The market volatility caused by the COVID-19 crisis has been traumatic for many investors and at times like this, it’s interesting to understand the effect human psychology can have on investor behaviour. Many books have been written about the way the human mind affects investment decisions, I want to focus on two interesting psychological biases that have been noticeable in recent months; recency bias and loss aversion.

Recency bias;

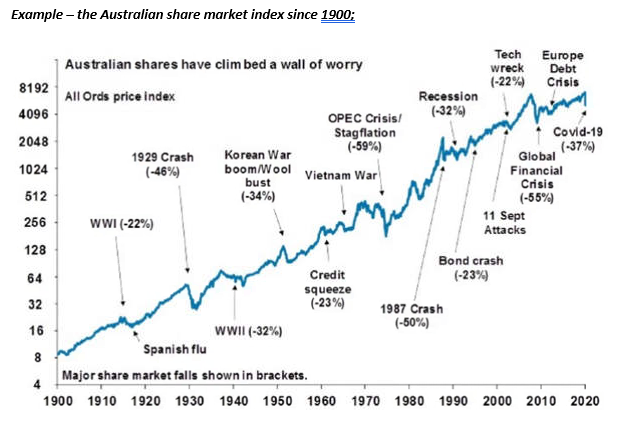

Recency bias is the tendency to place heavy importance on the most recent piece of information or experiences rather than considering longer-term realities. The human instinct is to try to estimate future probabilities based on a small number of recent outcomes instead of long-term experience. In an investment context, this bias is particularly powerful during times of volatility and when the investor has a keen interest in the outcomes. For example, in the midst of a financial storm when an investor’s portfolio values are plummeting, it’s difficult for that investor to remember that, over time, equity markets go up despite being hit by crisis from time to time.

Source: ASX, AMP Capital

When we experience a significant downturn, such as the sharp sell-off caused by the outbreak of the COVID 19 pandemic, the natural reaction is to fear the worst and worry that markets will continue to drop indefinitely. Another bias, the need for acceptance and to follow the crowd, also takes effect during this time. Screaming headlines in the media predicting huge losses and the end of the investment world as we know it can push people into making hasty decisions like selling investments when re-balancing their portfolio back to its original asset allocation might be more suitable for that particular investor.

It’s true to say recency bias does not always lead to negative outcomes – often asset prices will follow a trend for longer than expected and momentum is a big factor in many financial markets. However, this momentum will eventually result in significant over or under valuations of assets and it is during these transitional phases that investor decision making may become irrational.

Loss aversion;

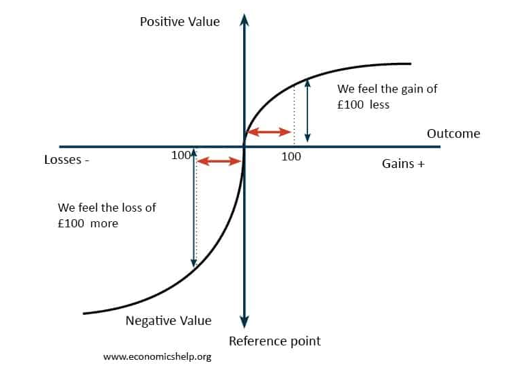

Human psychology is wired to feeling the effect of a loss much more vividly than a gain.

Losses experienced during a severe market downturn, often result in some investors trying to avoid risk at any cost. Such investors are prone to over-estimating risk in a portfolio which can be detrimental to achieving their investment goals because all investing involves risk.

For example, a young investor who experiences his or her first financial market sell-off, might be so scarred by the experience that they switch to a very low risk strategy or even to cash. This might reduce the volatility and avoid losses, but it will potentially result in the investor falling well short of their long-term return expectations/requirements.

It’s important for an investor to find a level of risk they can tolerate and one that is likely to deliver the long-term objectives for that investment.

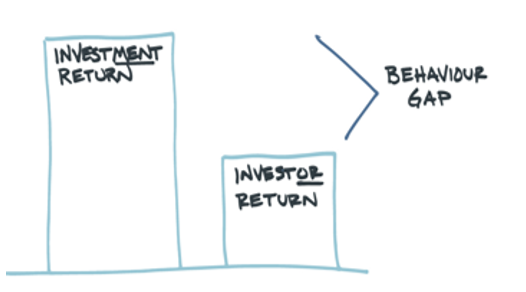

This difference in potential outcomes caused by psychological biases (the investment return compared with the investor return) is often referred to as the “behaviour gap”.

How to overcome these biases?

The considerable uncertainties currently faced by the global financial markets mean that volatility can be expected to continue for some time, and substantial movements in asset prices (both up and down) will be something investors should prepare for. In this environment it’s important to understand what we can do to mitigate the effect our own psychological biases can have on our investment decisions.

We are all subject to investment bias, from the most experienced investor through to the first-time share trader. But there are steps we can take to avoid the mistakes caused by these biases;

- Hold a well-diversified portfolio (not all your eggs in one basket).

- If you are investing in equity markets, accept that your investments will go down from time to time (sometimes quite dramatically).

- Understand your tolerance for risk.

- Try not to be influenced by media headlines or by other investors who “know what’s coming”.

- Create a plan and stick to that plan (unless something significant changes in your objectives/requirements).

If the above is proving challenging, contact a financial adviser who can help assess your situation, objectives, tolerance for risk etc, and recommend a suitable plan.