Genesis Energy recently hosted an interesting and important investor day that touched on the future of the New Zealand energy/electricity system.

Genesis’s view on the future of electricity use in New Zealand is unique, due to the variety of assets it has in its portfolio. Genesis runs the iconic Huntly Power Station (which uses both coal and gas to generate electricity) and has a 46% shareholding in the Kupe gas field, off the coast of Taranaki. Genesis also has hydro dams in its portfolio and supports wind and geothermal new renewable investments.

Huntly Power Station taken during a Milford site visit

The share market has generally applied a discount to the value of its thermal assets, due to the higher costs of running thermal plants (coal, gas and carbon input costs have been elevated in recent years), and applied a further discount due to the risk of stranded assets. Who wants to own a gas field when this energy source is being phased out?

This view has ignored the important role that Huntly, in particular, plays in our electricity system. When New Zealand has had extended dry periods with no rain, the country’s big hydro dams haven’t been able to generate enough electricity, and Huntly has had to fire up to fill demand. As New Zealand builds more renewable energy, particularly wind and solar, there will still be periods of time where the sun isn’t shining, and the wind isn’t blowing. Given Huntly’s proximity to the large demand loads of Auckland, Tauranga and Hamilton, it will need to fire up in these periods.

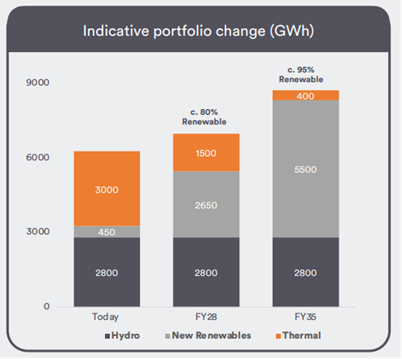

Source: Genesis Investor Day presentation highlighting more renewable investment and Huntly fuel transition

Genesis management made the pitch to investors to help support a “Transition within a Transition”. The New Zealand energy system is transitioning towards significant electrification and more renewables. Genesis is going to do this as well, with the company cutting its dividend and diverting all Kupe gas field cash flows and reinvesting these into new renewable energy builds. Furthermore, the business will transition Huntly away from coal and gas fuel towards a renewable biomass product, in which trials have reportedly gone well. Genesis aims to be a 95% renewable generator by 2035.

The company has ambitions for up to $1.1bn of new renewable projects over the next decade. If it deploys this at appropriate returns and successful transitions the New Zealand energy market, Genesis could easily close the valuation gap with its listed Gentailer peers.

Genesis Energy Investor Day: “Transition within a Transition”

Genesis Energy recently hosted an interesting and important investor day that touched on the future of the New Zealand energy/electricity system.

Genesis’s view on the future of electricity use in New Zealand is unique, due to the variety of assets it has in its portfolio. Genesis runs the iconic Huntly Power Station (which uses both coal and gas to generate electricity) and has a 46% shareholding in the Kupe gas field, off the coast of Taranaki. Genesis also has hydro dams in its portfolio and supports wind and geothermal new renewable investments.

Huntly Power Station taken during a Milford site visit

The share market has generally applied a discount to the value of its thermal assets, due to the higher costs of running thermal plants (coal, gas and carbon input costs have been elevated in recent years), and applied a further discount due to the risk of stranded assets. Who wants to own a gas field when this energy source is being phased out?

This view has ignored the important role that Huntly, in particular, plays in our electricity system. When New Zealand has had extended dry periods with no rain, the country’s big hydro dams haven’t been able to generate enough electricity, and Huntly has had to fire up to fill demand. As New Zealand builds more renewable energy, particularly wind and solar, there will still be periods of time where the sun isn’t shining, and the wind isn’t blowing. Given Huntly’s proximity to the large demand loads of Auckland, Tauranga and Hamilton, it will need to fire up in these periods.

Source: Genesis Investor Day presentation highlighting more renewable investment and Huntly fuel transition

Genesis management made the pitch to investors to help support a “Transition within a Transition”. The New Zealand energy system is transitioning towards significant electrification and more renewables. Genesis is going to do this as well, with the company cutting its dividend and diverting all Kupe gas field cash flows and reinvesting these into new renewable energy builds. Furthermore, the business will transition Huntly away from coal and gas fuel towards a renewable biomass product, in which trials have reportedly gone well. Genesis aims to be a 95% renewable generator by 2035.

The company has ambitions for up to $1.1bn of new renewable projects over the next decade. If it deploys this at appropriate returns and successful transitions the New Zealand energy market, Genesis could easily close the valuation gap with its listed Gentailer peers.

Milford on Newstalk ZB: 13 August 2025

Read MoreMilford on The Hits: 13 Aug 2025

Read MoreMilford on Newstalk ZB: 06 August 2025

Read MoreDisclaimer: Milford is an active manager with views and portfolio positions subject to change. This blog is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to a Financial Adviser. Past performance is not a guarantee of future performance.