Ryman Healthcare – is the worst now behind it?:

Ryman Healthcare has been in the news again after just completing a second large capital raise ($1bn), the second in as many years (post the ~$900m raise in February 2023).

Ryman has struggled in recent years with the uneconomic returns of its recently constructed retirement villages, and debt levels have subsequently ballooned. To be fair to Ryman, this came during a period of rapid construction-cost inflation and huge interest rate increases. But unfortunately Ryman’s large, high-density villages have not been economic for shareholders.

More recently, Ryman has altered its fees model for incoming residents to try and recoup some of the heavy cost inflation the business has experienced. At the weak trading update during the recent March 2025 capital raise, management commented that these changes had negatively impacted recent unit sales performance.

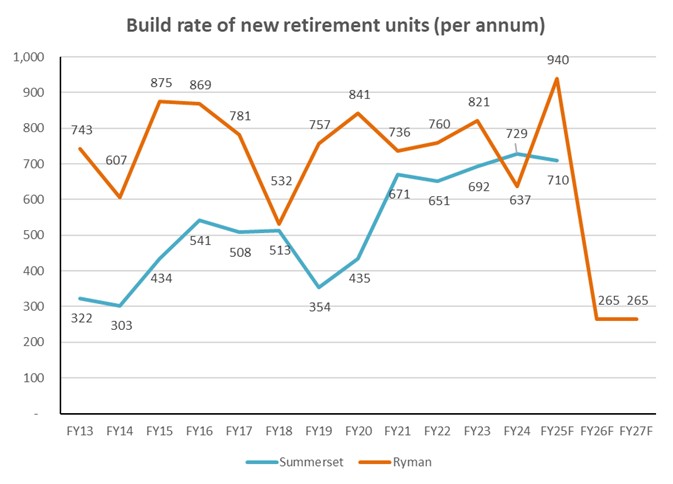

Source: Company disclosures, Milford analysis

Note: RYM has guided to material retirement unit build rate reductions over the next few years

Ryman has also clearly changed its business model to be driven predominantly by cash flow, and will almost completely stop new village development (see graph above). In our view, it makes sense to pause development at this point. But it has been a big change for investors to digest and, alongside the weak trading update, there has not been a lot of good news recently, hence the primary reason the stock price has performed so poorly post the March 2025 capital raise.

Contrast with Summerset:

A key peer, Summerset, has navigated some of the above challenges better than Ryman. It has proven to have a better development model to build new villages, which has assisted during the construction cost spike. It has been able to increase or decrease construction on a site-by-site basis more flexibly. This has enabled investors to continue giving Summerset credit for growth going forward.

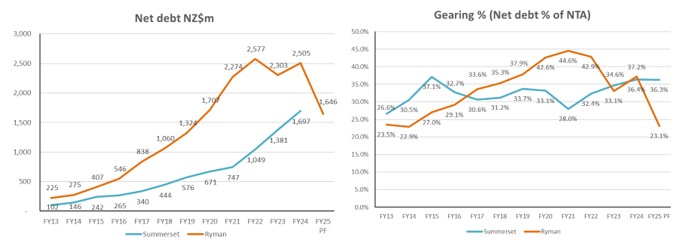

A few challenges remain though – the absolute debt number is still rising rapidly, and core cash flows (from village operations and care) remain weak. Australian expansion has been slow, although the New Zealand development engine has continued to perform solidly.

Summerset has really good business momentum, but it will need to continue to ensure developments are economic, and it stays in control of its debt / gearing levels.

Source: Company disclosures, Milford analysis

Note: Rymans two large capital raises have reduced its net debt and gearing % ratios

Where to next?

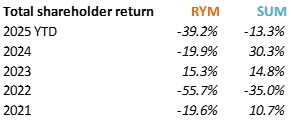

While the market and investors are comfortable on the demand side from an ageing population supporting retirement villages, ultimately the value of a company comes down to cash flow generation. Cash flow generation has been significantly challenged in the sector, hence the choppy shareholder returns over the past five years:

Source: Bloomberg, Milford analysis

Both companies have been investing heavily in the short term, to hopefully make more cash flow in the longer term. This does make valuation difficult, as small changes in core assumptions can produce vastly different longer-term cash flow outcomes. The most important assumption is housing market activity and price growth.

Interest rates are starting to provide a (small) tailwind, but the current excess supply in the housing market could restrain house prices in the near term.

The two Ryman capital raises have highlighted the risks of too much debt and not enough cash flow delivery. We hope that Summerset has been taking note of this scenario.

Disclaimer: Milford owns shares in both Ryman and Summerset across various funds. We also participated in Ryman’s most recent March 2025 capital raise.