Last week, Dr Morris Chang, founder of TSMC – the world’s largest contract manufacturer of semiconductor chips, said that he believes globalisation is ‘almost dead’. In this blog, I will delve into current data around globalisation, and the investment implications of this data.

Over the past 150 years, we have seen a significant increase in globalisation, which at its most simple level can be thought of as the process of interaction and integration among governments, companies and people worldwide1. This has been driven by the belief that global integration would be beneficial for all economies; developed nations benefitted from offshoring production at lower costs, while for emerging economies it was the pathway to rapid growth and greater prosperity.

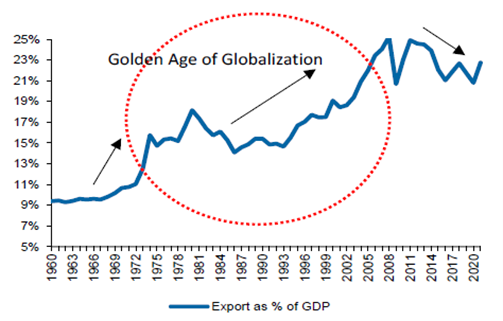

A metric we look at as a measure of globalisation is global exports as a percentage of global GDP. The chart below shows that, at least until now, we have not seen a significant deglobalisation trend, rather that growth in globalisation has been slowing since 2007, hence the coining of the term ‘slowbalisation’. Drivers of this have been multifactorial. There has been a reduction in the cost arbitrage achieved from manufacturing offshore; an increase in protectionist policies, for example, Trump’s trade war with China saw tariffs and trade barriers put on China; the Covid-19 pandemic caused huge disruption to global supply chains; and most recently the war in Ukraine has seen energy become weaponised, with countries considering how dependent they should be on Russian energy.

Source: Macquarie Research

We are, however, seeing a significant increase in the intentions of companies to bring manufacturing back home (‘reshoring’ or ‘onshoring’) or closer to home (‘nearshoring’ or ‘friendshoring’). UBS conducts regular surveys of c-suite executives in the US, Europe and China and in their most recent survey, 72% of respondents in the United States and Europe, and 54% of respondents in China indicated that they are planning to move parts of their supply chain closer to home2.

We are also seeing a proliferation in polices by governments around the world which is supportive of reshoring in certain industries. One area where this is evident is semiconductors, which can be thought of as the ‘brain’ within electronic devices. As digitalisation becomes increasingly widespread, access to semiconductors is becoming increasingly strategically important and countries want to ensure they have local capability. This is especially sensitive as currently approximately 75% of semi-conductor manufacturing capacity is located in China and Taiwan. The United States Chips Act is a $50bn bill that will increase semiconductor capability in the United Sates, and we have seen similar policies implemented in both Europe and Japan.

Another area that is seeing policy support to move supply chains onshore is in vehicle production. The auto industry has traditionally been optimised for cost, which has seen outsourcing to suppliers and operations offshoring in lower cost counties and ‘just in time’ supply chains. However, we are currently in the midst of a global shift from vehicles powered by internal combustion engines to electric vehicles. This shift has provided an opportunity to rethink the vehicle supply chain, particularly around electric vehicle batteries where around 80% of electric vehicle battery capacity is currently located in China. One of the objectives of the US Inflation Reduction Act is the development of new clean energy capacity, via roughly $390bn of investment and production tax credits. The act includes local content requirements which specify minimum onshore manufacturing requirements in order for the companies concerned to be eligible for the tax credits. The implication of this is that vehicle companies with ambitions in the United States, will likely invest in battery capacity onshore in the United States.

There are two industries that can be thought of as enablers of reshoring: logistics real estate and capital goods. Logistic property is property specifically designed for storage, goods distribution or order pick up. The warehouse logistics space is set to benefit from companies taking steps to increase resilience in their supply chains and “reshore” capacity. Anecdotally, companies are also seeing tenants invest more in automation which requires substantial capital investment, and that subsequently they are seeing trends of tenants requiring longer leases to protect their investments. The capital goods or industrials sector is the engine house of the assets used in the manufacturing process, thus to the extent we see increased capex from customer relocation and manufacturing coming online this will be positive for the sector.

So in conclusion, there has been a significant step up in rhetoric about deglobalisation in recent weeks and months. . However, while we have yet to see significant deglobalisation trends coming through in the data, we are clearly seeing: a slowing down in globalisation; companies increasingly looking to increase supply chain resilience; and pockets of reshoring in strategic industries, particularly where there is policy support. We will continue to monitor how this trend plays out over time, and to position our portfolios to benefit from these trends.

