The COVID-19 pandemic has changed the global vaccine landscape, catapulting mRNA vaccines into the limelight for the first time, with exciting potential applications. More broadly, in biopharma drug development, the pandemic has seen large funding increases which is a positive for companies exposed to the drug development process.

Going back to the beginning, 11th of March 2020, the World Health Organisation officially declared COVID-19 a pandemic. Given the highly transmissible nature of the virus and the alarming speed with which hospitals became overrun, it was evident that to get the pandemic under control, a vaccine would be required. However, in May 2020, Professor Jonathan Van-Tam, England’s Chief Medical Officer said, ‘we cannot be sure we will get a vaccine‘, which reflected the consensus view of experts at the time. This was because, as historical vaccine timelines showed, vaccines are simple in principle but complex in practice. The ideal vaccine protects against infection, prevents its spread, and does so safely. None of which is easily achieved. More than 30 years after scientists isolated HIV, the virus that causes AIDS, we still have no vaccine. The fastest vaccine ever developed was for mumps, which took four years.

Operation Warp Speed1 was underway, and against what history told us was possible, on the 12th of December 2020, Pfizer received Emergency Use Authorisation (EUA) by the FDA in the United States for its mRNA COVID-19 vaccine. Shortly after, Moderna’s mRNA vaccine received the same approval and since then, we have had additional vaccines approved: AstraZeneca; Novovax; & Janssen to name a few2.

What is special about Pfizer and Moderna’s vaccines is that this is the first time that mRNA technology had been approved for commercial use. Traditional vaccines work by teaching the immune system what the virus looks like by using a weakened virus or a critical piece of the virus’s protein coat. Once ‘educated’, the immune system will fight the virus if exposed. mRNA vaccines on the other hand, use the exact genetic code that makes the critical piece of the virus’s protein coat – which in the case of COVID-19, is the spike protein. Our own immune cells use this genetic code to make the critical protein, which then stimulates the production of antibodies and other immunity weapons that fight COVID-19 if exposed. These vaccines are highly effective against the virus, with efficacy greater than 90% at preventing symptomatic COVID-193.

mRNA has been said to be ‘revolutionising vaccinology’ according to Professor Beate Kampmann, the Director of the Vaccine Centre at the London School of Hygiene and Tropical Medicine and should see permanent changes in vaccine development. Other use cases of this technology are quickly emerging. For example, Moderna are currently in a Phase 3 study of their cytomegalovirus (CMV) vaccine candidate, which could be used to prevent CMV, one of the leading causes of birth defects worldwide .There are also studies underway looking at a mRNA influenza vaccine, multiple other pathogens of public health concern, along with research into potential oncological applications of mRNA technology.

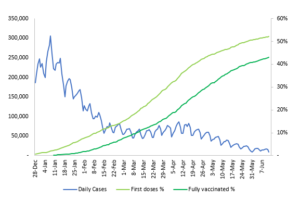

We now seen a global vaccine rollout of epic proportions. Globally, 2.1 billion doses of the vaccine have been administered. The US has fully vaccinated about 42% of their total population, and in the UK, vaccination is even higher at about 53%. As vaccination rates have increased, we have seen COVID-19 cases and hospital admissions fall steeply.

Chart: US vaccinations compared to daily infections

Source: JP Morgan Research, Our World In Data, United States Centers for Disease Control and Prevention

Source: JP Morgan Research, Our World In Data, United States Centers for Disease Control and Prevention

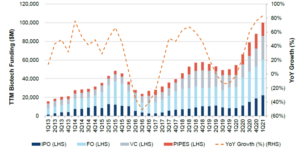

Looking at biotechnology more broadly, its saviour role in the pandemic has created a level of funding significantly higher than historical levels. Venture capital biotechnology financing in 2020 was $23bn, a +60% year-on-year increase from 2019 – a previous record year and as of the first quarter of 2021, trailing twelve months global biotechnology funding was $100bn.

Chart: Trailing twelve months global biotech funding

Source: Jefferies Research and Factset

Source: Jefferies Research and Factset

The outcome of an investment in one of these early stage biotechnology companies is somewhat binary, the pay-off can be large, but so is the downside. Instead, Milford seeks to capitalise on the buoyant drug development funding environment via investment in the companies exposed to the drug development process – those that provide the tools needed to undertake this research as well as companies that provide services such as outsourced drug research and manufacturing. We see value in Thermo Fisher Scientific and Danaher, global life sciences conglomerates where we believe the market is too focused on short term earnings headwinds. Both these companies also sell COVID-19 diagnostic tests which provided a boost during the pandemic and drove strong stock performance.

However, in 2021 this share price outperformance has waned as vaccines are rolled out and COVID-19 cases fall. The market recognises that the boost from diagnostic testing is fading, creating earnings challenges in the near-term, however the market’s penalisation of a stock driven by short-term concerns can create investment opportunity. Any investment carries risk, but we expect these two companies to continue to play an important role in our diversified portfolio, as they capitalise on the favourable longer-term trends of drug development.