Channel Infrastructure (CHI) owns and operates the Marsden Point fuel import terminal, where refined fuel is imported by ship from Asia and transported via a 170 km pipeline to Auckland. The terminal stores and distributes approximately 40% of New Zealand’s total fuel, including around 80% of the country’s jet fuel, serving major customers such as Z Energy, Mobil, and BP. In April 2022, the facility transitioned to an import-only terminal after the refinery was closed due to ongoing commercial challenges, including competition from larger Asian refineries.

Milford first invested in Channel in December 2023 when Mobil sold its shareholding, and we subsequently increased our holding as Z and BP divested their stakes. In our view, Channel’s import terminal offers defensive and predictable earnings (linked to inflation and fuel volumes) with future upside potential from repurposing the precinct for alternative energy projects.

Defensive and predictable earnings

Channel has a long-term, inflation-linked contract with the three major oil companies (Z Energy, Mobil, and BP). Under this agreement, Channel receives an annual fixed fee, and a variable fee linked to the volume of fuel passing through the terminal. In addition, Channel generates revenue from providing private fuel storage at the terminal. This has become a key growth area, supported by increasing demand for fuel storage (driven in part by government mandates for additional reserves to enhance energy security) with significant unutilised capacity at the terminal.

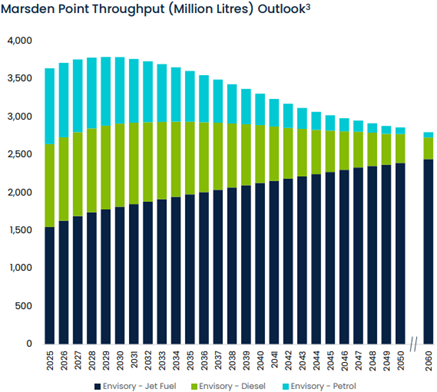

While petrol and diesel volumes are expected to decline due to the electrification of vehicles, jet fuel demand is forecast to continue growing in line with international air travel. This is primarily due to the technological challenges of developing long-distance electric aircraft. As a result, the aviation industry is shifting towards sustainable aviation fuel (SAF), which offers substantial emissions reductions while utilising existing fuel infrastructure and aircraft engines.

Figure 1 Channel Infrastructure 2024 Results Presentation

Marsden Point Energy Precinct

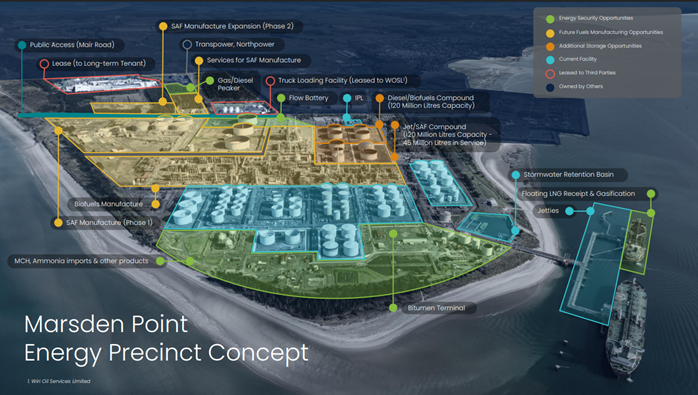

In our view, there is significant opportunity to repurpose the site for new energy projects. The precinct offers 120 hectares of available land, with existing zoning and infrastructure making it an attractive location for energy development.

The key near-term opportunity is a biorefinery, with a final investment decision expected in 2026. If the project proceeds, Channel would earn rental income as the landlord and receive proceeds from the sale of decommissioned refinery equipment, which is expected to be repurposed for the facility. Additional opportunities include a diesel generation plant to support electricity supply during winter peaks, as well as longer-term prospects such as hydrogen production.

Figure 2 Channel Infrastructure 2024 Results Presentation

What’s the outlook from here?

Overall, in our view, Channel owns highly strategic infrastructure assets, with the import terminal supporting a sustainable dividend and offering upside potential from repurposing the site for new energy projects. Over the long term, the key risk is the pace of electrification (particularly for long distance aircraft) and the company’s ability to successfully redevelop the site for alternative energy uses.