Arthur J Gallagher (AJG) is a US-listed insurance and risk management broker, providing property and casualty insurance, employee benefits and consulting services to businesses. It was founded in 1927, has a market cap of US$75b, and is still run by the Gallagher family.

The business has delivered an adjusted earnings per share compounded annual growth rate of 18% for the past 10 years, driven by solid organic growth rates and a consistent acquisition strategy focused on rolling up smaller operators.

We have a preference for AJG’s mid-market customer exposure, which remains underserved and offers more favourable growth opportunity than the large customer exposure of some of its peers. 90% of the time, AJG competes with brokers that are smaller, and therefore its scale and ability to invest in better technology and processes gives it a notable competitive advantage.

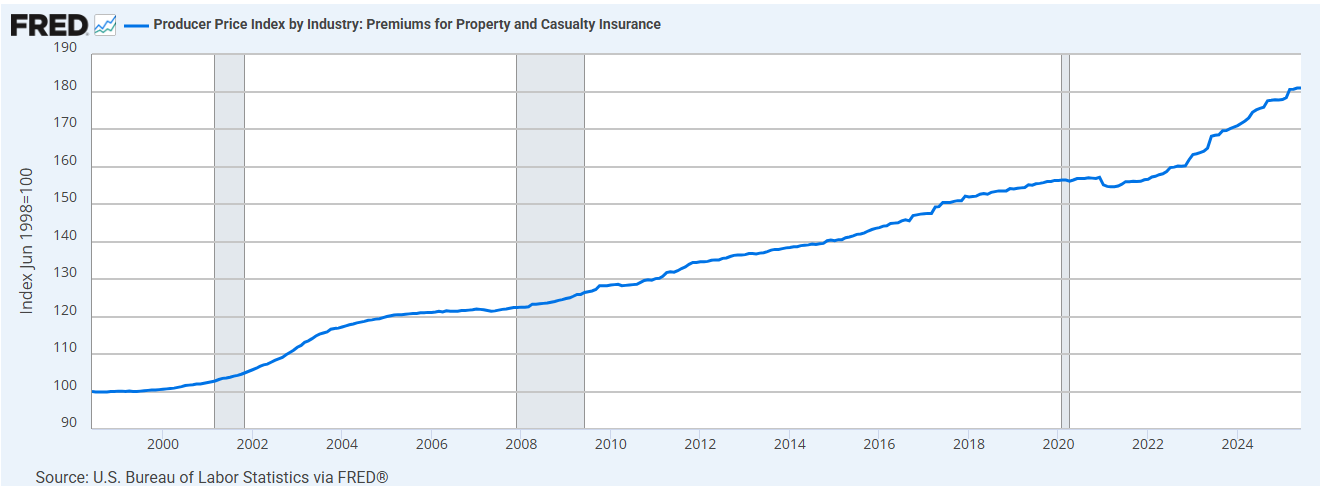

We view insurance brokers as a high-quality investment that benefits from the underlying growth trends in insurance, without taking on any of the underwriting risk. Inflation, elevated catastrophe losses and litigations, as well as increasing complexity, continue to put upward pressure on insurance premiums. As a broker, AJG typically generates commission revenues as a percentage of premiums placed.

AJG’s share price has tripled over the past five years due to the strength of its underlying business and elevated insurance pricing dynamics, which have been further supported by increased investor appetite. Recent share price weakness has been driven by signs of a ‘softening’ in commercial insurance pricing, which will moderate organic growth rates across the industry.

While some uncertainty remains around how cyclical pricing may be in the near term, we see the sell-off as an opportunity to rebuild a position. The long-term growth algorithm remains intact, and current valuations appear reasonable, with expectations better reflective of the potential for more normalised organic growth rates going forward.