The COVID-19 pandemic has had a significant impact on economies across the globe. One of the sectors most impacted has been tourism. Not many companies can endure revenues being cut to zero for an extended period, regardless of risk management. Without the government wage subsidy, a lot of our tourism companies (which are predominantly small businesses), would have shut their doors. Even with the subsidy there has been significant layoffs and the outlook remains uncertain. With domestic tourism reopening, we look at the road to recovery and what a Trans-Tasman bubble might look like.

Domestic Tourism is a key part of the recovery

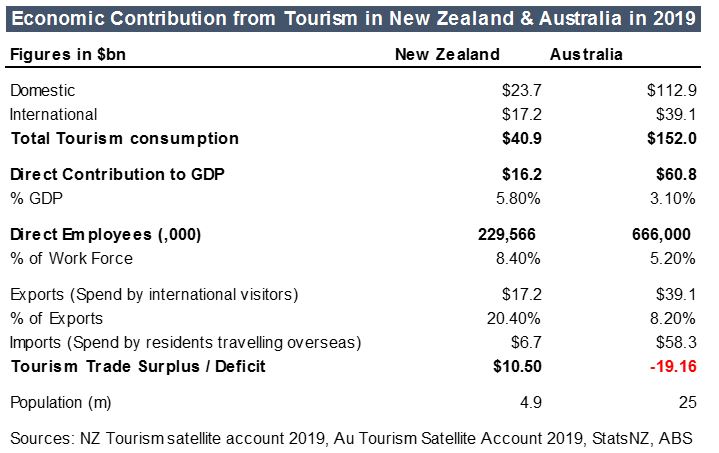

Tourism is a $40.9bn industry for New Zealand, contributing 5.8% directly to GDP, and directly employing 230k people or 8.4% of our workforce.[i] Domestic tourism makes up 60% of this and will be the major source of income for the tourism sector until borders are reopened. Domestic travel is allowed under level 2 and should bounce back as restrictions ease and confidence improves. In 2019 Kiwis spent $6.7bn[ii] on travel overseas which could help stimulate domestic tourism as Kiwis holiday locally instead, however discretionary spending is also likely to be weaker due to the impact the pandemic has had on jobs and households.

Implications of a Trans-Tasman Travel bubble

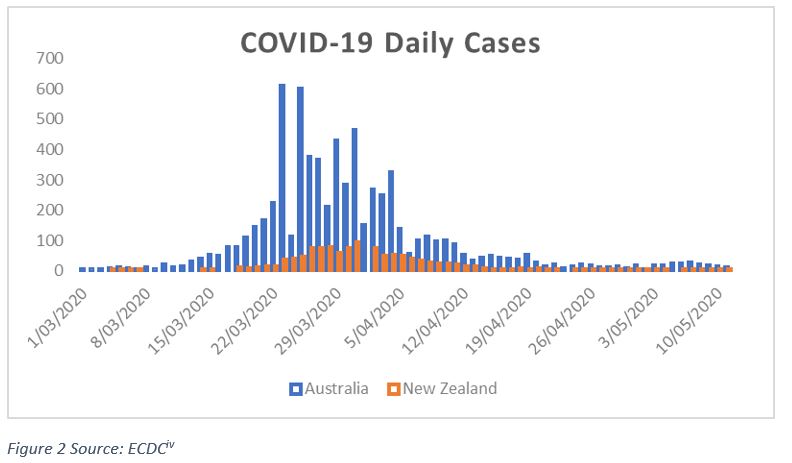

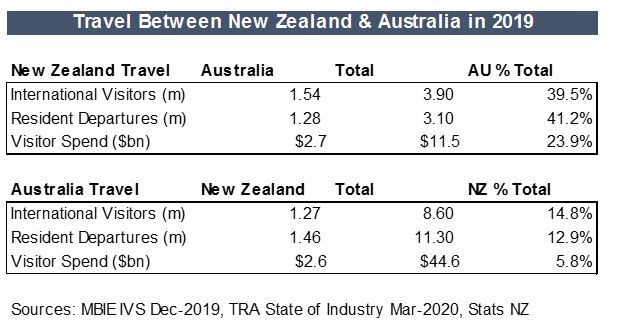

After domestic tourism, the next biggest contributor to NZ tourism is Australia, who made up 40% of visitor arrivals during 2019 and 23%[iii] of visitor spend. With both countries showing signs of getting the virus under control, politicians from both countries are discussing opening a Trans-Tasman bubble. What this looks like is yet to be seen with uncertainty on quarantine measures required and what flights would cost given social distancing measures (having an empty seat between travellers), and health requirements at airports.

