Genesis Minerals is an emerging mid-tier Australian gold producer focused on consolidating and developing high-quality gold assets in Western Australia. The company has consolidated regionally in the Eastern Goldfields of WA and has several gold deposits in its stable, including Gwalia – one of Australia’s oldest, deepest high-grade mines. The company’s growth strategy has focused on optimising operations and driving scale efficiencies across the region.

The gold supply demand backdrop looks favourable

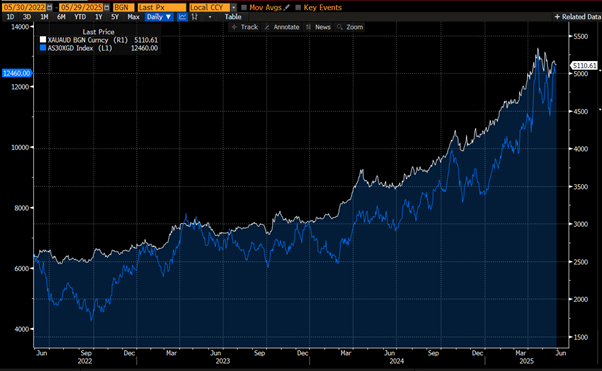

We think the current macro backdrop is structurally supportive for gold: persistent global fiscal deficits, de-dollarisation trends among central banks, a weaker USD, and ongoing geopolitical instability all support increased demand for gold as a store of value. In this context, Australian gold miners look increasingly attractive, especially now that cost inflation – while still high – has begun to moderate, setting the stage for margin expansion across the sector. With gold breaking through all-time highs, we believe Australian producers are entering a strong free cash-flow growth cycle.

ASX gold stocks (blue line) have broadly tracked the A$ gold price (white line).

Source Bloomberg

A golden opportunity in a supportive macro landscape

Within the Australian gold miners, Genesis stood out to us for three reasons: the quality and flexibility of its asset base, the strength of its management team, and its clean, well-funded balance sheet.

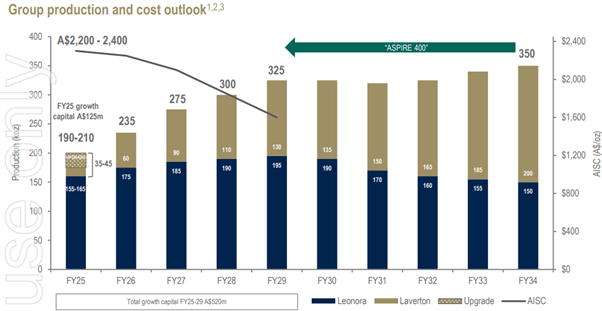

When Genesis first presented its 10-year production outlook at its Strategy Day last year, it laid out a strong, fully funded production growth profile supported by two plants, a large, underappreciated resource portfolio with 8-10 different mining areas, and a significant stockpile. Gold production was set to triple to ~300-350 thousand ounces of gold per annum (kozpa) over the next five years. This is important as stronger production, either through higher mill throughput or higher grade (a measure of gold concentration in a deposit), lowers the operating cost per ounce and improves margins.

Source: Company disclosure

Since then, the company successfully restarted its second mill earlier than planned, and has upgraded its FY25 guidance. Favourable exploration in the region and bolt-on acquisitions increasingly support the potential for mill expansions, which would provide significant operational cost savings, improve margins and grow production even beyond the company’s aspirational outlook to ~400kozpa. Indeed, we think there is potential for a blue-sky scenario to push to ~500kozpa if further resource upgrades and consolidation in the region occurs.

Given the complexity of operating mining assets, we typically look for strong management teams with a good operating track record. Genesis’ management team has developed a long history of under-promising and over-delivering, with the CEO having built his reputation by turning Saracen into a growth engine that ultimately merged with Northern Star.

On top of this, Genesis is debt free and completely unhedged. We see it as a high-quality way to gain exposure to a rising gold price over a multi-year period.

Well positioned for the bull cycle

Australian gold producers have had a strong run YTD, with a basket of the key small to mid-cap names having gone up over 60%, helped by the gold price having moved up ~25% in USD terms (and ~20% in AUD terms). Given the run, we have continued to actively manage our position.

Genesis has been a strong outperformer over a longer term 2–3-year view, but has lagged peers more recently as generalist investors have increasingly broadened exposure into smaller, more speculative gold names. This theoretically provides more torque in a rising market.

Looking ahead, we think Genesis is well placed to benefit from both a supportive gold backdrop and strong company fundamentals.