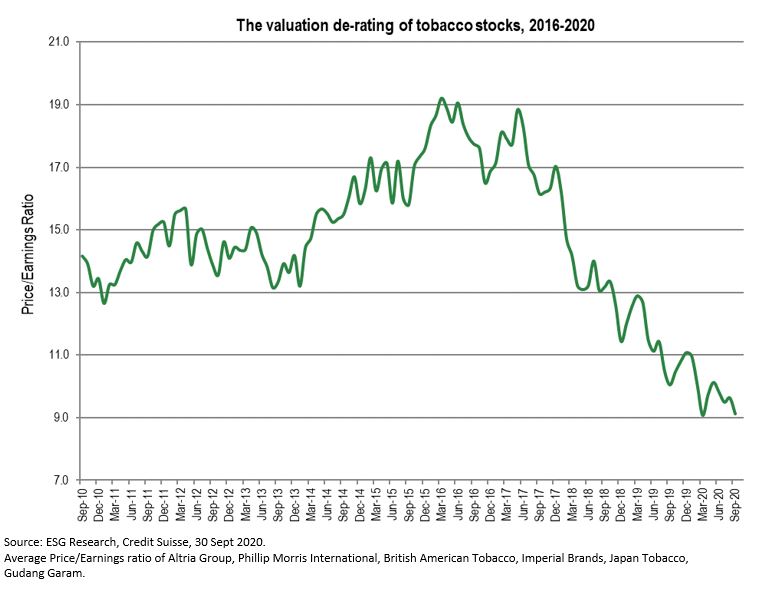

On the other hand, the wave of selling by sustainable investors exiting tobacco stocks had a significant impact on the valuation of tobacco companies from 2016-2020 (shown in the chart below). Today, there are some clear parallels to climate change. No CEO or Chair wants to preside over relentless share price declines given the consequences for their professional reputation and compensation. The threat of a valuation de-rating, potentially precipitated by widespread shareholder selling, provides a clear motivation for companies to develop credible transition strategies that satisfy sustainable investors.

There is far more that unites us on Team Sustainability, than divides us. Just as individuals have varied investment objectives with respect to return, risk and income, they will form different views about the best approach to sustainability. But all roads lead to Rome… Or in this case, to Paris, and towards the climate change objectives of the 2015 Paris Agreement.