Viva Energy is an Australian company in which Milford has held a position consistently since December 2021. I remember our first investment well. I was in isolation as the first person within Milford’s Australian office struck down with Covid. My symptoms were mild and manageable, reminding the team that Covid was transitory – underpinning our conviction to add more reopening beneficiaries to the portfolio. There was significant uncertainty about what reopening would look like. Viva Energy provided leverage to a return of mobility both domestically through the largest network of service stations and internationally through aviation.

Viva is one of Australia’s largest integrated downstream petroleum companies. It has a large network of retail sites (sole use of the Shell brand) and owns a refinery in Geelong, Victoria. Refining crude oil is a capital intense and highly volatile business. Earnings traditionally delivered incredible highs, but equally crippling losses when global refining margins contracted.

Available and accessible energy resources are critical to any country’s economic development. The pandemic reiterated to policy makers the importance of critical infrastructure which underpins key consumer and industrial sectors like agriculture, transport and mining. In 2021, the Australian Government announced a Fuel Security Services Payment (FSSP) designed to ensure the country doesn’t become 100% dependent on imported fuel. The payment essentially mitigated the downside risk of losses from notoriously volatile refining margins. The government also introduced minimum stock holding obligations on main grade fuels across the industry and required refinery upgrades to low-Sulphur fuels. I know of no other international refiner globally that has Viva’s pseudo-floor in refining margins provided by a contract with a national government.

With the world still grappling with an uneven economic reopening post Covid, Russia attacked Ukraine in February 2022. Russia, as a top five global oil refiner, swiftly suffered sanctions. This led to a period of elevated global refining margins, which was a windfall for Viva Energy’s refining earnings.

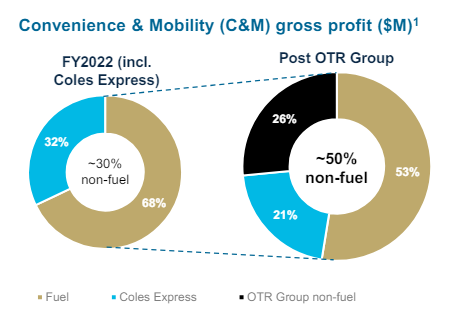

With a strong balance sheet, Viva embarked on a journey of diversification away from refining. Firstly, it acquired a nationwide network of 700+ Coles Express convenience sites. These sites are exceptionally located, but visibly tired, suffering years of neglect as a non-core business unit within the supermarket. Furthermore, Viva announced the acquisition of arguably the best convenience retailer in the country, On-The-Run (OTR Group), for $1.15bn. This game changing acquisition not only provided significant synergies, but substantially derisked the Coles Express integration and rebrand. An average OTR site generates over double the revenues of a Coles Express site, with more than half of gross profit generated from non-fuel sales from quick service restaurants and supermarkets.

Source: Viva Energy acquisition of OTR Presentation April 2023

Viva is a key enabler in Australia’s journey to decarbonise. By the end of the decade, Viva will likely operate the largest network of fast charging stations within its convenience sites. It is also in discussion with the Victorian Government to include a gas terminal and potentially a solar energy farm at its Geelong site. Further, Viva is working towards being Australia’s leading provider of biofuels in Australia. This lower carbon fuel made, from renewable feedstocks, is one of the few ways to decarbonise heavy freight and air travel. In sum, Viva’s refining infrastructure and distribution will be critical as the government likely incentivises the use of clean, renewable aviation and industrial fuels.

We hold Viva Energy in a number of our funds and are engaging with the company to ensure the right balance of investment is being directed towards our clean energy future. We understand that while it would be ideal to demand we shift immediately, businesses like Viva are required to successfully transition to a clean future over the next decade.

We hold Viva Energy in a number of our funds and are engaging with the company to ensure the right balance of investment is being directed towards our clean energy future. We understand that while it would be ideal to demand we shift immediately, businesses like Viva are required to successfully transition to a clean future over the next decade.

From a valuation perspective, we find Viva compelling at 11x FY25 P/E (price per earnings ratio) with a 5% dividend yield. The business continues to direct earnings generated from oil refining towards a network refresh of convenience sites. This process will not only generate strong future earnings growth, but deliver more resilient earnings, earning a far higher earnings multiple in time.

Michael is pictured above left, visiting an OTR site in Hazelwood Park, South Australia in November 2023.