Amazon – Earth’s most customer-centric company

From a humble online bookseller in 1994, to a global e-commerce giant and the world leader in cloud computing, Amazon really has lived up to its tagline and become “The Everything Store”.

It all started with a napkin

Amazon’s e-commerce business has grown to be the largest in the world (excluding China), selling approximately $640bn worth of goods in 2023, about the same as the world’s largest physical retailer, Walmart1.

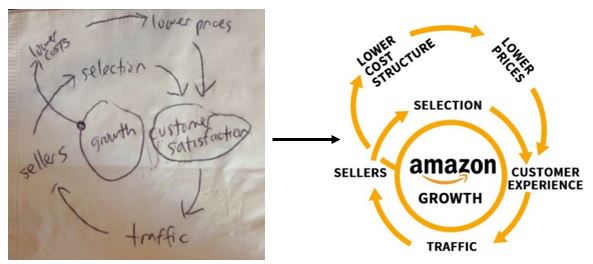

In order to understand how Amazon has achieved this, it helps to understand Amazon’s business model, which Founder Jeff Bezos scribbled onto the back of a napkin in 2001 (pictured below).

Bezos’ original napkin sketch of Amazon’s business plan2.

The flywheel is built around durable customer needs like price, selection and convenience – things that will forever be important to customers. At its core is an “obsessive” focus on the customer and a relentless pursuit of customer satisfaction, by making it faster, easier, and more convenient to find, buy and receive products. This leads to more traffic from both existing and new customers, which attracts third party sellers, eager to tap into Amazon’s customer base. This further expands Amazon’s selection and improves the customer experience. At the same time, it helps Amazon scale and achieve a lower cost structure, which can be passed on to customers in the form of lower prices. The loop becomes self-sustaining, helping to drive the attractive growth we’ve seen over time.

A great example of Amazon’s customer-centric philosophy is its Prime membership, which provides benefits such as free shipping, easy returns, Prime Video, Amazon Fresh and much more. Once a customer has paid the annual membership fee, it makes sense for them to consolidate more of their shopping needs on to Amazon. As Business Insider put it: “Asking the question ’How much would you pay for Amazon Prime?’ is kind of like asking how much would you pay to keep using Google, as it’s so fundamentally entrenched in our daily lives”.

Pandemic benefits and challenges for e-commerce

The pandemic has had a significant impact on Amazon’s e-commerce business over the Past four years. In 2020, Amazon reported its strongest revenue growth in almost a decade, as nervousness and lockdowns spread across the world, and online shopping became critical. In a rush to bring on more capacity, Amazon doubled its workforce3, doubled its fulfilment centre footprint (which had taken 25 years to build out), and built out a last mile transportation network roughly the size of UPS, all in just a couple of years4. As economies opened up in 2022 and people wanted to visit stores again, e-commerce suffered and Amazon’s revenue growth slowed dramatically. This resulted in a significant underutilisation of the extra capacity, which hurt profitability.

Fast forward to today, Amazon’s e-commerce business has reaccelerated to grow at a more normalised rate – lower than pre-Covid levels given the maturity of online shopping, but still healthy. Amazon has also made significant progress on lowering the “cost to serve”, which boosted retail margins and contributed to its recent record operating profit result. Management still see plenty of opportunity remaining to further lower the “cost to serve” and drive margin improvement.

Cloud computing: The real profit driver

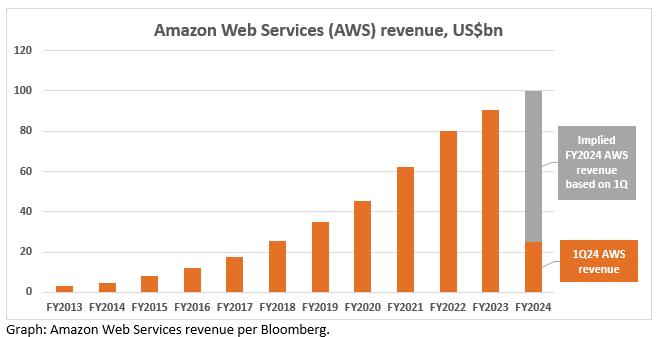

While e-commerce makes up 85% of Amazon’s revenue, it only makes up about 30% of profits, with the bulk of profits being generated by Amazon’s high-margin cloud computing business (called Amazon Web Services, or AWS).

