During these challenging times when we’re being bombarded with news, views and interviews, it’s easy to start questioning the foundations of our financial decisions. And now with 24/7 online access to our investment portfolios, we can more easily cause damage to our financial futures through our own actions.

The “Second Guess”

Second guess is defined as ‘to question a decision or action that has already been completed’. We are all prone to ‘second guessing’ our decisions. When market volatility causes investment portfolios to fluctuate in value, it can be an unnerving experience. Investment decisions that were carefully planned in times of calm are now being questioned. Friends and family are called upon for ‘expert’ opinions and advice, often causing more confusion.

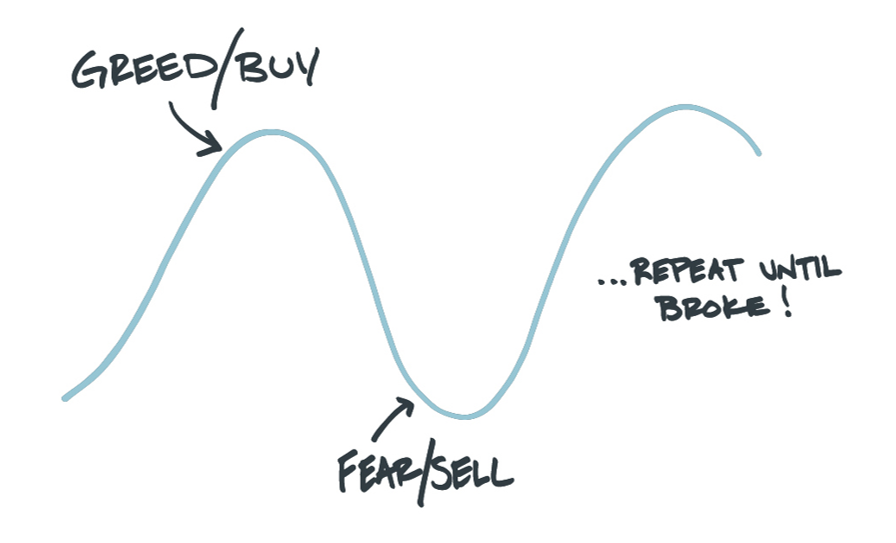

When it comes to investing, ‘second guessing’ can be highly destructive. If it gets the better of us, it can invoke the classic mistake of selling investment assets at a low point and missing a subsequent recovery. This is then followed by trying to time when to re-enter the market, missing the bottom and buying back in higher than the point of exit. If repeated over time, this becomes a behaviour that severely inhibits investment returns.

The “double-down”

As an active manager, Milford constantly monitors the market environment and will alter each funds’ investment positions, dependent on our market and company specific views. Our funds are also highly diversified, holding assets such as cash, bonds and listed property along with shares. Each of these asset classes can perform differently. During periods such as the recent Covid-19 market decline, our Portfolio Managers moved quickly to alter the funds’ asset allocations to become more defensive. This may have translated into a fund holding significantly more cash, owning fewer shares and altering the companies in which the funds did own shares. For example, selling tourism related shares and buying shares in supermarkets and telecommunication companies.

This is what active fund management is all about. Active fund managers make these risk-reduction decisions on behalf of their clients and all clients are treated equally.

This can however cause problems due to the behavioural trait of ‘doubling down’.

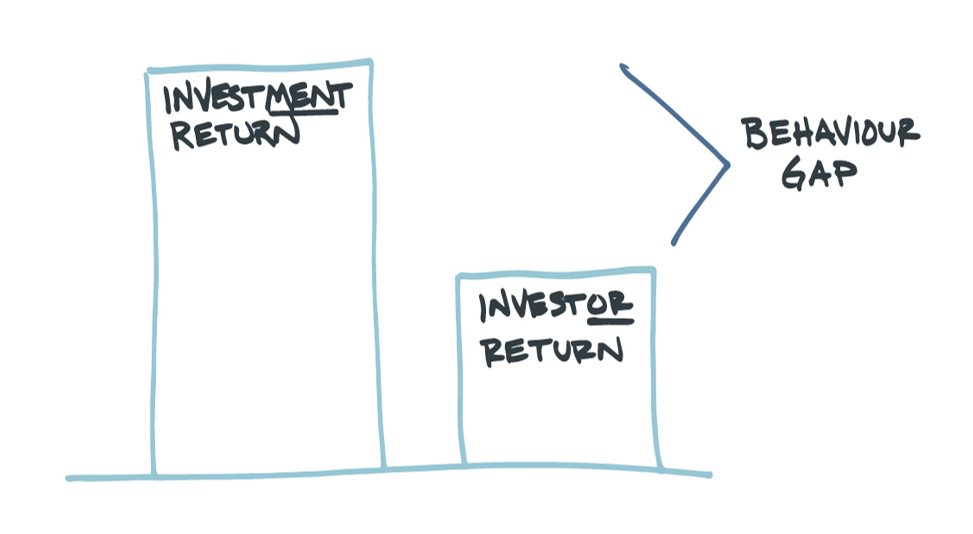

Often investors will try and reduce risk, in addition to what their fund manager has already done, creating a doubling down effect of risk reduction. Examples include, moving funds partially into cash, switching to lower risk funds, or exiting funds completely. Decisions are often made without taking into consideration what their fund manager has already done, or before considering the long-term effect of reducing risk, particularly when there has been a reduction in investment value. Multiple studies show the overlay of this investor behaviour can significantly detract from investment returns over the long term.

How can we help?

It’s normal during market volatility for investors to feel worried or concerned. With today’s technology, in just a few clicks investments can be altered online. This can cause instant relief but over the longer term can cause regret (a second wave of second guessing?) as personal goals may be compromised by those decisions. If your financial goals, risk profile and investment timeframes haven’t changed, generally speaking “staying the course” is the right decision.

At Milford we are always available for a conversation about markets, or to share our views and the actions we are taking to manage our clients’ money. We are solely focussed on helping people achieve their financial goals, either by managing money and/or providing advice. Or in some cases a mixture of both. Our Wealth Management and Advice service is often chosen by clients who are looking for professional advice and “hands off” portfolio management.