In just two-and-a-half years, the 2020s have already proved to be a decade of dramatic and disruptive change – but could some change be for the better? The world continues to weather a global pandemic, lockdowns, supply chain disruptions, and a European war. Oil, gas and electricity prices have spiked in the past 12 months, hurting the consumer and adding to a challenging economic backdrop. Add to that inflation and governments pulling desperately on the reins to quell it, and it begs the question: how does this play out and what does it mean for your investments?

Government response

The 2020’s turbulence has sparked meaningful policy change in key markets, as governments are forced to face the realities of energy independence and climate change. Governments are striving to solve the “Energy Trilemma” – how to provide secure, affordable and low-carbon energy.

The war in Ukraine has brought home to the EU a need to decouple from Russian energy, and has accelerated plans for decarbonisation through its revamped RePowerEU plan. The UShas passed its Inflation Reduction Act to combat rising commodity prices and accelerate its energy transition. Countries around the world are revisiting their positions in light of the current challenges, and many have set targets for a significant reduction in greenhouse gas emissions to “net zero” by 2050i; the key ambition of the Paris Agreement to limit the negative impacts of global warming.

The need for investment is significant… but appears to be manageable

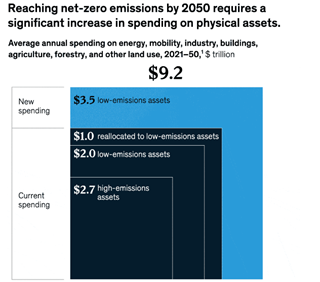

McKinsey Global Institute estimates the total spending on physical assets for energy and land-use systems required to meet net zero 2050 targets will be $9.2 trillion per year globally from 2021 to 2050 , illustrated in the diagram below. Of the $9.2 trillion to be spent, $3.5 trillion is new spending on low-emissions assets, while the remaining $5.7 trillion is current spending, some of it a reallocation to low-emissions assets.

Though the headline number of $9.2 trillion seems high, in the context of current investments and global GDP it appears manageable. The International Monetary Fund (IMF) and the International Energy Agency (IEA) put the estimate of incremental spending to reach net zero at 0.6-0.9% of global GDPii .For context, this is less than half of the global defence spend at 2.2% of global GDPiii and spread across the public and private sectors.

Renewable energy as a cost competitive stable alternative

Renewable energy technologies are moving in as the trilemma-solving technology of developed nations. Renewables tick the “low carbon” box by their very nature, as well as providing energy independence. But what about affordability and security?

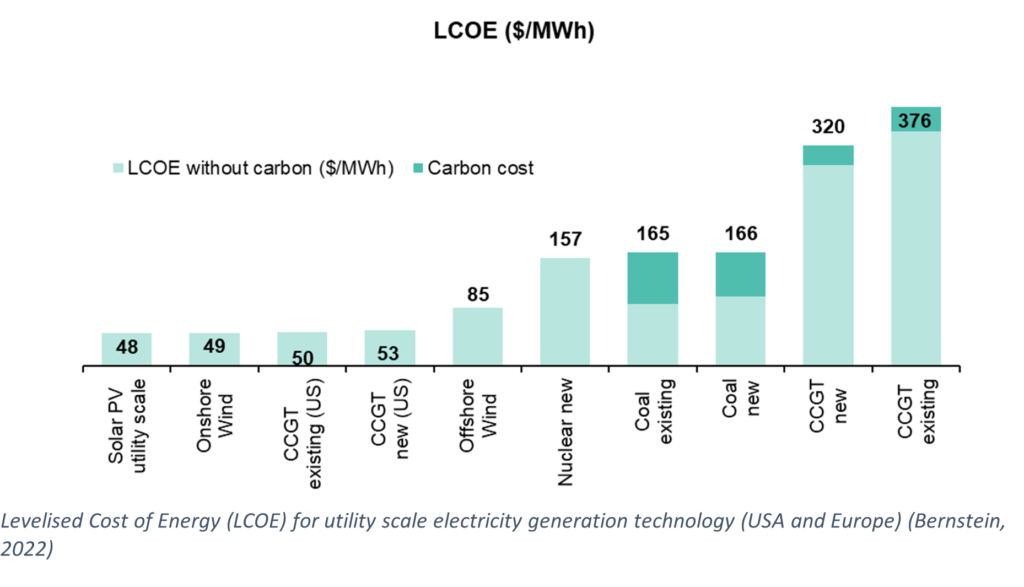

Bernstein Research estimates the cost of energy from renewable generation is now lower than conventional alternativesiv – and the world’s capitalistic instincts have been woken. Environmental benefits aside, the world wants the cheapest and most certain form of electricity to power its needs.

One of the natural benefits of renewable energy is the low variable cost per incremental unit (wind and sun are free) which means the price is known at the time of building for the life of the project (usually 20+ years) and does not require commodity inputs, which improves energy security and stability. This means utilities – and their regulators – are favouring renewables from a pure economic standpoint (a low and certain future cost).

While many assumptions go into these LCOE estimates, it is becoming clearer that the gradual reduction in the cost of renewable energy driven by technological improvement, combined with volatile coal and gas prices, is making renewable energy more attractive. As a result, it appears the transition from conventional to renewable energy is not just underway but accelerating.

What does all this mean for our investments?

The reallocation of trillions of dollars from high-emissions assets to low-emissions assets will create “winners” and “losers”. In addition, the spending required on physical assets to meet net zero targets creates significant transition opportunities for investors in Global Real Assets that should provide attractive returns and growth. That said, any large-scale transition is fraught with risks and there will undoubtedly be challenges along the way, such as the balancing act of ramping up new assets in-line with the retirement of old assets to minimise disruptions. The Milford investment team is working hard to keep on top of these demand and supply dynamics to maximise the risk reward of these investments.

Beyond electricity generation, opportunities exist in energy storage, energy transportation, carbon capture, and new/emerging technologies such as hydrogen – all part of an energy transition that needs fit-for-purpose infrastructure.

The winds of change are clearly blowing, and this storm may have a silver – or should we say green – lining yet.

————————————————————-

i https://www.mckinsey.com/capabilities/sustainability/our-insights/six-characteristics-define-the-net-zero-transition.

ii The Economist (5-Oct-22): The McKinsey Global Institute estimates that an annual average of 9.2% of GDP must be spent on physical assets to achieve net zero by 2050, but reckons this is an increase of only 0.9% of GDP over current plans. The IMF and the IEA similarly put the necessary incremental investment over the next decade at 0.6-0.9% of cumulative output.

iii https://www.sipri.org/media/press-release/2022/world-military-expenditure-passes-2-trillion-first-time

iv Bernstein research 8 August 2022 adjusted for natural gas prices on 31 October 2022 ($6/mmbtu)