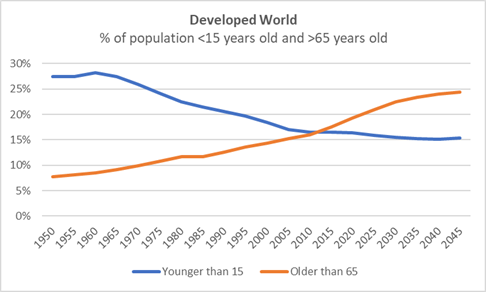

It is a well-known fact that the population is ageing in developed markets. Not only are people living longer, but fertility rates are falling, and this sees the number of retirees growing faster than the number of younger people, creating a phenomenon known as the demographic reversal.

Without a change to current policy, developed markets are likely to experience a shortage in labour supply, higher inflation, and upward pressure on real interest rates. While this creates challenges for policy makers, the ageing population may present new opportunities for investors, as outlined at the end of this article.

Data source: United Nations

Key themes

- The changing labour force

The changing demographics will see fewer working-aged people. Furthermore, the older working-aged cohort tend to participate in the labour force less than the younger cohort. Economic theory suggests that if there is less labour supply in the market, then wages will face upward pressure which could be inflationary.

- Pressure on government finances

With the decline in prime working-aged people, governments face the likelihood of a fall in tax receipts. This, coupled with increasing healthcare and pension costs with a rising dependency ratio, will put pressure on government budgets. Without a change to existing policy, this could see increases to public debt and pressure on sovereign credit ratings, which considered in isolation, could push up real interest rates. An increase in a government’s debt will increase the cost (upward pressure on the interest rate), as investors require greater compensation for the additional risk associated with holding that government’s debt instrument.

- Shift to consumption and reduction in private savings

An older-age cohort tends to shift from investment towards consumption (for example, healthcare and retirement travel), while not contributing to output, which is likely to have an inflationary impact. To fund consumption, retirees typically draw down on savings. Combine this with fewer workers in the high-saving phase of their lives and less ability for younger generations to save than in the past, there will likely be an overall reduction in private savings. Less supply of available funds for investment will place upward pressure on interest rates (i.e., the cost of funding).

What are the solutions?

A change in government policy is likely needed to help mitigate some of the impact of the ageing demographic, for example, raising the retirement age and/or increasing taxes. Another solution is a migration policy enabling access to labour from emerging markets where demographics are fundamentally different. Take sub-Saharan Africa for example; its population is intrinsically younger and is expected to almost double to more than 2 billion by 2040, accounting for more than half of the world’s population growth between now and 2050 (source: United Nations). Access to labour in emerging markets does not come without its challenges but could ultimately determine how inflationary the ageing demographic might be, and the need for other material policy changes.

What are the opportunities?

While the changing demographic could present macro challenges for investing in terms of inflation and higher real interest rates, there are pockets of opportunity for investors at a sector level. The healthcare and aged care sectors are obvious beneficiaries of an ageing population, however other sectors such as automation to help mitigate the labour force impact, and reproductive technologies to assist fertility may also benefit, amongst others. As an example, Milford has invested in Boston Scientific Corp., a medical device manufacturer that will benefit from the increasing healthcare burden as the population ages.

While the ageing demographic is a structural trend which will unfold over a long time horizon, it is not one to be dismissed when it comes to current investment opportunities.