We’re going to focus on the global aviation sector and aim to offer some insights into how COVID-19 has impacted the investment case for global airports – companies that are at the coal face of the current global crisis due to the unprecedented reduction in air travel. The article also illustrates the importance of specialist skills and a global perspective when investing in infrastructure stocks.

A key selling point of the infrastructure space for investors is that the asset class is associated with companies that enjoy monopoly positions as the exclusive provider of their service. They generate earnings and cashflows that are relatively stable and predictable, which is often linked to inflation. In other words – boring, but safe investments that provide a ballast for a portfolio. A Financial Analyst thrust into the world of infrastructure, will spend most of their time studying the accounts of mature companies in established industries. This sea of calm was disrupted by the public health and economic crisis that has emerged with COVID-19.

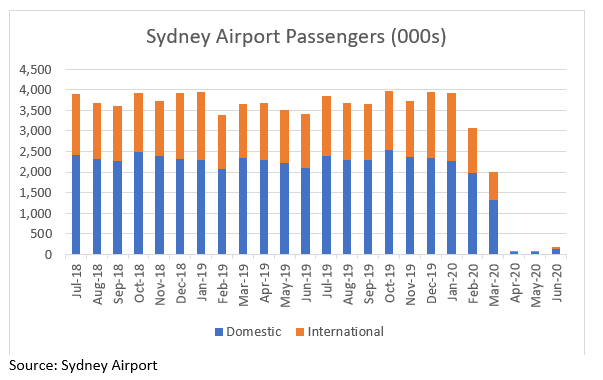

Passenger numbers for much of the world since April have been in the realm of -98% compared to 2019. This means close to zero revenues collected from airlines, no retail spending, and no car park fees. There also remains a question mark over how much rent can be collected from customers who themselves are hurting (retailers, hotels, and other airport tenants). There is some line of sight to the recovery for short haul travel (domestic travel, intra-Europe, and particular “bubbles” such as the Trans-Tasman) but timing remains unclear and at risk from further waves of the virus. Long haul travel recovery remains particularly difficult in the absence of a vaccine, and Qantas recently stated that 2022 international capacity is expected to be half that of 2019.

The backdrop for air travel is clearly bleak, and the share prices of listed airports are down 30% to 50% since January. The sector is clearly out of favour, but we think there are three key points to remember when thinking about the investment case for airports: the importance of a long-term view, a global perspective, and investing with a margin of safety.

Airports tend to either be owned in perpetuity or under long-term concessions (Sydney Airport expires in 2097). Our modelling indicates that 70% plus of the intrinsic value of listed developed-market airports today will be generated from cashflows that occur post 2030. A view on what normalised passenger levels will look like post the immediate crisis is therefore very important.

A global perspective allows investors to look beyond the assets in their home country and cast a wider net. Airports around the world can be different from each other in important ways, including passenger mix (domestic, international, business, etc.); airline exposure (financial strength/ diversification across carriers); quality of regulation; commercial businesses (contracts, counterparties); and debt levels.

The concept of margin of safety involves recognising that valuation is not an exact science, and buying shares at a discount to their assessed intrinsic value allows for capital growth, and allowance for worse scenarios than forecasted to eventuate (for example, with regards to air passengers).

Airports are currently facing the greatest crisis the industry has ever seen. But they remain monopolistic companies that will one day again provide an essential service to society. An assessment of the investment case for the sector requires insight that looks beyond the horrific prints of monthly passenger traffic and a fuller consideration of how these companies are expected to look over many decades ahead.