China’s intervention in the education and online technology sectors last month sent share prices of companies in these industries tumbling. Leading tech stock Alibaba is down 12% since headlines hit and others are worse hit, such as New Oriental Education which has been clobbered 69%. This event has served as a blunt reminder to foreign investors that regulation risk is not a thing of the past in the world’s second largest economy.

This is a significant setback to China’s plans to increase the foreign adoption of its currency and capital markets. Which begs the question of why they have done this?

Demographic headwinds

While the scale and speed of China’s economic growth over the last three decades is astonishing, the economy now faces a looming demographic headwind. China’s population is ageing rapidly, and this will lead to a sharply contracting labour force over the coming decades while their elderly and retired population continues to grow. This worsening “dependency ratio” will be a major challenge for China from both an economic and societal point of view.

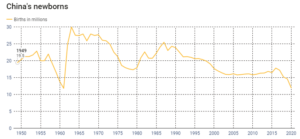

To combat this, China is now trying to encourage its population to have more babies. This is ironic given China’s famous one-child policy introduced in 1979 is a key driver of this demographic challenge. China changed to a two-child policy in 2016 but this had no impact on birth rates – in fact they have continued fall from 17 million in 2015 to 12.5 million in 2020.

Source: Wind, National Bureau of Statistics South China Morning Post

Source: Wind, National Bureau of Statistics South China Morning Post

China has since moved to a three-child policy in May this year but there is little hope this will help either. It is now believed that the declining birth rate is due to the cost of education and other middle-class necessities such as health care and property. This has caused cultural change in China where parents (and grandparents) pool all their resources into the best care, education and housing for one child rather than split resources across multiple.

While China is encouraging its population to have more babies, the Government is now moving to bring down the costs of raising a child to ease the financial burden on parents. Costs of property, health care and education have become extremely expensive in China in both an absolute sense and relative to incomes. This resulted in the forceful intervention in education last month to bring costs down.

What this means for investors

The Hang Seng Tech index which incorporates a lot of affected companies is still 12% below where it was mid last month. While we have likely seen the most dramatic moves in the affected stocks, we are going to see discounts remain on Chinese companies going forward. The market has been given a harsh reminder that regulation risk is real in China, and this shows up in lower valuations for Chinese companies.

There is a similar impact on international businesses with operations in China. Fortunately, there are no major Australasian companies that are largely impacted at this stage. But there is uncertainty for some industries, such as infant formula where there are some concerns that China may go as far as putting price caps on infant formula to reduce the costs of raising children.

For commodity producers such as Australia’s major miners, there is no impact at this stage. Separately, China is working to develop alternative iron ore supplies in Africa to reduce its reliance on Australian and Brazilian iron ore. This will eventually reduce iron ore prices but not until later this decade, given the long lead time to develop the infrastructure to export African iron ore.

While China will be an important market for business and investment given the size of its economy, investors will need to demand higher returns to compensate them for the regulatory risk.