The Buy-Now-Pay-Later segment has truly taken the world by storm. It is incredibly impressive to think two Aussies were responsible for what has been a massive shift in consumption habits globally and that the majority of BNPL companies are listed on the ASX. It is highly likely that you have come across one of the many providers and although the formula for coming up with a name is relatively simple – “[insert noun/verb] Pay” – how does the business model actually work and what’s driving the industry?

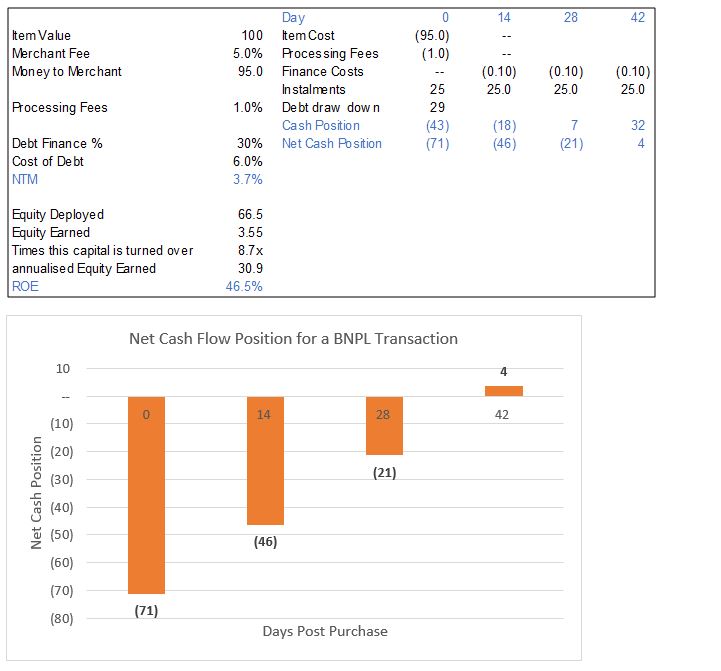

Putting aside the regulatory licenses and merchant contracts, a worked example provides a good perspective on how the cash flows through these businesses.

- Say you bought a $100 pair of shoes using the Afterpay (APT) platform. You’ll be splitting this across four equal payments and will likely pay APT the first instalment on day one, in this case $25.

- APT will then pay the retailer $100 less the agreed merchant fee. This merchant fee is critical and is essentially the Revenue line for BNPL providers. Say it is 5%, APT would pay the retailer $100 minus 5% of the product value, in this case $95.

- After receiving the first $25 instalment APT is out of pocket $70. What they are relying on is paying the retailer $95 but collecting $100 off the consumer.

- There are other costs that are incurred for providing this service, the most substantial of which are the transaction processing fees and, if you’re using debt to pay the retailer, the financing costs.

- As can be seen below, the cash profile of the BNPL provider will only turn profitable upon receipt of the final payment however if successful, the annualised Return on Equity (ROE) is amazing, particularly if you’re using a mix of debt and equity.

- This is largely due to the rapid payback period relative to traditional credit products. On average, APT can recycle the same dollar of capital 12x per annum, amplifying their ROE.

This is a theoretical example of a good customer that will pay back every instalment on time. In reality, this is not the case. From this good customer’s behaviour, you must pay for all your operating costs such as rent, employee expenses, marketing etc. and then have enough to cover the bad debts (aka the bad customers). As you can imagine, this is a volume game.

