2022 has been a challenging year with extreme volatility in share markets, and the road ahead is likely to be bumpy given heightened uncertainty. There are multiple reasons to be pessimistic right now, just read your local newspaper – bad news sells! However, when we look back at history there are several periods where the outlook has been bleak and, in this blog, I will walk you through these and how we fared coming out of them.

For the last 3 years, there has been a plethora of bad news. We have been dealing with the first pandemic in 100 years; the highest inflation in 40 years; and a war in Europe after 75 years of peace. This is a troubling list for any investor and share markets hate uncertainty. In my experience, it is not the well-known risks that we read about in the paper that we should worry about, it’s the ones that come from nowhere that no-one predicted. In my opinion, two of three risks identified above have come from left field and it is not surprising that financial assets like shares have been weak this year.

With that in mind, how do I see these risks playing out? Please read the below with a large “grain of salt”.

Pandemic – the worst of the pandemic appears to be behind us. I am a big believer that great things come from adversity and what an amazing feat to have developed a successful vaccine in just eleven months.

Inflation – in certain parts of the world, inflation does look more ingrained, and we could see elevated inflation for an extended period. However, with central bank policy being tightened so aggressively, swiftly higher interest rates and economic growth slowing, it seems reasonable to expect inflation to sharply decelerate over the coming year. Indeed, longer term inflation indicators we monitor are very well contained.

War – the outcome remains uncertain. My Ukrainian friend (lives In Kiev) tells me the resolve of the Ukrainians has never been stronger, so expect a drawn-out standoff. We are monitoring closely.

Strategy for uncertain times = take a longer-term approach

Looking at history, there are always reasons to sell your shares. Prior to Milford, I spent 15 years investing in Emerging Markets and we were always dealing with a crisis of some kind, but it always amazed me how resilient share markets are over the long run.

There is an old adage on Wall Street that says “markets climb a wall of worry” i.e. there is always something to worry about, but markets can still climb. While the wall of worry feels particularly steep at this juncture, over the long-term share markets go up, as economies grow, and companies generate higher profits.

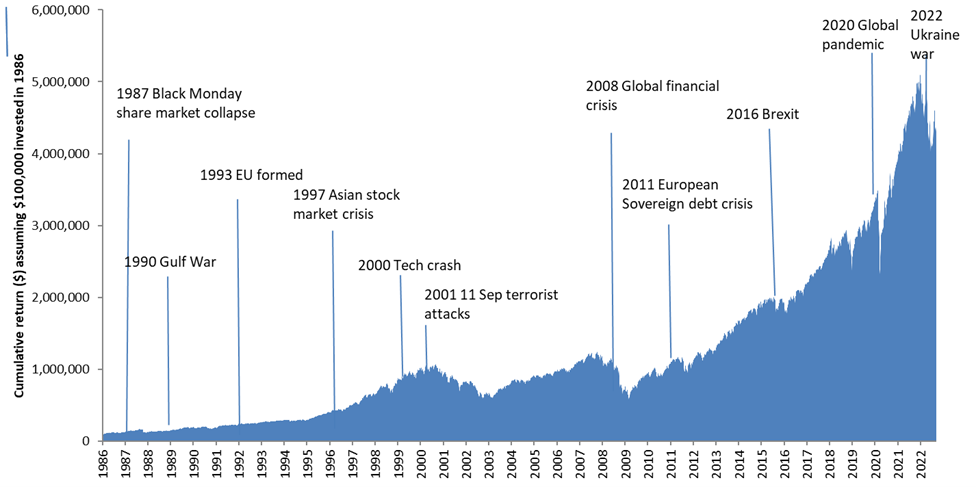

In the chart below, I show the S&P 500 index (500 largest companies in the US) and some of the key risk events that have occurred since 1986. These events included wars, terrorist attacks, debt crises, banking blow ups and, more recently, the global pandemic. Looking at the chart, you would struggle to tell where the 1987 crash was or other major events. However, despite this worrying sequence of events, if you invested US$100,000 in 1986 and sat tight you would now be sitting on a nest egg of circa US$4.4 million – setting yourself up for a very comfortable retirement. To maximise long term returns you need to stomach the volatility.

Source: Bloomberg

There are lots of reasons to be optimistic about the future

In these uncertain times, short-term economic variables are incredibly hard to predict (not even economists can), so why not focus on more predictable long-term trends that are durable in nature?

The great Canadian ice hockey player Wayne Gretzky said “to do well you have to skate to where the puck is going to go next, not where it is right now”. The same is true in investing; so why not focus on the predictable trends of the future: ageing populations; digitalisation; growth in the middle class; decarbonisation; pet humanisation; healthcare innovation; or, one of my favourites, the rise of precision agriculture. We believe these trends will play out over the long term and are less sensitive to the ups and downs of an economic cycle.

And I know these times are unsettling for you our clients, and we never lose sight of the fact we are investing your hard-earned savings. But we are invested alongside you, and as active managers, we are constantly adjusting our portfolios to changing markets and managing risks, as well as looking for new opportunities.

There are a lot of things to worry about right now but as history shows, we will get through this. I’d like to finish on a positive note with a quote from a staunch monarchist, Winston Churchill: “The pessimist sees difficulty in every opportunity. The optimist sees the opportunity in every difficulty”.