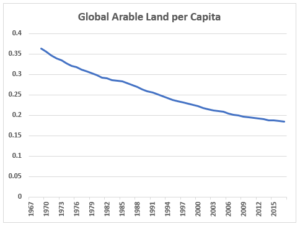

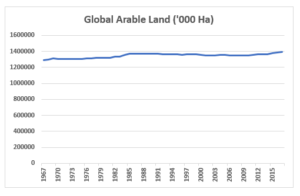

Food security, or access to sufficient safe and nutritious food, is one of the most important challenges facing the world today. The global population is expected to grow 30% by 2050 and with rising incomes driving higher protein consumption, food production will need to significantly outpace population growth.

Meanwhile, additional arable land is in short supply, so farms will need to become more productive. Precision agriculture, or technology-loaded farm machinery is a necessary enabler, with tractors and their attachments sitting at the intersection of the physical farming process and the digital solutions needed to drive change. The solutions to feeding the world exist, though the inequality reflected in the way food is distributed globally poses deeper challenges and questions that go beyond the scope of this post.

We find the large farm machinery industry to be opportunity rich; it is an attractive oligopoly and Deere, CNH Industrial (CNHI) and AGCO are each investing organically, as well as partnering with technology enablers to capitalise on the rise of precision agriculture.

Source: Bloomberg

Source: Bloomberg Source: FAO, The World Bank, Milford Analysis

Source: FAO, The World Bank, Milford Analysis

Precision agriculture influences the way farmers apply inputs including seeds, nutrients, pesticides, and herbicides. GPS geolocation data, sensors, drones, and imagery in combination with software and AI help ensure agricultural inputs are applied in the right quantity, at the right time, in the right location.

Examples include:

- Precision planting allows farmers to plant single seeds with half-inch accuracy and at faster speeds than older equipment, improving plant times and ultimately yield per acre (it also lowers a farmer’s seed costs).

- Deere’s See & Spray solution, which can be likened to facial recognition for plants; as the sprayer is towed by a tractor up and down a field cameras and AI are used in real time to recognise a plant from a weed and spray weed killer only onto the weeds. This will allow for the development of more potent herbicides to target more resilient weeds, thus increasing yields, and is also expected to support 30-50% reductions in herbicide consumption (corn and soybean) and up to 90% for crops including cotton.

These solutions, in combination with many others can enable significant yield improvement even today e.g. the best corn farms achieve over 600 bushels of corn per acre vs. just 167 bushels per acre at the average farm.

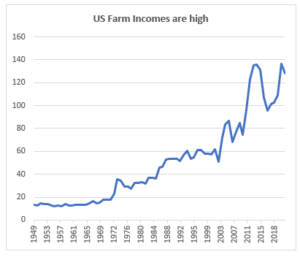

At Milford, we look to invest in companies enjoying improving fundamentals, where that change is not already reflected in their share prices. Precision agriculture helps position farm machinery as an attractive long-term investment proposition, which is helped by a favourable cyclical outlook for farm machinery demand. Despite the attractive value proposition precision agriculture solutions represents, the sales of new large tractors and combines in the crucial US market have languished about 25-30% below mid-cycle levels for several years and would need to double to reach the 2013 peak.

Elevated availability of used equipment and lower farm incomes were key drivers of the weaker demand. Throughout 2020 and 2021 we have observed:

- Falling dealer inventory of used equipment (down around -40% y/y in March)

- Rising used equipment prices (over30% y/y in 1Q21)

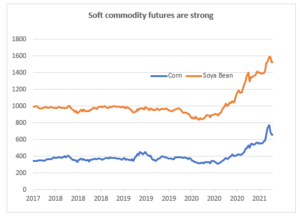

- High soft commodity prices

- Farm incomes recovering back to prior peak

These developments together bode well for a cyclical upswing in new equipment, which is now well underway.

Source: Bloomberg

Source: Bloomberg

Source: USDA, Farm Net Cash Income

Source: USDA, Farm Net Cash Income

Milford also look for multiple ways to “win”, rather than have our investment outcome be contingent on one scenario playing out. This approach has previously led us to the farm machinery space, and more specifically CNHI, a leading producer of large tractors, construction equipment and commercial vehicles. There is however little synergy between the farm machinery and commercial vehicle businesses and the CNHI board and Management team has committed to separating the two businesses by early 2022.

We believe the sum-of-the-parts is greater than the whole and the management teams of these more focused “pureplay” companies will drive better financial results and ultimately be more attractive to investors, providing another leg to our investment case beyond the cyclical recovery.

Farm equipment stocks have performed well which creates vulnerability to cyclical disappointment or supply chain challenges; Milford view the space favourably but are actively monitoring the key drivers of our investment case.