Contact Energy (CEN) is a leading electricity generator and retailer (“Gentailer”) listed on the NZX. It is the second largest generator of electricity in New Zealand, with approximately 25% of the market. Contact’s generation base is a mix of South Island hydro, North Island geothermal, and North Island gas-fired thermal. The company is also active in the retail electricity and gas markets.

Contact (and the wider energy sector) have an important role to play in the decarbonisation of New Zealand. A core part of Contact’s strategy is building new renewable energy to meet growing demand for electricity. This demand is driven by the increasing electrification of carbon intensive industries.

Contact has a significant pipeline of new renewable generation infrastructure to be built, including the sector leading Tauhara Geothermal project in Taupo which is under construction. Once complete Tauhara will deliver 1.4TWh of electricity per year at a total cost of $880m. It is scheduled to deliver its first power in Q2 of 2023.

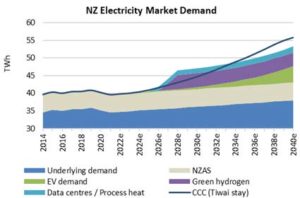

NZ electricity demand

Electricity demand in NZ has been steady for much of the past decade at around 40TWh per year. However, to meet NZ’s carbon emission commitments a lot of our industries and households will need to reduce their carbon footprint by transitioning away from fossil fuel power to electricity. According to the NZ Climate Change Commission, demand for electricity in NZ is expected to grow another approximately 20TWh or 50% by 2050. Demand is typically driven by population growth and changes in industrial load like the Tiwai NZAS smelter. In recent years, new demand has arisen from new technology with electric vehicles, data centres, coal boiler substitution, and green hydrogen expected to be large users of electricity.

Decarbonisation challenge

The key challenge for the industry is building the right amount of new renewable generation to meet this demand. We believe Contact is well placed with their significant Geothermal pipeline and strong balance sheet to help fund this development. Contact has 3.0TWh per annum of announced Geothermal projects to be delivered this decade. Fortunately, geothermal is not experiencing the same global supply chain constraints experienced by solar panels and wind turbines currently.

Outlook

Contact Energy is a core holding in many of the Milford funds. We are supportive of their new generation build pipeline and their contribution to helping NZ decarbonise. The sector is entering an exciting new phase and market tailwinds should add to growth for Contact Energy over the long term. By its nature as a utility and provider of critical services Contact has defensive qualities that we like which gives the stock good risk-return dynamics.

The photo is from a Milford trip to the Tauhara Geothermal field. This is piping that takes steam from the drill well to the generation turbine hall to create electricity.

Source: Milford analysis, NZ Climate Change Commission