Covid has had a heavy impact on labour mobility and labour markets right across Australia and New Zealand. One area where this has been particularly noticeable in Australia has been in mining services. There has been a heavy reliance on a Fly in Fly out (FIFO) workforce, which historically leaned on New Zealanders as one of the key labour pools that supports elevated work. With 40-50% of construction work in the Pilbara (Iron Ore heartland of Australia) FIFO, the challenges of closed state and international borders have been ugly on the bottom lines of corporates, seeing profit margins halve in some instances. The re-emergence of Covid via the Delta strain has elongated the havoc that Covid posed for labour availability and, by extension, margins.

Opportunity?

For those with skills that can get to Australia, and particularly Western Australia, there are significant rewards on offer. Sign on bonuses, peak employment allowances and more favourable rostering are driving high churn. The surging cost of labour being reminiscent of the 2011/2012 mining super-cycle. The rewards can be handsome for skilled labour in this environment.

In terms of the investment landscape these pressures on labour costs have presented many challenges over the recent past to mining service operators, and especially for those exposed to fixed price contracts. Given these issues, it would be easy to steer clear, but at Milford we like to look for diamonds in the rough. Sometimes areas that have been indiscriminately sold-off present compelling risk/reward for those who understand the challenges and are willing to take a longer-term view.

Why now?

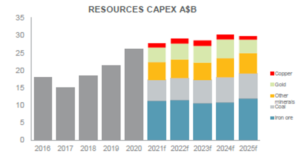

We are currently experiencing peak border uncertainty across Australia and New Zealand. It is weighing on the outlook for labour availability. Having said that, looking through this, the volume of work looks to remain robust across the Australian resources landscape given strong commodity pricing and end market demand. The abundance of work is demonstrated by the chart below illustrating industry expectations for elevated capex.

Source: Monadelphous FY2021 investor presentation

Source: Monadelphous FY2021 investor presentation

Margins look to be close to the bottom as the impacts of pre-Covid contracts unwind, and new contracts that account for labour variability are being won. The market remains focused on these “trough margins” given we are still very much in lockdown. We are looking forward to their potential over the next 12-24mths, as the new contracts commence with better margin protection and as labour availability improves on the back of vaccines, state borders reopening and international borders reopening. If they can achieve more normal margins some of these businesses present an attractive risk/reward opportunity in our opinion with stocks still trading significantly below pre-Covid levels.

Recovery?

Whilst the recovery in work and margins is not guaranteed, and timing could be delayed Milford believes there is an attractive risk/reward presenting itself in this space for those who can weather the volatility. As always, we continue to do work and look to select the right businesses, to capitalise on the opportunity as it presents itself.