The Electricity Generators and Retailers (Gentailer) sector is one of the NZ-listed market’s biggest sectors, making it important to NZX participants and analysts. Given the importance of electricity/energy, the sector is closely followed by the New Zealand public and politicians as well.

With the New Zealand general election on 14 October 2023, is there a chance the Gentailer sector will become a political football once more?

The electricity sector has been involved in political party campaigns in the recent past:

- During the 2011 election, the National Party decided to pursue a Mixed Ownership Model of the state-owned energy companies, which led to the listing on the NZX of Meridian Energy, Mighty River Power (now Mercury) and Genesis Energy.

- During the 2014 election campaign, Labour and the Greens proposed a Crown-owned single buyer of electricity generation to set prices for the generators.

Keeping the lights on is the most important political / public relations consideration for the Gentailer sector and any slip ups here could have large political / regulatory implications. Note the media attention and investigations into the relatively small blackout of 34,000 homes in the winter of 2021. The following MBIE investigation ultimately fined grid operator Transpower over the incident and determined no fault lay with the generators.

Without tempting fate, so far the main political parties in 2023 are largely in agreement on speeding up consent times for new renewable generation projects.

There are some differences between the main parties on the Lake Onslow pumped hydro scheme (National said it will scrap this) and policies around New Zealand Oil & Gas, which also impact our Electricity / Energy system.

I believe part of the relative alignment of the major parties on electricity policy is due to the political bipartisan support for the decarbonisation / electrification of our economy and also the key question of who pays for this. This investment is currently being ”paid for” by the market, which suits politicians and taxpayers.

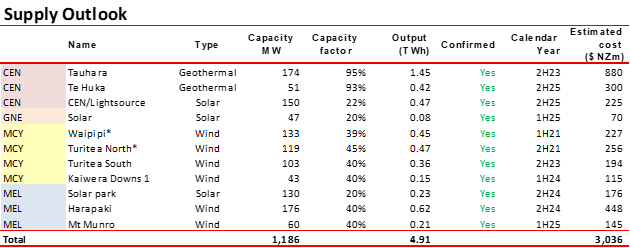

Source: Public announcements, Milford analysis

*recently completed

Gentailer confirmed projects and spend over a five-year time span.

The “big four” Gentailers are spending over $3bn over a five-year period to generate almost 5 terawatt-hour (TWh) of new generation (around +12% of current market supply).

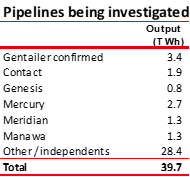

There is also a huge pipeline of other projects being explored by the Gentailers and other private independent operators too, spanning the next decade or so. Note that not all of these projects below will go ahead, but it gives an indication of the new generation development activity being evaluated. This equates to almost +40 TWh of projects, which matches our entire current electricity supply.

Source: Public announcements, Milford analysis

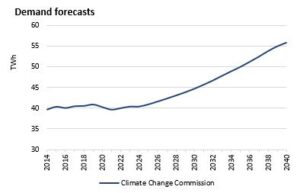

This new supply is rising to the challenge of decarbonising / electrifying our economy. This is almost +15 TWh (+37% from current) forecast of new electricity demand by 2040.

This large investment will be keeping politicians and taxpayers happy. As long as the electricity sector continues to respond to the signals being sent to it by the market, perhaps it can stay out of the political crossfire this election cycle.

Source: NZCCC forecasts, Milford analysis

Gentailers – a political football?

The Electricity Generators and Retailers (Gentailer) sector is one of the NZ-listed market’s biggest sectors, making it important to NZX participants and analysts. Given the importance of electricity/energy, the sector is closely followed by the New Zealand public and politicians as well.

With the New Zealand general election on 14 October 2023, is there a chance the Gentailer sector will become a political football once more?

The electricity sector has been involved in political party campaigns in the recent past:

Keeping the lights on is the most important political / public relations consideration for the Gentailer sector and any slip ups here could have large political / regulatory implications. Note the media attention and investigations into the relatively small blackout of 34,000 homes in the winter of 2021. The following MBIE investigation ultimately fined grid operator Transpower over the incident and determined no fault lay with the generators.

Without tempting fate, so far the main political parties in 2023 are largely in agreement on speeding up consent times for new renewable generation projects.

There are some differences between the main parties on the Lake Onslow pumped hydro scheme (National said it will scrap this) and policies around New Zealand Oil & Gas, which also impact our Electricity / Energy system.

I believe part of the relative alignment of the major parties on electricity policy is due to the political bipartisan support for the decarbonisation / electrification of our economy and also the key question of who pays for this. This investment is currently being ”paid for” by the market, which suits politicians and taxpayers.

Source: Public announcements, Milford analysis

*recently completed

Gentailer confirmed projects and spend over a five-year time span.

The “big four” Gentailers are spending over $3bn over a five-year period to generate almost 5 terawatt-hour (TWh) of new generation (around +12% of current market supply).

There is also a huge pipeline of other projects being explored by the Gentailers and other private independent operators too, spanning the next decade or so. Note that not all of these projects below will go ahead, but it gives an indication of the new generation development activity being evaluated. This equates to almost +40 TWh of projects, which matches our entire current electricity supply.

Source: Public announcements, Milford analysis

This new supply is rising to the challenge of decarbonising / electrifying our economy. This is almost +15 TWh (+37% from current) forecast of new electricity demand by 2040.

This large investment will be keeping politicians and taxpayers happy. As long as the electricity sector continues to respond to the signals being sent to it by the market, perhaps it can stay out of the political crossfire this election cycle.

Source: NZCCC forecasts, Milford analysis

EP48: Will NZ Super see you through retirement?

Read MoreMilford on Newstalk ZB: 10 September 2025

Read MoreMilford on The Hits: 10 Sep 2025

Read MoreDisclaimer: Milford is an active manager with views and portfolio positions subject to change. This blog is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to a Financial Adviser. Past performance is not a guarantee of future performance.