This month of May saw the re-opening of New Zealand’s borders to a substantial part of the world. It marks an important milestone in the country’s recovery from the Covid-19 pandemic. For the first time since March 2020, when we took the unprecedented but necessary action of closing our border to those without citizenship or residency, we welcome back international tourists. Tourism is one of our largest industries, and the one which was most impacted by the Covid-19 response.

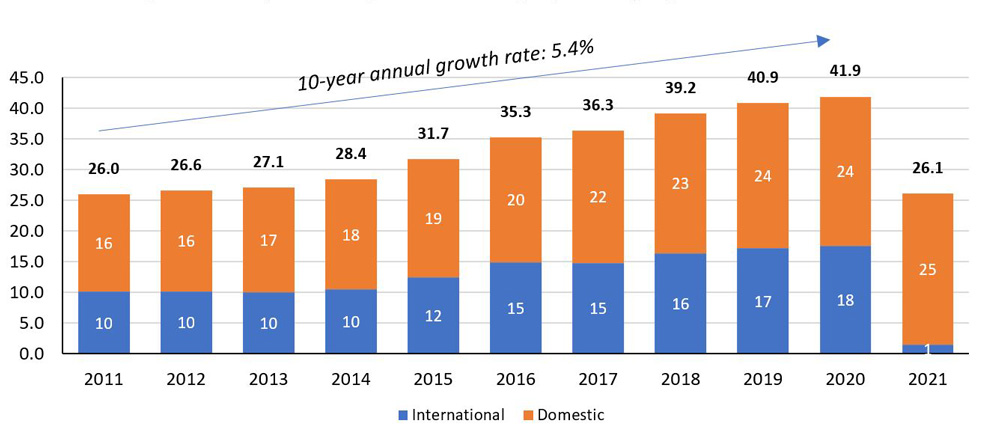

Prior to Covid-19, we had experienced significant growth in tourist numbers and tourism expenditure. In the decade preceding the pandemic, tourist numbers and expenditure both grew at a ~5% compound annual growth rate. By March 2020, annual tourism expenditure had grown to $41.9bn, split approximately 57% domestic and 43% from international tourists.

NZ tourism expenditure by domestic/international ($bn, March y.e.)

Source: Statistics New Zealand

In March 2020, almost overnight, the contribution from international visitors fell to zero. It has remained that way since, with the exception of the Trans-Tasman bubble which opened briefly between April and July 2021.

The tourism industry thus underwent deep structural change with significant fixed cost and capacity removed to reduce operating losses and survive the border closure period.

Operators will, then, be looking forward to the recovery in international tourism. The question remains, though, how soon will international tourists return in earnest.

Anecdotal evidence from industry sources is clear that interest in New Zealand remains robust and demand is expected to bounce back quickly as international visitors who are, increasingly, moving on from Covid-19 look to re-connect with the world. Indeed, the relative outperformance of our Covid response, from a health perspective, may serve to strengthen our reputation as a safe destination.

Government policy will continue to play an important role in the recovery. We must be careful to not fall too far out of step with other nations with whom we compete for tourists. Many of those nations are increasingly relaxing pre-departure and arrival Covid test requirements for vaccinated travellers. This creates more uncertainty for travellers to New Zealand relative to other countries, reducing the desirability of travel to here in the near-term.

Despite these current uncertainties, we believe the current environment presents an interesting and exciting opportunity to invest in the tourism industry. Much of the early uncertainty surrounding the pandemic has diminished, whilst operators have dealt with much of the pain in restructuring operations to make it to this point.

Operators will be seeking capital to strengthen their balance sheets, allowing them to weather near-term volatility and add back capacity ahead of the return of international tourism. Interesting opportunities will also likely emerge for M&A activity, as the industry necessarily consolidates to ensure long-term sustainability.

Examples of this include the recent announcement of the merger between THL and Apollo Travel, and the recapitalisation of Real NZ by a consortium of investors that included Milford’s Private Equity Fund III.

Yes, tail risks remain in the form of a potential new, more deadly variant forcing border closures once more. Or a completely new virus could emerge prompting government to roll out the Covid-19 response playbook.

A strong balance sheet and a tight handle on fixed costs are key to tourism operators weathering these disruptions. If investors can get comfort in this respect, the upside is compelling as we return to normality and re-open to the world.