New Zealand’s listed stock market, at just 52% of New Zealand’s overall GDP in 2019, does not provide investors with comprehensive exposure to the New Zealand economy. Offshore, this is not the case, with the listed market capitalisations in Australia, USA, Canada and the United Kingdom all in excess of 100% of the nations GDP, respectively. These foreign exchanges are more representative of their home economies and have substantial weightings to financial, information technology, primary industries, and mining sectors.

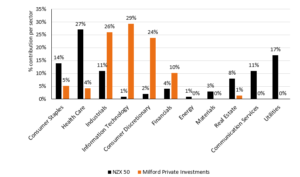

The lack of breadth of the NZX 50 is illustrated in the chart below. This chart, provided by Cambridge Associates, sets out the capitalisation of NZX50 companies by sector. It shows that the NZX 50 is heavily weighted towards lower growth, but dividend paying, companies in segments such as Utilities (17%), Telecommunications (11%) and Real Estate (8%). The NZX 50 also has exposure to sectors such as Consumer Staples (14%), Healthcare (27%) and Industrials (11%), but these exposures are concentrated in a small number of large growth names such as The a2 Milk Company, Fisher & Paykel Healthcare, Ryman and Mainfreight.

NZX 50 (as at 31 March 2020) and Milford Private Equity sector diversification

At Milford, we have identified Healthcare, Information Technology and high-value Consumer Discretionary as sectors which have exhibited growth rates substantially higher than GDP in recent years, and we expect this trend to continue. We, therefore, believe these sectors will yield excellent investment opportunities going forward. The private market in New Zealand provides a broader universe of investable New Zealand companies than the NZX, and with this comes greater access to all segments of the economy.

Milford has been investing in private companies on behalf of our clients for over ten years now, and the distribution of our private investments by sector is overlaid on the chart, represented by the orange bars. It shows a significant weighting towards Information Technology, Consumer Discretionary products with high gross margins and large addressable markets offshore, and Industrials. As we look forward, we expect to continue to invest in these segments that are not well represented on the NZX, to provide sector diversification and good investment outcomes for our investors. Technology, in particular, is a sector in New Zealand that has grown expansively in recent years, and we are now very much a relevant player on the global stage. Recent sales of technology companies part owned by Milford including Unleashed, Vend and Coretex (conditional) are all good examples of positive investment outcomes from private markets that we will strive to continue to achieve going forward.