Infrastructure charges are set to outpace inflation

Many infrastructure companies (for example electricity networks and airports) are either regulated or monitored due to limited competition. As part of this process, pricing is reset every several years taking into consideration the company’s regulated asset base, as well as an appropriate return on investment reflecting interest rates and risk.

Household bills have benefited from this in recent years, with pricing set using extraordinarily low interest rates. For example, an interest rate of 1.12% was used for electricity networks while an interest rate of 0.51% was used for fibre company Chorus. These will reset in 2025 to reflect current interest rates above 4%. Other infrastructure companies and owners (for example, councils) are also increasing prices to reflect higher borrowing costs.

There is also significant investment expected over the next decade to replace ageing infrastructure, improve climate resilience, and meet population growth. This has been further exacerbated by the large increase in building costs and interest costs to finance these projects. This will ultimately flow through to prices paid by households.

Implications for the economy and households

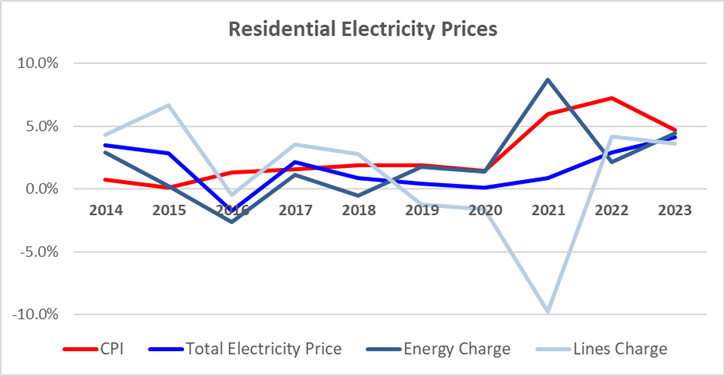

Infrastructure charges generally get paid indirectly. For example, electricity line charges make up 37%i of the typical household power bill. Over the past decade, electricity prices have risen below inflation, in part due to the impact of lower interest rates on electricity line charges. Looking ahead this could reverse as prices are reset. Transpower has already proposed a 46%ii increase in revenue, and electricity distributors could require a similar increase.

Source: MBIEiii

We have seen large price increases from other infrastructure companies including Auckland Airport and some of our ports which will flow into airfares and freight costs. There is also a big question of how government fund its own large infrastructure projects. We have started to see large increases in both council rates and charges from council-owned assets such as Port of Auckland and Watercareiv.

Overall infrastructure charges could outpace inflation over the next decade (in contrast with the previous decade) which will make the RBNZ’s objective of taming inflation more difficult and put further pressure on households.

Implications for companies

The reset in prices is broadly neutral for regulated companies, with returns being reset to better reflect current interest rates. Determining an appropriate return is a difficult exercise for regulators, and changes to their approach can create uncertainty for investors. Setting the return too low risks incentivising underinvestment in critical infrastructure, while setting it too high can incentivise overinvestment and unnecessary price increases. This is why regulators also regulate or monitor investment plans. The impact on companies exposed to these costs is less certain and will depend on the extent they can pass these costs on.

[i] https://www.ea.govt.nz/your-power/bill/

[ii] https://www.transpower.co.nz/our-work/industry/regulation/rcp4/our-proposed-five-year-workplan

[iv] https://akhaveyoursay.aucklandcouncil.govt.nz/hub-page/long-term-plan-2024-2034