There are two new contribution rates available for KiwiSaver investors. Previously, you could only contribute at 3%, 4% or 8% of your salary. But from 1 April this year, you can now also choose to contribute at 6% or 10%. Plus you can still make additional deposits of any amount directly to your account. So, with that many choices, what’s the right rate for you?

The most popular option is to contribute 3%. But saving 3% of your salary isn’t very much. Will it be enough to fund the future you’ve dreamed of? In many cases, the answer is a resounding “no”.

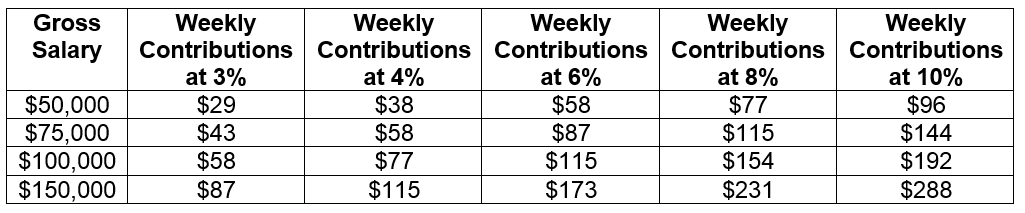

Of course, the reason many of us don’t save more is because we can’t afford to. But imagine if you were able to make some small adjustments and managed to save just 1% more. How much would that improve your future?

Believe it or not, even a small change like this can make a big difference.

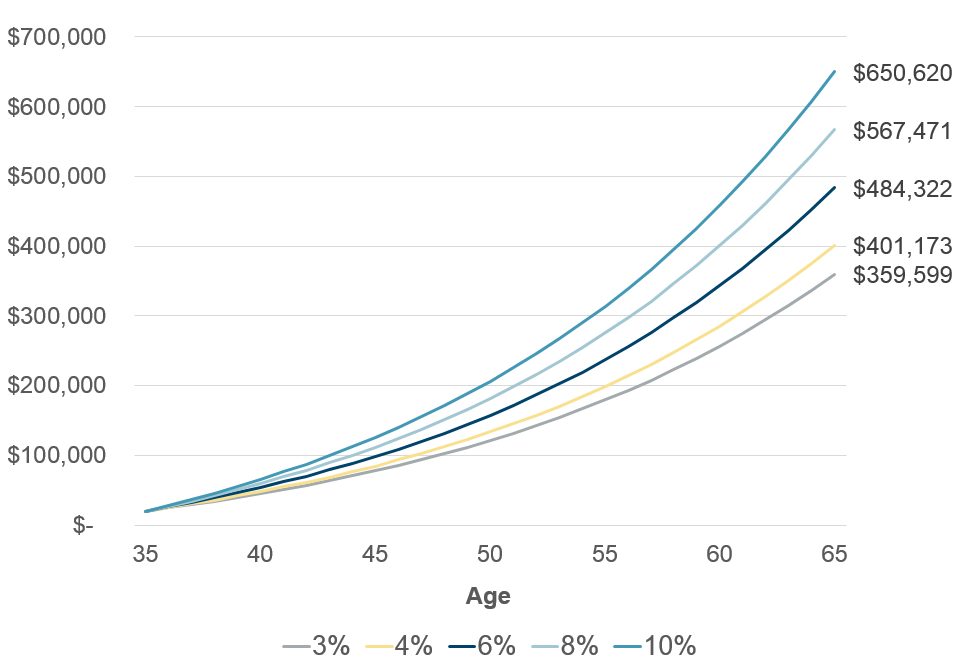

Contributing a bit more now, can make a big difference to your future

Assumptions: 35 year-old KiwiSaver investor earning $50,000 gross salary, $20,000 starting KiwiSaver balance, 8% p.a. net investment return, 3% employer contributions, 2.5% p.a. wage growth and no withdrawals. Balances shown in today’s dollars, adjusting for assumed 2% p.a. inflation. Sourced from Milford’s KiwiSaver Retirement Calculator. Please note this is a hypothetical example and meant for illustrative purposes only. Past performance is not a guarantee of future performance.

It may be more affordable than you think too…

But remember that KiwiSaver is not your only option

Our KiwiSaver Retirement Calculator allows you to estimate what your own KiwiSaver investment could look like at different contribution rates. You can try the tool here.

Although KiwiSaver is a great way to save, it’s important to remember that your KiwiSaver savings are locked-in until age 65. Because of this, many people prefer to place their additional savings into investments they can access before age 65, such as PIE Investment Funds.

If you do decide to increase your KiwiSaver contribution rate, the process is very simple. Just tell your employer what rate you want to contribute at and they will adjust it for you – that’s it.

Either way, one thing is very clear – saving and investing a bit more now can help you create a much more comfortable future.