WillScot Mobile Mini (WSC) is the market leader in North American modular workplace solutions (around 50% market share) and portable storage solutions (around 25% market share). WSC leases mobile site offices and storage units to almost all industries. Use cases range from providing organisations with a temporary warehouse space to store inventory and portable offices used at construction sites, through to more unusual situations e.g. ahead of the Artemis rocket launch, WSC delivered several modular offices for NASA; WSC containers loaded with supplies were air-lifted to islands in Fort Myers after Hurricane Ian washed away bridges; and 100k square feet of modular space was delivered as additional footprint for a semiconductor facility in Texas. This is a well-managed company with a compelling growth strategy and one that is well-placed to benefit from both the reshoring trend we are seeing in certain sectors and increased infrastructure investment.

Portable storage units show left hand side below, modular office example right hand side below

The company as we know it today originally came out of a ‘special purpose acquisition company’ in 2017, as WillScot – the leading provider of modular space solutions in North America. Shortly thereafter, it acquired Modular Space Holdings, the number two modular space player. The subsequent 2020 merger with Mobile Mini added capability in storage solutions as Mobile Mini was the leading provider of portable storage solutions in North America. These transactions created today’s fleet of around 400,000 modular and storage units which have over 115million square feet of turnkey space which is relocatable anywhere in North America. This fleet is more than five times the size of its nearest competitor, which gives scale advantages, and WSC is also the only company with a nationwide presence.

The beauty of WSC’s offering lies in the long-lived nature of assets, on average 20 – 30 years, which can be continually reused for different customers throughout its life. This is an example of the ‘circular economy’ whereby materials are reused and refurbished so they can be used for as long as possible, reducing waste. It also translates to attractive unit economics and high return on investment. Taking the example of a traditional modular unit, these require an upfront investment of ~$50k to purchase the unit and a further ~$6k for fit-out. After being leased for around 3 years, this investment will have paid itself back. Between customers, the unit is refitted and in the middle of its useful life will undergo a larger refurbishment that costs ~$10k. After 20-30 years, the unit comes to the end of its useful life, and the materials will be sold for scrap, realising on average ~50% of the original cost of the unit as proceeds. Putting this all together implies an attractive internal rate of return on the unit of ~25%.

Part of what makes these unit economics so attractive is WSC’s ‘value added products and services’ offering or ‘VAPS’. This is the provision of items such as shelves, lights or locks to a storage unit. On the modular office side of the business, examples include working internet, conference rooms, and chairs and desks. This is a win-win situation. Customers win as WSC’s VAPs-offering removes the time, cost and hassle of setting these up. WSC wins as customers pay a monthly fee for the VAPS they select, which is in addition to the monthly rent they pay for the unit. The margin on VAPS is attractive, at over 70%, which means we expect WSC’s margins to step up as VAPS penetration increases. On average, the cost of WSC’s units for customers is small, on average less than 0.50% of the total project, which means that customers are happy to pay a little extra to save a lot of hassle.

Significant focus from investors has been around how resilient WSC would be in a recession, which is a key risk for the stock. Deliveries of new units correlate with economic activity, so during a slowdown in economic activity we expect that new deliveries would decline. Offsetting this, is the fact that WSC’s current monthly rental rate is ~30% above its average monthly rate, providing significant upside to revenue as the current fleet converges to spot pricing. Spot pricing or new deliveries would need to decline significantly to offset this tailwind. Progression of pricing and fleet churn are key factors we are monitoring on a go forward basis.

WSC is also a beneficiary of the reshoring trend we are seeing in certain sectors. Following the supply chain disruption during the pandemic along with the geopolitical tensions that have arisen following the current war in Ukraine, companies are rethinking their supply chains. This started under Trump with the trade war, and governments have been reprioritising the production and manufacturing of strategic industries to ensure there are capabilities onshore. This has been supported by policy via the US Chips Act (supportive of the manufacturing of semiconductors onshore in the US) and the Inflation Reduction Act (supportive of the production of renewable energy and electric vehicle batteries on shore in the US). Bringing this manufacturing onshore involves complex and long-dated projects, which will be a tailwind to WSC. Also supportive is the US Infrastructure bill, which is a ~$1trillion package to improve and modernise US infrastructure. This will create significant construction activity which is positive to WSC.

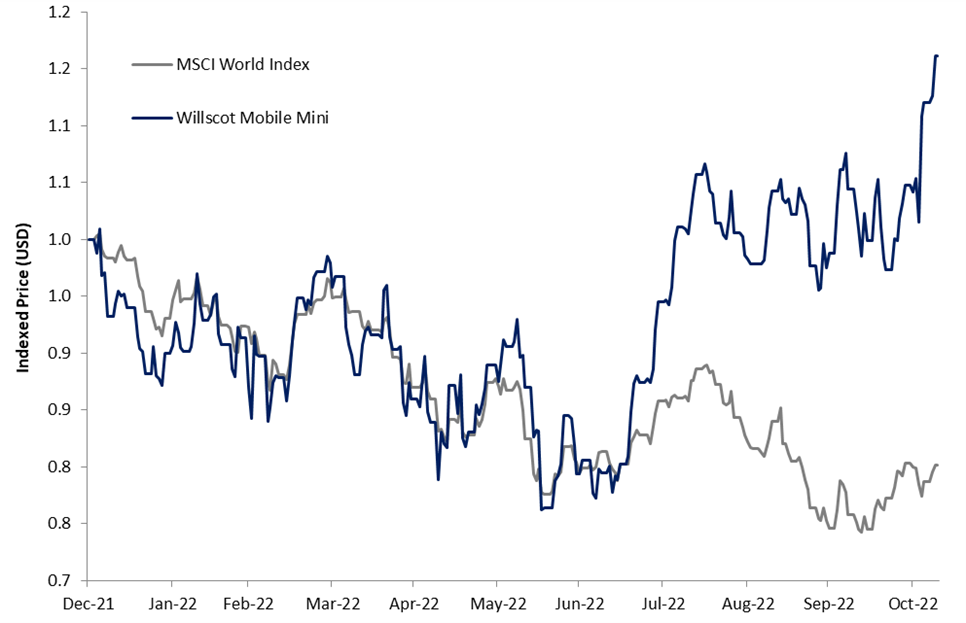

WSC Year to Date Share Price Performance Relative to the MSCI World

Source: Bloomberg to 9 November 2022

WSC’s shares have performed well this year relative to the MSCI World Index (see chart above). Despite the strong run, we remain constructive on the outlook for the shares given their idiosyncratic growth drivers, noting that there are risks for the company around performance in a slowdown.