The third global energy revolution is now upon us. The first was the coal-powered steam engine introduced in the Industrial Revolution, allowing for the mechanisation of labour. The second was the oil and gas revolution, where the commercialisation of refining and optimisation of well-drilling allowed for the flow of cheap and abundant oil and gas. And finally, today we have the green energy transition, where the world attempts to reduce its reliance upon the fruits of its first two revolutions by embracing renewable energy.

It is an exciting time to be an investor – the fundamental reconstruction of an industry presents countless high-growth investment opportunities. However, early-stage investment in any technology inherently involves higher risk and volatility. As the full might of global science, technology and engineering race to decarbonise our energy system, this transition is evolving rapidly.

We have previously discussed the changes and challenges we expect to see in global electricity generation and associated infrastructure [read our decarbonisation blog], but renewable electricity is only one piece of the puzzle. While we expect increasing electrification in many industries, there are energy applications that electricity at this time can’t satisfy – at least not economically. High-heat industrial applications, long-term energy storage and long-range transport are among current “hard-to-abate” activities. Unfortunately, many of these activities are also highly emissions intensive.

Currently, many of these applications are satisfied by fuels such as diesel, kerosene and natural gas. Biofuels, including Sustainable Aviation Fuels, are one possible low-carbon replacement for transport, and some governments are already enforcing minimum blending requirements for some fuels. But these still fall short for some heavy industrial uses, such as steel-making or combined heat and power (CHP) boilers.

Enter hydrogen. Hydrogen is the smallest and most abundant element in the universe and has many chemical properties that make it attractive as a combustible fuel. It has a very high energy-to-mass ratio (~2-3x higher than current standard combustible fuels) and is chemically straightforward to produce. When combusted, it releases zero greenhouse gases; the only byproduct is pure water.

Hydrogen is already a commonly produced industrial gas traditionally used in refining, chemicals and fertilizer production. The vast majority of hydrogen is currently manufactured via an emissions-intensive process using natural gas and steam known as Steam Methane Reforming (SMR) – producing what is termed “grey” hydrogen. But zero-emission “green” hydrogen can be generated using renewable electricity to separate water molecules. The downside to green hydrogen is that it requires a significant amount of renewable electricity to produce – resulting in costs 3-5x higher than grey hydrogen. Hydrogen also facilitates corrosion, which means it can be difficult to transport in traditional pipelines, so is typically generated close to its end use.

Hydrogen as a fuel has received significant government attention in the past 12 months, with the EU touting hydrogen as core to its strategy to replace Russian gas in the wake of the Ukraine conflict. The Unites States has also jumped on the hydrogen bandwagon, offering significant subsidies for green hydrogen producers as part of its landmark Inflation Reduction Act. Just this month, energy powerhouse United Arab Emirates has updated its hydrogen strategy and pledged to produce 1.4 million tonnes of clean hydrogen annually by 2031.

So the forecast supply of green hydrogen is increasing exponentially – but is there any new demand, or is hydrogen fuel just a green herring? Right now, we don’t know to what degree the hydrogen economy will ultimately be realised and which industries will adopt hydrogen and which will find other solutions. Of late, pureplay hydrogen stocks have experienced significant volatility. But the sector does have some material tailwinds, and is picking up pace.

We have preferred to gain hydrogen exposure via the more traditional route – Industrial Gas companies like Air Liquide and Linde, the biggest players in the conventional hydrogen market. These companies are experts in air gases, have existing global industrial customer networks, and own significant hydrogen infrastructure. They hold long term contracts to provide hydrogen to refiners, petrochemicals companies, fertilizer (ammonia) manufacturers and chemicals companies.