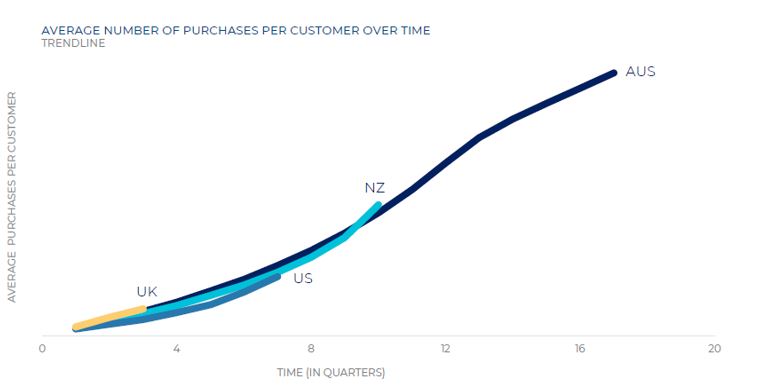

One of the great features of this model is the power of repeat customers. If you have one customer and they use your product twice a year instead of once a year, you have essentially doubled your sales without doing anymore work. In addition, that returning customer has a very low propensity to default. So not only do they drive sales volume up, they drive your losses down. Below is a screenshot from APT’s 1H20 result presentation. As can be seen below, frequency of use grows over time as consumers become more familiar with the platform and due to the product being accepted at more merchants over time.

So, what is driving this business?

As we highlighted above, a consumer gets the product straight away and can split the payment for the item into a certain number of instalments depending on the provider with the first payment due straight away. It is just an alternative form of credit and hence, what its replacing are traditional credit cards and other forms of financing such as personal loans.

The products appeal to millennials due to what appears to be an aversion to credit cards by this generation. Some say its due to the GFC however I believe it’s more a function of millennials preferring tech enabled products. With BNPL providers, you can sign up and consume in under 5 minutes. With a credit card, you generally need a relationship with the bank and there is at least a week before the card arrives! So, are BNPL providers just filling the void left behind by cumbersome credit products? Either way, demand for credit cards by millennials is less than the prior generation with a study finding 23% of millennials did not own a credit card[1]. Another study found only 1 in 3 actually had a credit card[2]. A Fed Survey found the 18-24 demographic preferred to pay with cash.

Other research suggests as people get older, they are more likely to get a credit card so perhaps the adoption of credit has been pushed out rather than quashed. Funnily enough you can use a credit card to pay off your BNPL purchases, although APT highlighted in their recent update that approx. 90% of all transactions were done via a debit card.

Although these products are increasing their offline or instore penetration most sales are still done online. The COVID crisis saw a huge shift to online consumption which drove consumers to these types of products. In addition, it encouraged merchants to address their ecommerce offering, accelerating adoption and inbound for the industry.

Another distinction that APT highlighted in their 1H20 results is that the avg. outstanding balance for an APT customer was $211 vs $3,380 for a credit card (according to RBA data) – this is a drastically different psychological debt for a consumer.

Finally, there are some genuine advantages to BNPL vs credit cards:

- Quick sign up (less than 5 minutes generally).

- It is not a line of credit and is used for discrete purchases.

- Is free for the consumer if they pay it back on time.

- Late fees are small and are generally capped at a % of the item purchase (~25%). These charges do not compound.

- For a merchant, it can be an attractive ecommerce

Whatever the true reason is, these products have been wildly successful. Afterpay has ~11% population penetration in ANZ, 1.7% in the US after launching in May of 2018 and 1.5% penetration in the UK in less than 12 months. The combined market cap of the main four ASX listed BNPL companies is A$28.2b and they have achieved an avg. 6 month return of 182%. These products are also continually evolving. They were used primarily for apparel purchases however can now be used to book flights and holidays (assuming people were actually buying such things!). It is also inevitable some form of loyalty program will be introduced, closing the gap between their product, and those of credit cards.

Who knows, maybe Afterpay will one day be synonymous with Amex, MasterCard, or Visa? Or perhaps with the genius of hindsight we will look back at the $90 share price and be amazed it reached those levels. Whatever the outcome, what Anthony Eisen and Nick Molnar have achieved to date is truly impressive and we will be monitoring APT’s full year results tomorrow very closely.

[1] ttps://www.prnewswire.com/news-releases/td-banks-annual-consumer-spending-index-reveals-credit-knowledge-gap-exists-among-millennials-300810766.html

[2] https://fortune.com/2018/02/27/why-millennials-are-ditching-credit-cards/