Most people to whom we pose this question reply with an immediate “No!”. On face value, it seems illogical that a company should be responsible for anything other than its own greenhouse gas (GHG) emissions and its waste. But let’s dig a little deeper.

What about an oil company? Should it be responsible for the emissions created when its customers use that oil? Or a plastics producer; does it have some responsibility for the plastic being dumped in the ocean? These questions are difficult to answer. On the one hand, a company can’t control how its customers use and dispose of its products, and in many cases customers are still heavily reliant on products which cause pollution. But, on the other hand, companies shouldn’t create harmful products, or could at least take some responsibility for the pollution they have profited from creating.

This question is an important one with far reaching consequences. If a company is to be held responsible for the pollution created by its product, then manufacturing products that harm the environment will become much less attractive. It will push faster change away from products like fossil fuels and plastic. This is good for the environment, but likely bad for the average household wallet. Low-polluting alternatives are typically more expensive if they exist at all.

Unsurprisingly, governments and regulators are treading carefully.

Scope 3 GHG emissions – in the too hard box?

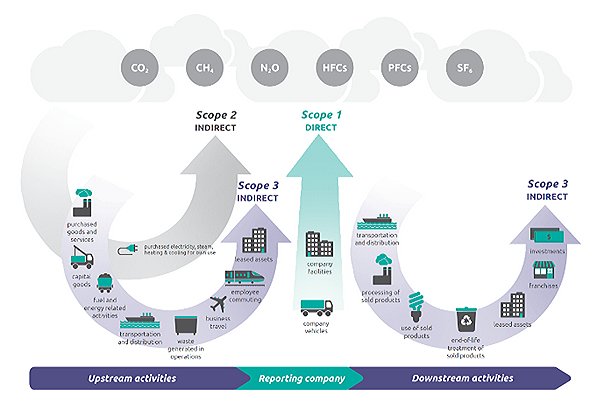

First, the boring bit. A company’s GHG emissions are bucketed into three groups.

- Scope 1: the emissions it makes directly when producing its goods or services.

- Scope 2: the emissions of the power used when making those goods or services.

- Scope 3: the indirect emissions made as a result of those goods and services. This includes the emissions created when those goods and services are used by customers, and the emissions from the supplies needed to create the goods and services.

Source: US Environmental Protection Agency

For the past few years, most climate groups, many governments, and regulators have been broadly aligned that companies should report and reduce their scope 3 emissions. This has been acknowledged as the easiest way to incentivise companies to invest in creating lower pollution alternatives. It helps the environment, and helps the people dependent on those products to shift away from them. Investing in electric vehicles is a better way to wean the world off oil than expecting people to walk to work, for example.

Yet, in practice, this has proved exceptionally difficult. For many products, there are no practical alternatives that can be produced at the same cost and scale.

Australia’s iron ore producers, including Rio Tinto and BHP, are a perfect example. The smelting of iron ore into steel needs incredibly high heat that is traditionally delivered by burning coal. This creates high GHG emissions, but Rio and BHP cannot force their customers to invest in costly electric arc furnaces to make lower-emission steel. The steel producer doesn’t want to pay for an electric arc furnace because most consumers won’t pay a higher price for lower-emissions steel. That means the only way an iron ore producer can meaningfully reduce its scope 3 customer emissions is to sell less iron ore. But the world needs steel to create products, ironically including those that will help the world to decarbonise, such as wind farms.

How to solve this whole-of-system problem? The answer is no one size fits all, and regulation is moving in this direction. This is pragmatic but could be costly to our future.

It’s all about carbon credits

Unfortunately, climate reduction targets can be of variable quality and complex to decipher. Greenwashing is rife. Hence a credible authority to validate the credentials of emission reduction targets is a necessary evil. The United Nations Global Compact, the World Resources Institute, the World Wide Fund for Nature (WWF) and the Carbon Disclosure Project established the Science-based Targets Initiative (SBTi) to create a globally recognised standard for companies to set net zero targets, aligned with limiting global warming to 1.5°C above pre-industrial levels.

This standard determined that companies should prioritise reducing emissions across their whole supply chain, but can use carbon credits to offset those emissions that are impossible to address. Typically, every company has some emissions they can’t tackle, but this should be reduced to a very small amount over time if best efforts are being made.

Carbon credits are tradable units that represent the reduction, avoidance or removal of one metric ton of carbon dioxide (or equivalent volume of other greenhouse gases). In practice, companies are increasingly relying on carbon credits to address scope 3 emissions. For some, it is the only avenue until new technology is developed or becomes cheaper. For others, it’s just easier.

The use of carbon credits brings its own heated debate because a wide range of activities can generate credits, from planting trees to installing energy efficiency technology to building energy projects. In some cases, it’s a credible way of channelling money to emission reduction projects that would otherwise not be afforded, particularly in capital-constrained developing countries. In others, it’s investing money into cheap offsets that don’t reduce emissions and justify ongoing pollution. In reality, it’s both.

SBTi took an unexpected U-turn in April by announcing that companies could now use carbon credits to offset scope 3 emissions. It has since stepped back to review its net zero standard and take feedback. However, the cat may already be out of the bag. The US government in early June released its first set of principles that attempt to define how “high-integrity” carbon credits can play “a meaningful role” in helping cut greenhouse gas emissions and channelling “a significant amount of private capital” to combat climate change. These principles include allowing businesses to use carbon credits to offset scope 3 emissions.

The US government guidelines are neither binding nor enforceable. However, this guidance will likely shift the direction of company climate action. Without investment in low pollution alternatives, the solutions needed to limit global warming will take longer to deliver. Climate science tells us that the snowball effect of global warming means the higher the world temperature becomes, the harder it is to stop. Time is of the essence. Yet many companies will gladly buy cheap credits to offset emissions if they can legitimately do so, rather than tackle complex and expensive emission reductions.

How to cut through the noise

As with all climate action, the reality is complex and nuanced. Some companies have credible options to cut scope 3 emissions and others do not. It depends on the cost and availability of new technology, ease of use and a customer’s propensity to pay. Further, some carbon credits are credibly investing in technology and nature solutions to address climate change, others are not. What should we expect of the companies we invest in?

At Milford, we ensure we understand the decarbonisation pathway of the companies and industries we invest in. The Sustainable Investment team research climate science, technology, regulation and company action to enable us to compare decarbonisation targets and cut through the noise. Armed with this knowledge, we can engage with companies to push for more action where it’s possible. In addition, we research global carbon markets and analyse the integrity of the carbon credits used by companies. In many cases, this means asking for more disclosure to allow investors to assess the quality of the credits being purchased.

Much work is still to be done and many companies have improvements to make. But, outside of a one-size-fits- all approach, governments and regulation cannot solve this problem alone. Investors need to know what they are invested in, do the work and push for better. It will take all stakeholders to create the change we need, and at Milford we want to play our part by ensuring the companies we invest in are moving in the right direction.