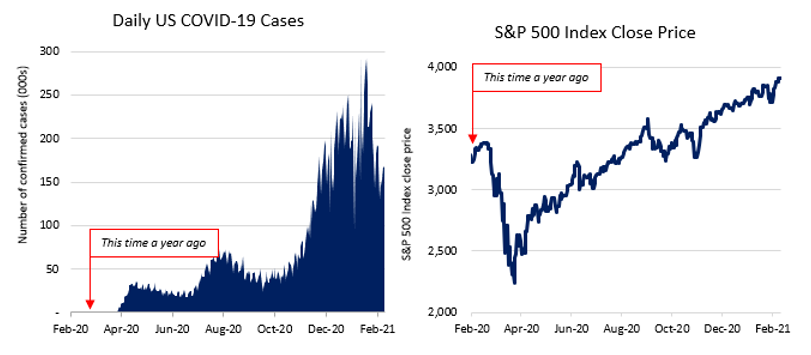

This time a year ago, as companies were reporting their year-end earnings, the S&P 500 closed at USD $3.36 trillion1 and the number of confirmed COVID-19 cases in the United States could be counted on my fingers.

Source: Bloomberg as at 11 February 2021.

Three weeks earlier, Wuhan China had gone into quarantine. On the back of this news, consensus earnings estimates for the S&P 500 (largest 500 companies in the US) fell just -2% for the first quarter of the year, while estimates for the remainder of the year remained largely unchanged. Reports published in earnings season a year ago, told us to ‘expect a short-lived’ and ‘transitory’ impact from COVID-192.

Now, with the benefit of hindsight, it is easy to forget how unknown the territory we entered was. Over the next month, COVID-19 cases spread rapidly, markets plunged and the World Health Organisation declared a pandemic. Since then, as you know, we have lived through one of the greatest upheavals to human existence in living history. Countries closed their borders, we stayed home, and our world changed dramatically.

Companies experienced supply chain disruptions, an almost overnight shift to working from home, and needed to innovate to deliver under new constraints. The resilience and adaptability that ensued was impressive and is highlighted again this earnings season. Despite the staggering number of COVID-19 cases (over 100m globally, 26m of which are in the US3), the S&P 500 is now +15.6%4 above levels seen a year ago, having completely recovered from the sell-off we saw in March last year. To date, nearly 300 companies have reported their final quarter results5 and we are seeing:

- Companies are beating analyst earnings expectations – 66% of companies beat expectations on both revenue and earnings, which is well above the historical average of 38%. In part, this reflects strong performance but it could also be argued that expectations were too low, given ongoing pandemic uncertainty, mixed economic readings and many companies unwilling to provide guidance. Interestingly, these outperformances have not been rewarded, and on average, companies have traded down almost a quarter of a percent the day following their announcement. This is reflective of the fact that share prices have already performed strongly in the lead up to results.

- Companies are growing – in aggregate 4Q earnings per share grew +2.5% compared to the levels seen a year ago pre-COVID. This has been driven by Financials (+20%), Technology (+16%) and Health Care (+12%) while more economically sensitive areas of the market have been harder hit, such as Industrials (-35%) and Energy (-102%).

- Capital expenditure (company investment) is recovering – capital expenditure turned positive compared to levels seen a year ago which is a sign of management confidence in the outlook. For example, Amazon increased capital expenditure +176% in the quarter, spending more than Google, Microsoft and Facebook combined. Excluding Amazon, S&P 500 capital expenditure in aggregate was -10%, a significant improvement from -16% in the prior quarter.

- Full year expectations are positive – while Covid restrictions remain in place throughout the US, the vaccine roll out is underway and this, coupled with additional doses of fiscal stimulus, is expected to revive activity throughout the year. Analysts are currently expecting sales growth of +10% for 2021 and earnings growth of +24%.

When we find ourselves back here in 12 months assessing year-end earnings, I suspect we will again be astounded by how much can change in a year. While we continue to find ourselves in uncharted territory, we remain confident that whatever the next year brings, the companies we invest in will continue to innovate, adapt, and succeed.