Profiting from Management Spin? Opportunities presented by corporate demergers

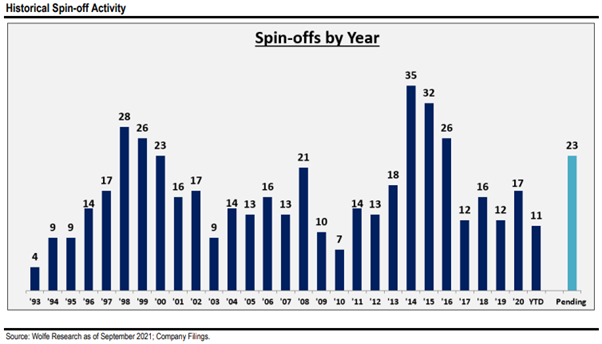

Breaking up is hard to do. But that is the journey on which many well-known corporate conglomerates have embarked in recent years. In one week in November 2021, the quintessential American conglomerate, General Electric, alongside health care behemoth Johnson & Johnson and Japan’s very own Toshiba all announced plans to simplify and slim down corporate structures, spinning-off individual businesses into separate listed entities. These three household names join others such as Siemens and IBM which have pursued similar strategies. Whilst every corporate spin-off or demerger is different, we consider events such as this a hunting ground for stocks with differentiated drivers of investment returns, providing important portfolio diversification.

But why do corporates bother? The spin process can be complex, demanding of management attention and additional costs will be incurred. Yet, after decades during which many corporates blindly followed a “bigger is better” mantra, simplification and focus are in vogue as corporates strive for operational excellence.

Often, the expectation is that, freed from the bureaucratic shackles of a conglomerate, managers have the autonomy to take control, to take calculated risks and allocate capital into projects to improve competitiveness and accelerate growth. Other times, it is the parent that benefits, without the drain on resource an underperforming business unit may be responsible for.

Companies also expect to be rewarded with a higher valuation in the stock market. Investors often do not value the earnings resilience that a conglomerate may provide. Investors may consider they can achieve the same diversification benefits by building a well-structured stock portfolio. Often, a conglomerate will include businesses that are lower quality, lower growth, or going through a difficult point in their business cycle. For this reason, large and diversified corporates often trade at a “conglomerate discount” relative to the valuation the individual business units would attract were they independent entities. Spinning off the “bad” businesses, shines a greater light on the “good” businesses, and the sum value of the parts may be greater than the whole.

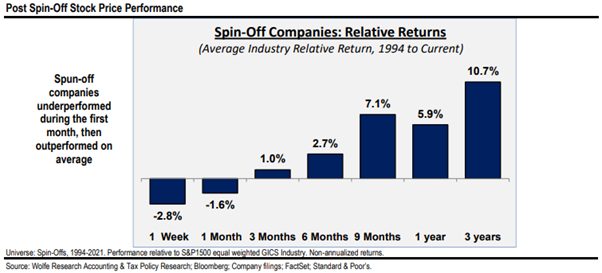

The empirical evidence is difficult to refute; Wolfe Research has found that spin-off companies on average outperform markedly in the 3 years following spin. However, performance does diverge, and we observe many spin-offs of underperforming business units. Instead of reinvesting in a challenged business the parent company cuts ties. This benefits the parent but may leave the underperforming unit somewhat stranded. When assessing spins, we employ the same standards around fundamental business quality that we demand of other investments. Caution and careful analysis are required but these can be fruitful investment opportunities.

Whilst General Electric, Johnson & Johnson and Toshiba were well known enough to capture the headlines, these companies follow a long list of lesser-known corporates to pursue a similar path. We’ve posted before about precision agriculture, and the separation of CNH Industrial’s commercial vehicle business, which is due to complete on January 3, 2022. Danaher is another portfolio company of ours. Its board and successive management. teams have proven themselves highly effective capital allocators willing to take portfolio action, acquiring faster growing and higher quality businesses whilst spinning off more mature or more cyclical businesses over time. This has created significant shareholder value as Danaher has transformed itself from a cash generative but cyclical industrial product maker at the turn of the century to the life sciences powerhouse it is today.

The stock market is littered with corporates in the midst of change. We believe these opportunities play an important role in our portfolio.