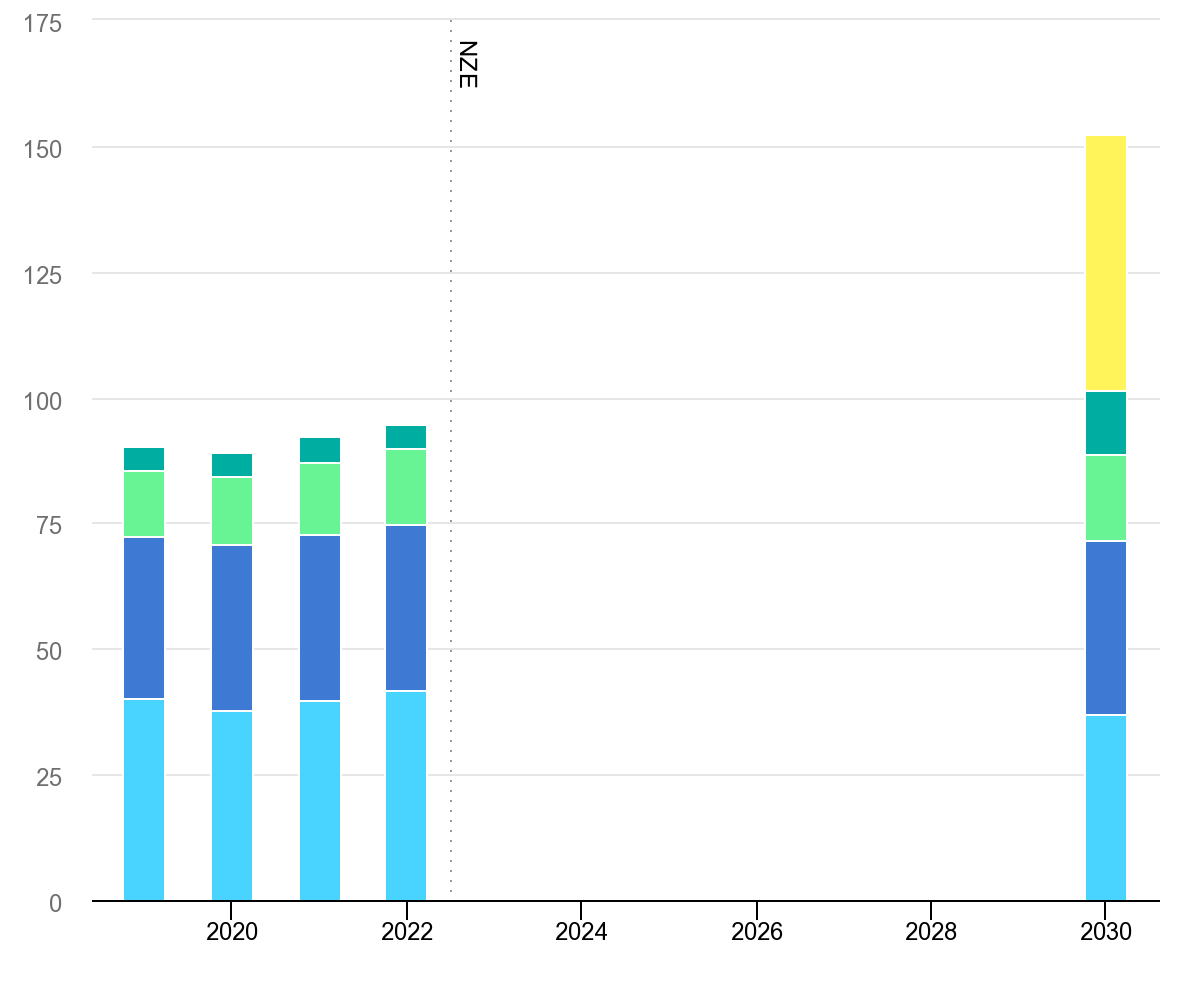

Figure 1 – International Energy Agency (IEA) 2030 hydrogen demand forecast breakdown by industry for their Net Zero Scenario. The yellow “Other” category seen in 2030 shows the potential scale of hydrogen demand for new applications. (IEA, 2023)

This means these companies can satisfy demand for new applications of hydrogen as an extension of their existing business model. They also have significant capital and expertise available to undertake large projects for existing high-emitting customers wanting to decrease their carbon footprint. By their nature, Industrial Gases are defensive companies, have well diversified end markets, and tend to perform well in recessionary environments. This means transition benefits are additive to a strong core business, balancing risk.

For now, we believe we are well positioned to capture the emerging hydrogen market – but we continue to closely monitor any investment opportunities which may flow down the pipeline.

Graph Source: IEA, Global hydrogen demand by sector in the Net Zero Scenario, 2020-2030, IEA, Paris www.iea.org/data-and-statistics/charts/global-hydrogen-demand-by-sector-in-the-net-zero-scenario-2020-2030-2, IEA. Licence: CC BY 4.0

Hydrogen: a transition gas, or just a pipe dream?

The third global energy revolution is now upon us. The first was the coal-powered steam engine introduced in the Industrial Revolution, allowing for the mechanisation of labour. The second was the oil and gas revolution, where the commercialisation of refining and optimisation of well-drilling allowed for the flow of cheap and abundant oil and gas. And finally, today we have the green energy transition, where the world attempts to reduce its reliance upon the fruits of its first two revolutions by embracing renewable energy.