Amazon is the global leader in cloud computing which is essentially ‘”on demand” computing delivered over the internet. It does away with the need to own all the physical hardware, storage, databases, networking and software, which is becoming increasingly difficult to manage in today’s technology-heavy world. Cloud computing provides scale, flexibility, faster time to market, automatic updates, and advanced security, for a much lower cost. Amazon’s cloud computing business has now reached a run-rate of $100bn in revenue – up 4x since 2018.

Cloud computing and artificial intelligence (AI) go hand-in-hand. The newest and most exciting piece of AI is called generative AI, which can generate new content rather than simply analysing data that already exists. Generative AI is expected to grow approximately 32% per year5, and it’s thought that over time, 90% of the content online will have been made by generative AI, not humans6. In its recent quarterly result, Amazon highlighted that it’s seeing considerable momentum in generative AI, now generating a multi-billion dollar revenue run-rate, despite it still being early days.

A key challenge in generative AI is accessing enough power – an AI data centre needs more than double the amount of power versus a normal data centre7, and according to the International Energy Agency, the electricity consumed by data centres globally will more than double from 2022 to 2026, to an amount roughly equivalent to what Japan consumes annually8.

Amazon has made significant strides in its commitment to renewable energy. 90% of operations were powered by renewables last year, and it plans to be at 100% by 2025. It’s the world’s largest corporate purchaser of renewable energy for the fourth year in a row9, and it has the eighth largest clean energy portfolio globally10. Once in operation, it would be enough clean energy to power the generation needs of New Zealand almost twice over11.

The third leg of growth

Advertising is a new but fast-growing business for Amazon, building up an impressive $47bn business in just five years to become the world’s third largest ad platform12. Advertisers are attracted to Amazon’s reach (200m+ global Prime subscribers13) as well as the rich data set of customer purchase intentions. Notably, advertising is a very high-margin revenue stream so the segment has an outsized positive impact on profits.

Amazon shares have been a strong performer over the past year, up 60%14. However, we still see ample opportunity ahead, driven by an acceleration in both e-commerce and cloud computing as well as improvements in profitability. Amazon’s success is underpinned by its long-term focus, dedication to innovation, and its goal to be “Earth’s most customer-centric company”.

[1] UBS report “A Closer Look at WMT’s Dual P&L”, 8 April 2024.

[2] https://channelkey.com/amazon-content-seo-and-optimization/amazon-flywheel-the-secret-to-success-for-earths-most-customer-centric-company/

[3] https://www.nytimes.com/2022/11/14/technology/amazon-layoffs.html

[4] Amazon 4Q 2023 earnings call.

[5] https://www.bloomberg.com/company/press/generative-ai-to-become-a-1-3-trillion-market-by-2032-research-finds/

[6] https://futurism.com/the-byte/experts-90-online-content-ai-generated

[7] https://www.bbc.com/news/business-68238330

[8] https://www.bbc.com/news/articles/cj5ll89dy2mo

[9] https://www.aboutamazon.com/news/sustainability/amazon-renewable-energy-portfolio-january-2024-update

[10] https://about.bnef.com/blog/amazon-is-top-green-energy-buyer-in-a-market-dominated-by-us.

[11] https://www.mbie.govt.nz/building-and-energy/energy-and-natural-resources/energy-statistics-and-modelling/energy-publications-and-technical-papers/energy-in-new-zealand/energy-in-new-zealand-2023.

[12] https://www.wsj.com/articles/amazon-hopes-to-dominate-the-world-of-streaming-ads-it-faces-some-challenges-along-the-way-7176a7a2

[13] Amazon 2021 Shareholder Letter.

[14] Bloomberg data to 22nd May 2024.