Upon returning from the US last year (Read Previous Blog Here), one of the themes I had experienced was the incredible strength of the consumer. I’d visited adventure shops where profits were up 100-300%, largely off booming dirt bikes and jet-ski sales volumes ( >95% of sales on credit)! Demand had been so strong, the store manager scrapped all discounting. So, one year on, I thought it would be a good opportunity to revisit the consumer.

There is no doubt that the US has been far more resilient to the unrelenting climb of interest rates than anyone (including me) expected. A humbling reminder was the US GDP print released just last month indicating near 5% growth. Did anyone really expect growth near 5% at the beginning of the year, let alone a year ago?!

There is no better company that typifies the resilience of the US economy than the mighty Coca-Cola. In the latest quarterly, North American prices rose by 5% leading to flat volumes. Not impressed? Well, you should be. This price rise follows 15% last year, and 5% a year earlier. All up, prices are near 25% higher than three years ago and the average American is still guzzling just as much.

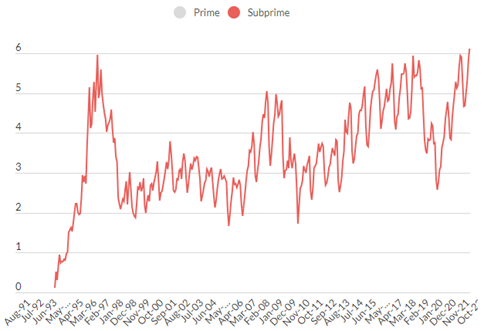

That’s not to say we are not observing pain around the edges. Data shows that borrowers who took out loans in 2021, 2022 and 2023 are having an abnormally hard time staying ahead of their scheduled payments. Loan delinquencies are rising and lower income cohorts are clearly under pressure. Auto loan delinquencies among lower-income borrowers reached 6.1% in September, a near 30-year high (Figure 1). Data released just last week by the Federal Reserve Bank of New York said only 65.8% of households surveyed said they would be able to come up with $2,000 if an unexpected need arose within the next month. That’s the lowest reading since the series began in 2013.

Figure 1: US Auto loan 60+ Delinquency index

Source: Fitch ratings (October 2023)

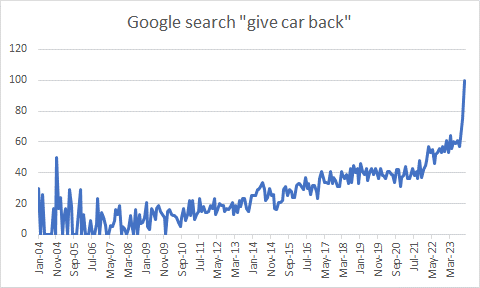

Affordability has never been worse than it is now. It’s not overly surprising given the surge in average credit card interest rates reached as high as 22-25%, used car rates at 12-14% and new car rates at 9-11% (rates subject to credit scores). Google searches of “give car back” have even exploded higher. I suspect if the search term “give jet-ski back” had enough data it would be careering off the page!

Figure 2: Google searches for “Give car back” (US)

Source: Google Trends 22/11/2023

To date, these edges of stress are only just edges. Quarantined to the lower-income exposed dollar shop, with no obvious potential contagion into broader socio-economic cohorts. That said, the long lag effects of monetary policy mean that economic and behavioural impacts of rate rises are still ahead of us and hard to quantify. When economies turn, data can be lagged and choppy, which means on-the-ground research is critical. In Australia, more recently, anecdotes have been more cautious regarding very real cost-of-living challenges. We don’t need to look far in the past to know that big changes tend to happen slowly, then all at once. We therefore maintain a heavily diversified portfolio across a broad range of sector exposures. We also hold elevated cash levels, ready to deploy when opportunities present themselves.

Reflecting on the Year: Revisiting the Pulse of the US Consumer

Upon returning from the US last year (Read Previous Blog Here), one of the themes I had experienced was the incredible strength of the consumer. I’d visited adventure shops where profits were up 100-300%, largely off booming dirt bikes and jet-ski sales volumes ( >95% of sales on credit)! Demand had been so strong, the store manager scrapped all discounting. So, one year on, I thought it would be a good opportunity to revisit the consumer.

There is no doubt that the US has been far more resilient to the unrelenting climb of interest rates than anyone (including me) expected. A humbling reminder was the US GDP print released just last month indicating near 5% growth. Did anyone really expect growth near 5% at the beginning of the year, let alone a year ago?!

There is no better company that typifies the resilience of the US economy than the mighty Coca-Cola. In the latest quarterly, North American prices rose by 5% leading to flat volumes. Not impressed? Well, you should be. This price rise follows 15% last year, and 5% a year earlier. All up, prices are near 25% higher than three years ago and the average American is still guzzling just as much.

That’s not to say we are not observing pain around the edges. Data shows that borrowers who took out loans in 2021, 2022 and 2023 are having an abnormally hard time staying ahead of their scheduled payments. Loan delinquencies are rising and lower income cohorts are clearly under pressure. Auto loan delinquencies among lower-income borrowers reached 6.1% in September, a near 30-year high (Figure 1). Data released just last week by the Federal Reserve Bank of New York said only 65.8% of households surveyed said they would be able to come up with $2,000 if an unexpected need arose within the next month. That’s the lowest reading since the series began in 2013.

Figure 1: US Auto loan 60+ Delinquency index

Source: Fitch ratings (October 2023)

Affordability has never been worse than it is now. It’s not overly surprising given the surge in average credit card interest rates reached as high as 22-25%, used car rates at 12-14% and new car rates at 9-11% (rates subject to credit scores). Google searches of “give car back” have even exploded higher. I suspect if the search term “give jet-ski back” had enough data it would be careering off the page!

Figure 2: Google searches for “Give car back” (US)

Source: Google Trends 22/11/2023

To date, these edges of stress are only just edges. Quarantined to the lower-income exposed dollar shop, with no obvious potential contagion into broader socio-economic cohorts. That said, the long lag effects of monetary policy mean that economic and behavioural impacts of rate rises are still ahead of us and hard to quantify. When economies turn, data can be lagged and choppy, which means on-the-ground research is critical. In Australia, more recently, anecdotes have been more cautious regarding very real cost-of-living challenges. We don’t need to look far in the past to know that big changes tend to happen slowly, then all at once. We therefore maintain a heavily diversified portfolio across a broad range of sector exposures. We also hold elevated cash levels, ready to deploy when opportunities present themselves.

Milford on Newstalk ZB: 10 September 2025

Read MoreMilford on The Hits: 10 Sep 2025

Read MoreMilford Ask Us Anything Broadcast Event, September 2025

Read MoreDisclaimer: Milford is an active manager with views and portfolio positions subject to change. This blog is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to a Financial Adviser. Past performance is not a guarantee of future performance.