In addition to supporting the tourism industries in both countries, a successful Trans-Tasman bubble would prove both countries are safe travel destinations, generating travel demand and showing the way to open borders with further countries.

In absolute terms, the tourism flow across the Tasman has been very similar, with 1.5m visitors from Australia spending $2.7bn in New Zealand during 2019, and 1.3m kiwis visiting Australia spending $2.6bn. There is a clear relative benefit to New Zealand however, with Australia having a 5x larger population, and making up a larger part of our tourism industry. Australian visitors make up 2/3[v] of international skiers, so the tourism industry is hoping to get the bubble up and running ahead of ski season, which would provide some welcome relief.

A long recovery ahead for international tourism

Outside of a potential Trans-Tasman bubble, the outlook for international tourism is more dire with uncertainty on how long this pandemic will last, and when borders will be able to reopen. Once borders do reopen, there will likely be pent up demand from some travellers, while it could take a lot longer for more at-risk parts of the population to feel safe enough to start travelling again. There is also likely to be a reduction in the flight routes offered by airlines who have had to reduce flight capacity significantly. Locally we saw Air New Zealand reduce long-haul capacity by 85%[vi]. The airline industry has also been hit with large losses resulting in some airlines going bankrupt, such as Virgin Australia. It will take years for airlines to recover and they will be focused on the most profitable flight routes first which will impact visitor numbers.

The pandemic may have a lasting impact on some areas of travel, for example the sharp rise in virtual conferencing and time working from home during the pandemic may reduce the demand for business travel going forward. Safety will also be a key consideration in choosing a travel destination, and countries like New Zealand which have managed the pandemic well could be beneficiaries.

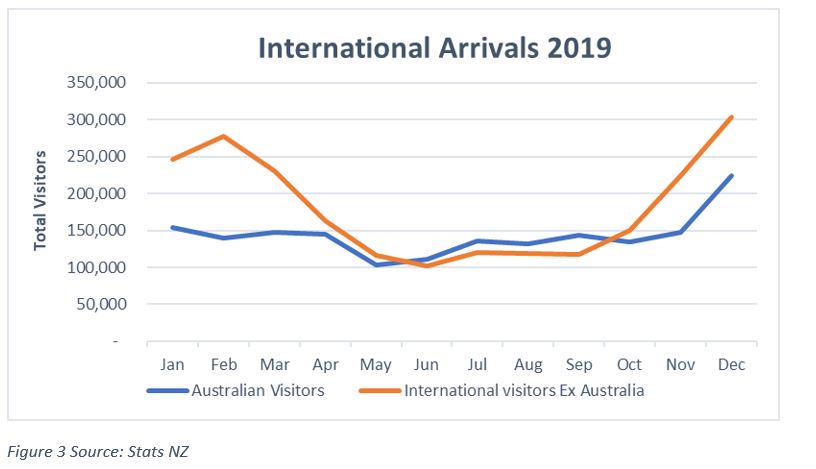

In terms of timing, outside of Australia, 2/3 of international visitors arrive over the summer months between October and March. These visitors have a long lead time, with visitors from Europe planning trips 9-12 months ahead, compared to less than 3 months for Australia. This means that even if borders were to reopen this year, international tourism would still be limited. Border dependent, we might not see much of a recovery until summer 2021. A full recovery could be years away due to the impact on airlines and traveller demand.

Overall Domestic & Trans-Tasman travel will be key for Tourism

With no international travel on the immediate horizon, domestic travel will be the immediate backbone of the tourism industry. As restrictions ease domestic tourism should recover quickly, albeit with some impact from weaker discretionary spending. This could support a lot of the industry, but it will still be hard going with high unemployment in the sector. Opening a Trans-Tasman bubble safely would be a material positive for the industry, particularly for those companies relying on international visitors. The outlook remains tough for the tourism industry, but a recovery in domestic and Trans-Tasman travel would help support the industry until international tourism eventually returns.

[i] NZ Tourism Satellite Account https://www.stats.govt.nz/information-releases/tourism-satellite-account-2019

[ii] NZ Balance of Payments https://www.stats.govt.nz/

[iii] NZ International Visitor Survey https://www.mbie.govt.nz/immigration-and-tourism/

[iv] European CDC https://www.ecdc.europa.eu/en/publications-data/

[vi] Air New Zealand https://www.airnewzealand.co.nz/press-release-2020-airnz-capacity-reductions