It is an exciting time to be an investor – the fundamental reconstruction of an industry presents countless high-growth investment opportunities. However, early-stage investment in any technology inherently involves higher risk and volatility. As the full might of global science, technology and engineering race to decarbonise our energy system, this transition is evolving rapidly.

We have previously discussed the changes and challenges we expect to see in global electricity generation and associated infrastructure [read our decarbonisation blog], but renewable electricity is only one piece of the puzzle. While we expect increasing electrification in many industries, there are energy applications that electricity at this time can’t satisfy – at least not economically. High-heat industrial applications, long-term energy storage and long-range transport are among current “hard-to-abate” activities. Unfortunately, many of these activities are also highly emissions intensive.

Currently, many of these applications are satisfied by fuels such as diesel, kerosene and natural gas. Biofuels, including Sustainable Aviation Fuels, are one possible low-carbon replacement for transport, and some governments are already enforcing minimum blending requirements for some fuels. But these still fall short for some heavy industrial uses, such as steel-making or combined heat and power (CHP) boilers.

Enter hydrogen. Hydrogen is the smallest and most abundant element in the universe and has many chemical properties that make it attractive as a combustible fuel. It has a very high energy-to-mass ratio (~2-3x higher than current standard combustible fuels) and is chemically straightforward to produce. When combusted, it releases zero greenhouse gases; the only byproduct is pure water.

Hydrogen is already a commonly produced industrial gas traditionally used in refining, chemicals and fertilizer production. The vast majority of hydrogen is currently manufactured via an emissions-intensive process using natural gas and steam known as Steam Methane Reforming (SMR) – producing what is termed “grey” hydrogen. But zero-emission “green” hydrogen can be generated using renewable electricity to separate water molecules. The downside to green hydrogen is that it requires a significant amount of renewable electricity to produce – resulting in costs 3-5x higher than grey hydrogen. Hydrogen also facilitates corrosion, which means it can be difficult to transport in traditional pipelines, so is typically generated close to its end use.

Hydrogen as a fuel has received significant government attention in the past 12 months, with the EU touting hydrogen as core to its strategy to replace Russian gas in the wake of the Ukraine conflict. The Unites States has also jumped on the hydrogen bandwagon, offering significant subsidies for green hydrogen producers as part of its landmark Inflation Reduction Act. Just this month, energy powerhouse United Arab Emirates has updated its hydrogen strategy and pledged to produce 1.4 million tonnes of clean hydrogen annually by 2031.

So the forecast supply of green hydrogen is increasing exponentially – but is there any new demand, or is hydrogen fuel just a green herring? Right now, we don’t know to what degree the hydrogen economy will ultimately be realised and which industries will adopt hydrogen and which will find other solutions. Of late, pureplay hydrogen stocks have experienced significant volatility. But the sector does have some material tailwinds, and is picking up pace.

We have preferred to gain hydrogen exposure via the more traditional route – Industrial Gas companies like Air Liquide and Linde, the biggest players in the conventional hydrogen market. These companies are experts in air gases, have existing global industrial customer networks, and own significant hydrogen infrastructure. They hold long term contracts to provide hydrogen to refiners, petrochemicals companies, fertilizer (ammonia) manufacturers and chemicals companies.

Figure 1 – International Energy Agency (IEA) 2030 hydrogen demand forecast breakdown by industry for their Net Zero Scenario. The yellow “Other” category seen in 2030 shows the potential scale of hydrogen demand for new applications. (IEA, 2023)

This means these companies can satisfy demand for new applications of hydrogen as an extension of their existing business model. They also have significant capital and expertise available to undertake large projects for existing high-emitting customers wanting to decrease their carbon footprint. By their nature, Industrial Gases are defensive companies, have well diversified end markets, and tend to perform well in recessionary environments. This means transition benefits are additive to a strong core business, balancing risk.

For now, we believe we are well positioned to capture the emerging hydrogen market – but we continue to closely monitor any investment opportunities which may flow down the pipeline.

Graph Source: IEA, Global hydrogen demand by sector in the Net Zero Scenario, 2020-2030, IEA, Paris www.iea.org/data-and-statistics/charts/global-hydrogen-demand-by-sector-in-the-net-zero-scenario-2020-2030-2, IEA. Licence: CC BY 4.0

Month in a Minute: August 2025

Read MoreStock Story: Arthur J Gallagher

Read MoreMilford on Newstalk ZB: 3 September 2025

Read MoreDisclaimer: Milford is an active manager with views and portfolio positions subject to change. This blog is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to a Financial Adviser. Past performance is not a guarantee of future performance.