KiwiSaver has been a very successful addition to the retirement savings and wealth creation of New Zealanders. It’s now discussed quite widely and openly in the NZ media. However, one important and perhaps uncomfortable aspect of KiwiSaver that’s rarely discussed is what happens to your KiwiSaver money when you pass away?

Myths about what happens to your KiwiSaver in the event of your passing include: ‘the government gets it’, that it automatically goes to your loved ones, or that you can nominate a beneficiary to receive your KiwiSaver.

As much as it is important to have KiwiSaver and even more important to be in the right type of fund or funds, it is also important to make sure that your KiwiSaver (and other assets) pass to who you want them to.

All KiwiSaver members should have a Will in place. Your KiwiSaver is an asset of your personal estate, and cannot be left automatically to a named beneficiary, and cannot be in joint names, or the name of a Trust. By having a Will, you can direct that your KiwiSaver, along with your other assets, be left to a specific beneficiary or beneficiaries. It will also streamline the administration of your estate by having named executor/s and trustee/s to carry out your wishes.

If a KiwiSaver member dies without a Will in place, and their total assets, including their KiwiSaver, are valued at more than $15,000, their assets will be held until Letters of Administration have been granted by the court. Until Letters of Administration are granted, no one can access the estate assets and the process is likely to be longer and costlier than if a Will is in place.

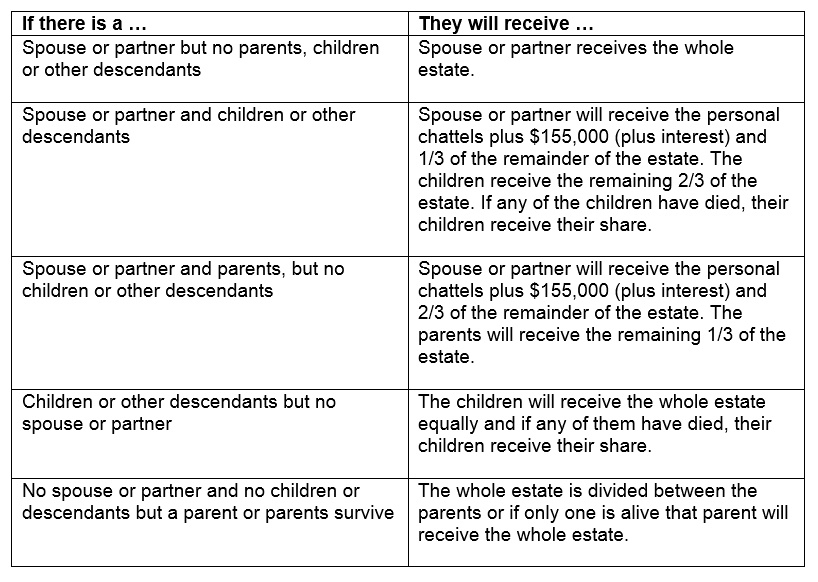

Once Letters of Administration are granted, the trustee/s can then start dealing with the assets of the estate – however the distribution of the assets is not per your wishes, but as prescribed by the Administration Act 1969, for example:

If a KiwiSaver member has a Will, although the estate administration may be delayed while legal formalities such as Probate are completed, the process is quicker and cheaper. You will help to ensure that your assets, including your KiwiSaver, are left to the people you intend to benefit.

KiwiSaver is a great way to save for your retirement, but it is important to not only grow your wealth, but to ensure that it is protected for those that you care about in the event that you pass away. If you don’t have a Will, we suggest seeking advice from a legal professional or trustee company. If you do have a Will, remember to review it every two years, or as your circumstances change.