Compared to 18 months ago, we now know how to control COVID outbreaks by restricting movement and tracing contacts and have seen that governments and central banks are willing to move fiscal and monetary mountains to help economies bounce back. Not to mention, we have a growing arsenal of effective vaccines to accelerate our journey toward collective immunity.

For many people it may seem like a question of when, rather than if we will all get back to something pretty close to ‘life as normal’. If you also believe that markets are forward looking, then surely the ‘reopening trade’ must be well and truly over?

How are sectors performing?

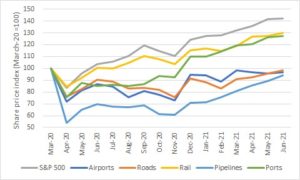

Some sectors associated with reopening have indeed done fairly well. Take Ports and Cargo Rail, for example. Up 30% since March 2020, they have very nearly kept up with the wider market which includes outright pandemic winners like Tech. Both of these deal more in moving physical goods and should continue to benefit from stimulus measures that put money into the hands of consumers.

Share prices of sectors driven by flows of people, such as Airports and Toll Roads, are still below pre – crisis levels. In many cases elevated valuation multiples factor in some of the recovery yet to come, but there is a long way to go to get ‘back to normal’ (not to mention any release of pent-up demand). The International Air Transport Association (IATA), for example, forecasts airline passenger numbers won’t return to 2019 levels until 2024.

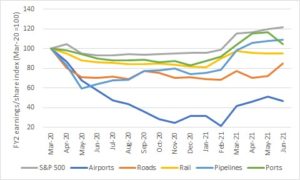

Finally, fossil fuel pipelines have seen earnings’ estimates lift with the rising oil price but are, even after a six month share price rally, still one of the worst performing reopening plays. This may well reflect a concern that the world they are helping reopen may, for them, be very different to the one pre-pandemic. Oil and gas may still be needed to fuel the recovery, but the green energy transition is now centre stage and activism is increasing on the ground and in the boardroom.

Sectors that move goods have benefitted from economic strength and have outperformed …

Source: Factset

Source: Factset

… while people-moving sectors experience a much slower recovery

Source: Factset

Source: Factset

Conclusion

Rather than simply playing out, the ‘Reopening trade’ has become more nuanced as the pandemic has progressed. Milford believe that sectoral and indeed stock specific considerations have become increasingly important for strong returns.