Central banks are walking a tightrope as they try to lower inflation via the blunt tool of monetary policy in a backdrop of a slowing global economy. The recent fall in market expectations of inflation, also seen in lower bond yields infers that the market believes central banks may be successful in engineering a soft economic landing – lowering inflation with a limited recession. This has supported performance across both bond and share markets. But is this utopian “soft landing” realistic?

Some positive signs

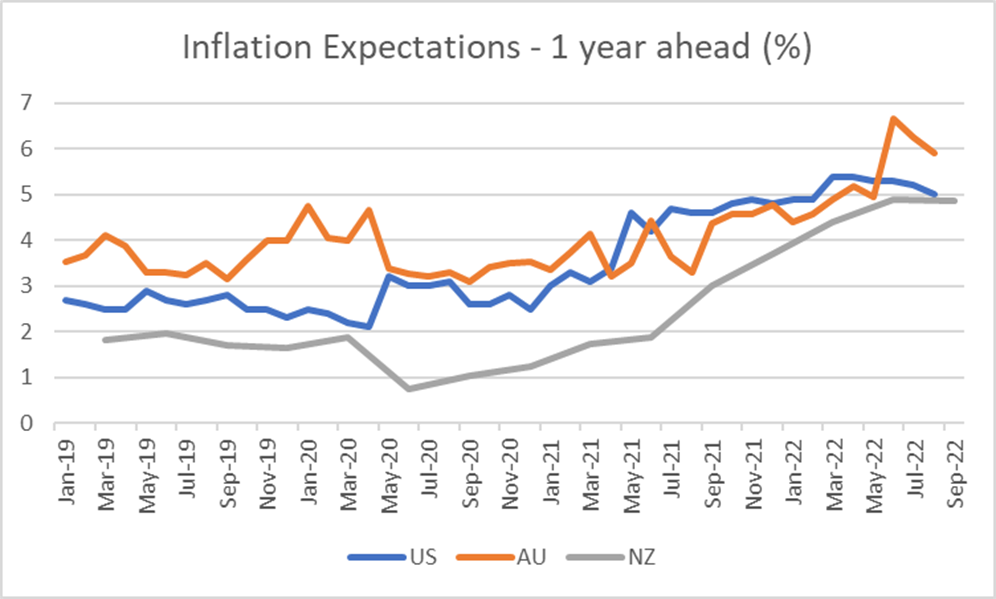

Over recent weeks a number of data points have suggested record levels of inflation may be starting to moderate. Inflation expectations surveys are one such important indicator and have shown signs of peaking – part driven by falling commodity prices and easing supply chain constraints, and part the early signs of tighter monetary policy taking effect.

Source: Bloomberg

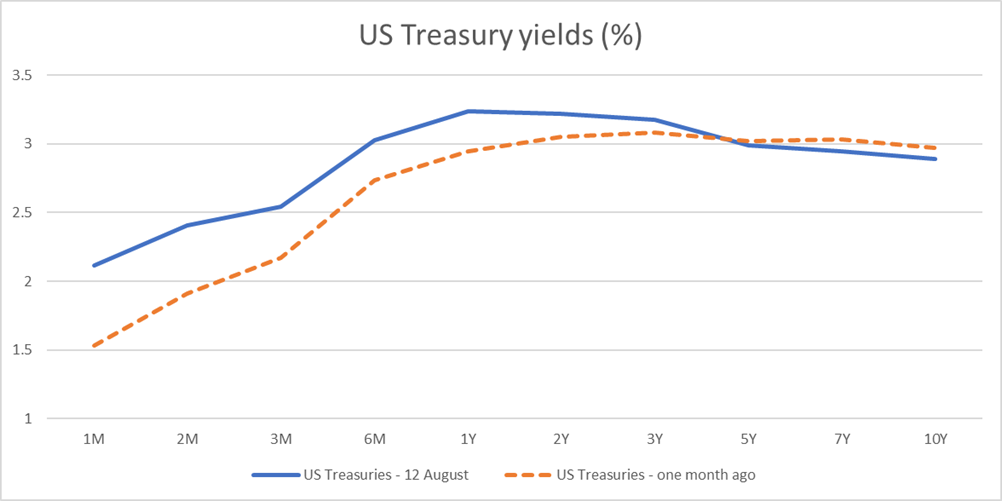

Further, economic indicators suggest global activity is slowing, but not collapsing. This has supported the idea that economies have capacity to absorb higher interest rates near-term and the front loading of hikes will bring inflation under control. This can be seen in the US Treasury curve below where, over the last month, shorter dated Treasury yields have increased, but longer-term yields have moderated. Interestingly, the Treasury curve suggests US interest rates may start to decline as soon as next year. But is this too optimistic?

Source: Bloomberg

A narrow path ahead

Central banks have a difficult task ahead balancing the risk of persistent inflation with the risk of a recession. A so called “soft landing” (where interest rates are high enough to curb inflation but not cause a recession), is easier said than done:

- Too little monetary policy tightening (interest rate hikes) over the short term and the risk is inflation persists, becoming embedded in expectations and fuelling further inflation – and the result is a need for even higher interest rates;

- On the other hand, too much tightening could push the economy into recession.

Given the lag between changes in monetary policy and evidence of its realised impact, the risk of both scenarios is high which makes the soft-landing pathway narrow. Like landing an aircraft on a simulator when one has an annoying lag between the joystick and the screen!

Market expectations

At their June 2022 meeting, the Fed disclosed their base expectation for the Fed Funds Rate (the US cash rate) was around 3.75% at the end of 2023 – albeit with heightened uncertainty. Current market pricing is closer to 3.2%.

As things stand, the market may be assuming too little monetary policy tightening – underestimating the stickiness of inflation and central bank resolve to take their policy rates into more restrictive territory. We are early in the tightening cycle and there is likely some time before central banks will have conviction that inflation is on a downwards trajectory towards their targets, typically closer to 2% p.a. Not least of all, in recent weeks members of the Fed have been particularly vocal that they perceive interest rates may need to remain higher for longer than the market is currently anticipating.

All that said, there are tentative signs that the tightening cycle may already be sufficient to have raised recessionary risks. High levels of debt mean households and corporates are particularly sensitive to sharp increases in interest rates and economic activity could contract quickly. In recent weeks, and as shown in the chart above, we have seen “yield curve inversion” in the US. This is where longer dated interest rates are below shorter dated rates. Historically, a sustained period of inversion has foreshadowed a recession 12-18 months later.

What this means for investors

Central banks are in a difficult balancing act between controlling inflation and risking a recession, making the risk of a policy mistake acutely high. Investors therefore need to remain nimble so as to be able to adjust to a complex and evolving process. For now, we remain wary of the optimistic scenario the market is anticipating.