Is globalisation dead?

Last week, Dr Morris Chang, founder of TSMC – the world’s largest contract manufacturer of semiconductor chips, said that he believes globalisation is ‘almost dead’. In this blog, I will delve into current data around globalisation, and the investment implications of this data.

Over the past 150 years, we have seen a significant increase in globalisation, which at its most simple level can be thought of as the process of interaction and integration among governments, companies and people worldwide1. This has been driven by the belief that global integration would be beneficial for all economies; developed nations benefitted from offshoring production at lower costs, while for emerging economies it was the pathway to rapid growth and greater prosperity.

A metric we look at as a measure of globalisation is global exports as a percentage of global GDP. The chart below shows that, at least until now, we have not seen a significant deglobalisation trend, rather that growth in globalisation has been slowing since 2007, hence the coining of the term ‘slowbalisation’. Drivers of this have been multifactorial. There has been a reduction in the cost arbitrage achieved from manufacturing offshore; an increase in protectionist policies, for example, Trump’s trade war with China saw tariffs and trade barriers put on China; the Covid-19 pandemic caused huge disruption to global supply chains; and most recently the war in Ukraine has seen energy become weaponised, with countries considering how dependent they should be on Russian energy.

Source: Macquarie Research

We are, however, seeing a significant increase in the intentions of companies to bring manufacturing back home (‘reshoring’ or ‘onshoring’) or closer to home (‘nearshoring’ or ‘friendshoring’). UBS conducts regular surveys of c-suite executives in the US, Europe and China and in their most recent survey, 72% of respondents in the United States and Europe, and 54% of respondents in China indicated that they are planning to move parts of their supply chain closer to home2.

We are also seeing a proliferation in polices by governments around the world which is supportive of reshoring in certain industries. One area where this is evident is semiconductors, which can be thought of as the ‘brain’ within electronic devices. As digitalisation becomes increasingly widespread, access to semiconductors is becoming increasingly strategically important and countries want to ensure they have local capability. This is especially sensitive as currently approximately 75% of semi-conductor manufacturing capacity is located in China and Taiwan. The United States Chips Act is a $50bn bill that will increase semiconductor capability in the United Sates, and we have seen similar policies implemented in both Europe and Japan.

Another area that is seeing policy support to move supply chains onshore is in vehicle production. The auto industry has traditionally been optimised for cost, which has seen outsourcing to suppliers and operations offshoring in lower cost counties and ‘just in time’ supply chains. However, we are currently in the midst of a global shift from vehicles powered by internal combustion engines to electric vehicles. This shift has provided an opportunity to rethink the vehicle supply chain, particularly around electric vehicle batteries where around 80% of electric vehicle battery capacity is currently located in China. One of the objectives of the US Inflation Reduction Act is the development of new clean energy capacity, via roughly $390bn of investment and production tax credits. The act includes local content requirements which specify minimum onshore manufacturing requirements in order for the companies concerned to be eligible for the tax credits. The implication of this is that vehicle companies with ambitions in the United States, will likely invest in battery capacity onshore in the United States.

There are two industries that can be thought of as enablers of reshoring: logistics real estate and capital goods. Logistic property is property specifically designed for storage, goods distribution or order pick up. The warehouse logistics space is set to benefit from companies taking steps to increase resilience in their supply chains and “reshore” capacity. Anecdotally, companies are also seeing tenants invest more in automation which requires substantial capital investment, and that subsequently they are seeing trends of tenants requiring longer leases to protect their investments. The capital goods or industrials sector is the engine house of the assets used in the manufacturing process, thus to the extent we see increased capex from customer relocation and manufacturing coming online this will be positive for the sector.

So in conclusion, there has been a significant step up in rhetoric about deglobalisation in recent weeks and months. . However, while we have yet to see significant deglobalisation trends coming through in the data, we are clearly seeing: a slowing down in globalisation; companies increasingly looking to increase supply chain resilience; and pockets of reshoring in strategic industries, particularly where there is policy support. We will continue to monitor how this trend plays out over time, and to position our portfolios to benefit from these trends.

EP48: Will NZ Super see you through retirement?

Read MoreMilford on Newstalk ZB: 10 September 2025

Read MoreMilford on The Hits: 10 Sep 2025

Read MoreDisclaimer: Milford is an active manager with views and portfolio positions subject to change. This blog is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to a Financial Adviser. Past performance is not a guarantee of future performance.