In the current economic climate, it’s evident that New Zealand is facing considerable challenges. Just recently we’ve witnessed profit downgrades from notable NZ companies like Spark, Tourism Holdings and Fletcher Building. During such turbulent times, it’s prudent for investors to scrutinise the domicile of their assets to avoid overexposure to a single market.

Assets are commonly classified into three primary categories:

| Assets | Domicile | |

| Lifestyle Assets | Homes, baches, cars, etc | New Zealand |

| Business Assets | Operating businesses, commercial properties | New Zealand |

| Financial Assets | Shares, bonds and term deposits | Can be diversified across New Zealand, Australia and the global market |

Reviewing these categories, it’s apparent that a significant portion of the average Kiwi’s wealth is closely tied to New Zealand, with the exception of offshore investments in shares or bonds.

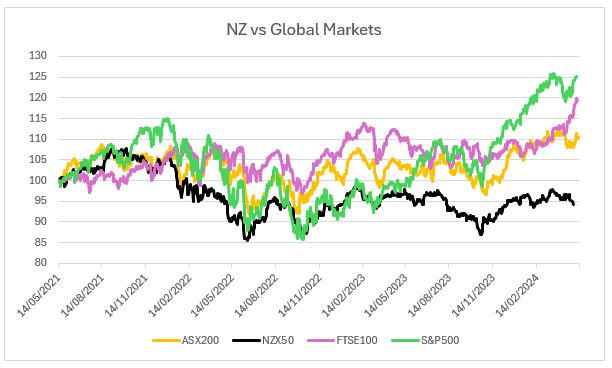

Investing offshore offers several advantages. Over recent years, global equities, exemplified by indices like the S&P 500, have consistently outperformed NZ equities (see chart below of major share market indices over the past three years). This superior performance is attributed to stronger economic conditions in the Unites States, and the presence of several large, listed companies that are performing very well—think Microsoft, Amazon, Google, among others.

The US and European stock markets have thousands of listed companies, and many of these large companies are investing in growth themes that NZ companies cannot compete in. Some of these themes include the cloud, artificial intelligence, digital advertising and large-scale pharmaceuticals.

Source: Bloomberg

Moreover, offshore investments present potential currency benefits. Holding investments in foreign currencies, such as US dollars or UK pounds, shields against the fluctuations of the New Zealand dollar. Given New Zealand’s status as a small trading nation with a volatile currency, this diversification strategy becomes particularly relevant.

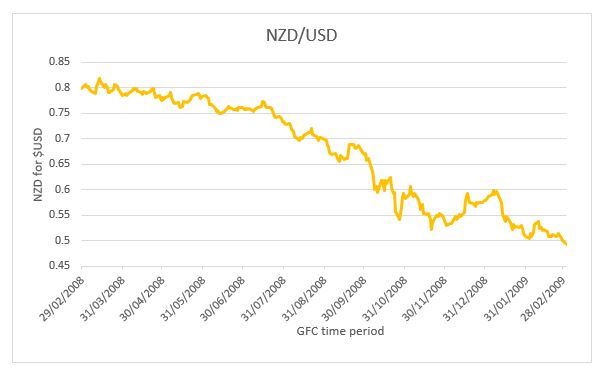

The chart below underscores the vulnerability of the New Zealand dollar, especially evident during events like the Global Financial Crisis (GFC) of 2008-2009. Currently trading around 60 cents against the US dollar, the New Zealand dollar’s value is influenced by interest rate differentials. With the weak NZ economy, there’s a likelihood of sharp rate cuts by the Reserve Bank of New Zealand (RBNZ) to stimulate growth.

Source: Bloomberg

In conclusion, diversifying investments beyond New Zealand’s borders not only enhances portfolio resilience, but also unlocks opportunities for superior returns and currency exposure. As investors navigate these challenging times, a strategic allocation of assets can mitigate risks and capitalise on global growth prospects.