“Inflation Swindles Almost Everybody” A few months ago, at the Berkshire Hathaway AGM, investor Warren Buffet uttered those words. With 811 years of investing experience and a net worth reputed at US$104bn, when he speaks, others listen.

The words are a useful reminder to ensure our long-term goals achieve what we want in real terms. After years of low inflation, the words ‘purchasing power’ (a measure of what your money can buy) had almost fallen into obsolescence, until now.

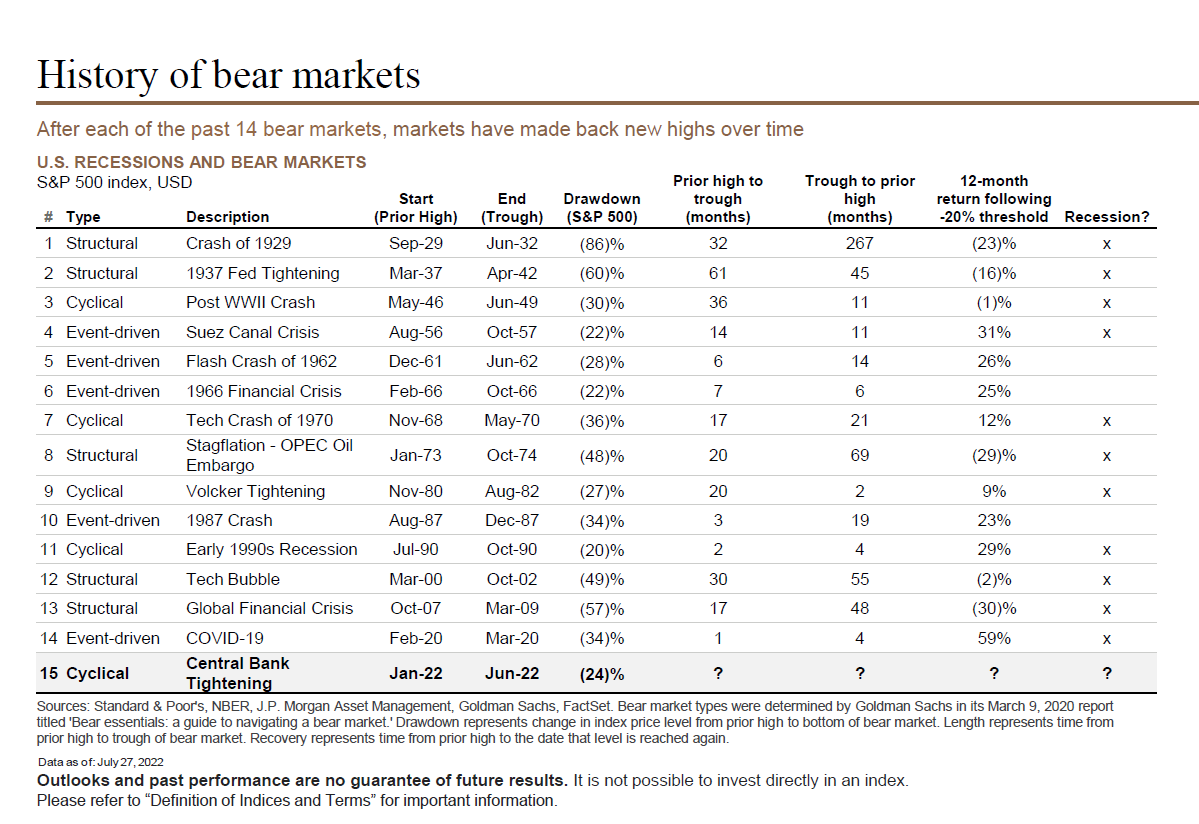

It’s fair to say that investors have been tested this year. From the highs of December 2021, we experienced the worst start to the year since 1970 and since June to the time of writing, the S&P500 has ‘bounced’ over 17%.

The market falls of the first six months pushed many people to resort to holding cash as it increases the feeling of security. But with inflation running at 7.3%2 putting money under the mattress or on deposit at 3-4% p.a. is planning to go backwards. That inflation is eating away at your purchasing power. Feeling less anxious in the short term may be a costly long-term mistake.

But how do we plan to go forward when we’ve just witnessed almost six months of falling markets.

Maximising long-term returns at a personal level is about an investor’s ability to trust in the investing process and tolerate the downs in order to benefit from the ups. Building trust goes hand-in-hand with building knowledge and here are some points noted from history.

There is a wealth of information which shows (see table below);

- staying invested is better over the long-term.

- that the cost of missing the best days of market performance by sitting on the sidelines is significant, and

- after each of the last 14 bear markets, those markets have hit new highs over time

And, yet we ignore it. Its all to do with anxiety and feeling safe at a point in time. However, that point in time ignores another point in time – the future when you’ll be using the money you’ve invested.

Like all forms of anxiety, to be successful, we need to manage our investment anxiety. Understanding the relationship between risk and return is key. One of the best comments I saw recently was ‘volatility is the price we pay for better long-term returns’.

Being prepared, psychologically, for the ups and downs of markets is fundamental to successful long-term investing. We need to accept our anxiety but not let it dictate to us. That doesn’t mean we should ignore what is going on. It means we need to understand the impact of what is happening on our own investments and our long-term goals. Before making a short-term decision, think about the long-term and importantly don’t let short term anxiety force you into long term regret.

———————————————————————-

1. Buffett is reputed to have bought his first share at age 11 in 1941.

2. NZ Stats July 2022