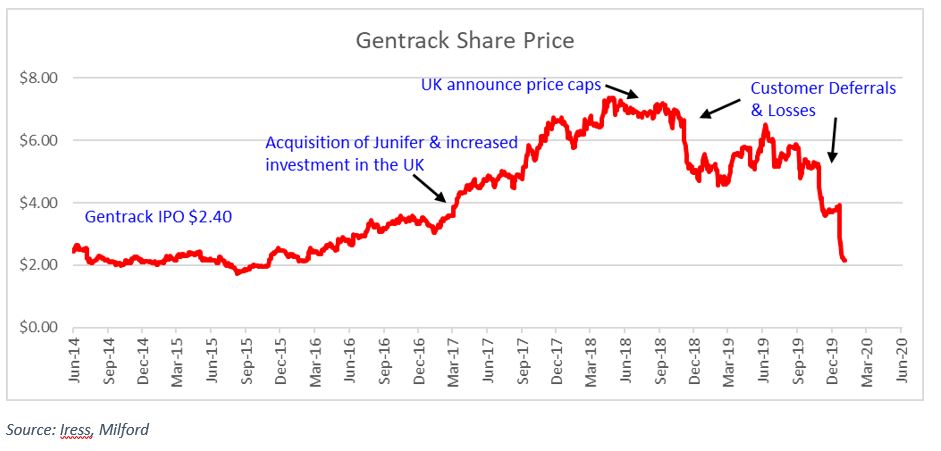

Former darling Gentrack surprised the market in January with a large profit downgrade blamed on customer weakness in key markets, sending the share price back below their listing price in 2014. Let’s look at what went wrong.

Gentrack sells software to utilities and airports. Their customers include power companies like Mercury and Genesis who use their billing and customer management software. After establishing a strong presence in New Zealand, they expanded globally, targeting regions where there are new players entering the market.

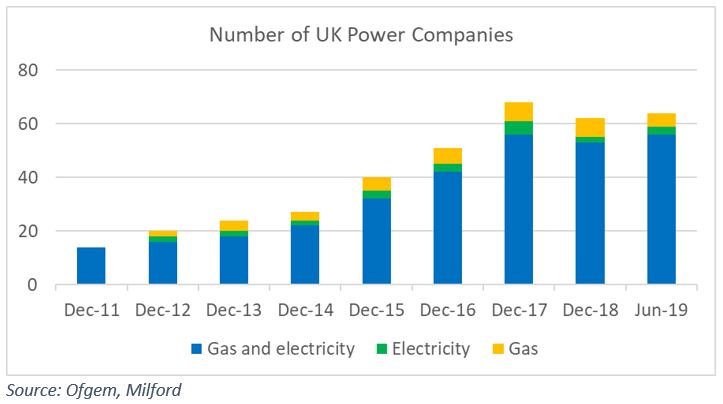

In 2014 consumers in the UK were getting fed up with high power prices and poor customer service which led to a rush of new entrants. To take advantage of this opportunity, Gentrack significantly increased headcount and acquired Junifer, a UK competitor. The outlook was looking very strong with Gentrack winning new customers including pilot projects with some of the UK’s largest power companies.

This positive outlook quickly turned negative in late 2018 when Theresa May announced price caps to reduce the prices power companies could charge consumers. Power company profits declined sharply as a result, creating limited appetite for new investments. This flowed onto Gentrack who saw their project pipeline dry up and profit expectations for 2020 slashed from $30m two years ago1, to nil.

Gentrack has high customer concentration, receiving revenue from a small number of large customers. This has created a lot of earnings volatility based on customer demand, with limited influence over project timing.

To reduce this volatility Gentrack has been transitioning from an upfront license fee revenue model, to a recurring revenue model which will result in more predictable contracted revenues over the long term. This new model also carries risk however, with Gentrack investing in onboarding new customers, only to have them pull out. Under the previous model Gentrack would have been paid for this work.

The outlook for Gentrack remains tough with a reduced pipeline and continued investment required to maintain and attract new customers. Provided Gentrack can maintain their customer base, they will be well positioned to take advantage of a recovery in the UK power market. After several downgrades the company has lost the confidence of investors and will need to improve disclosure and start delivering against their guidance.

1Source: Factset consensus estimates