Competition and corporate consolidation. President Biden’s 2020 election campaign was relatively quiet when it came to this topic. We were left without a strong read on which direction a Biden-led Democratic Government would take. That changed in July 2021, with President Biden signing the Executive Order on Promoting Competition in the American Economy (the Order). This has investment implications that must be actively monitored and evaluated. After decades of industry consolidation and rising corporate profit margins, could we be at a turning point?

The existence of competition is crucial to a healthy capitalist economy that encourages innovation, better value for money, higher wages, economic growth and ultimately, increasing living standards. The Order recognises this and suggests broad industry consolidation and anti-competitive practices have weakened competition in the USA, widening inequality and constraining consumer choice, whilst the rate of small business formation is down by almost 50% since the 1970’s1. Employer bargaining power over employees has also increased, and overly restrictive licensing requirements make it harder for people to find jobs and discourage interstate migration e.g. a Barber requires a different license to cut hair in another U.S. state!

We can observe that corporate profits have increased as industry consolidation has progressed

Some of this is organic and appropriate; a natural progression of market share as more effective corporations “win” in the marketplace. However, in many industries mergers and acquisitions have played a strong role. The Order addresses this head-on and consummating large deals will be more challenging going forward.

EBITDA = Earnings before Interest, Tax, Depreciation & Amortization Source: Wolfe Research

EBITDA = Earnings before Interest, Tax, Depreciation & Amortization Source: Wolfe Research

The Order is wide-reaching, calling out many industries, including:

- Agriculture, where farmers are squeezed between concentrated market power in both inputs (seed, fertiliser, feed, equipment), and their channels for selling farm output.

- Health Care broadly, and including prescription drugs, which in the USA sell for multiples of the price of the same product in other countries.

- Technology (of course) with focus on the large Internet platforms and the power they have.

- Telecommunications i.e. prices for Broadband and cable television.

- Financial Services and hidden fees.

- Container shipping i.e. dominant foreign owned shipping lines and alliances.

The Order is also a detailed call to action

In addition to demanding stronger enforcement of antitrust legislation when assessing corporate mergers and acquisitions, it addresses anti-competitive behaviours and practices and calls for deregulation, or the review of rules that are of questionable utility, but may stifle competition. Just how effective the Order will be in bringing about change remains to be seen, but it does have substance and gets quite specific by industry. One example in health care, is the call for a rule to enable over-the-counter purchase of hearing aids. The intent here is to promote innovative and lower cost hearing aids by lowering the friction created by the existing requirement for a prescription from a Doctor. That prescription requirement has benefited incumbent hearing aid suppliers, creating a barrier to entry for new players and supporting pricing.

It’s imperative that President Biden is seen to be acting to lower prices

His presidency has commenced as the world reopens from the COVID-19 pandemic; economies are accelerating, the consumer is in good shape, corporate confidence is high. Yet supply chains are stretched and inflation is a topic du jour in financial markets given its implications for monetary policy setting and corporate profits. Central banks have proffered the argument that inflation will be transitory, that it will recede as inventories rebalance and labour markets normalise. Perhaps, but if recent second quarter corporate earnings are anything to go by, gripes about inflation could be moving increasingly mainstream and be heard at BBQs and beaches, from Boston to Bondi (if these lockdowns ever end). Make no mistake, from personal care to French fries, white goods to apparel, companies are raising prices and rather than recede, the increases are guided to gather steam as 2021 concludes.

One could argue President Biden has inherited this period of inflation, but if it persists, I’d wager Republicans will be apportioning the blame to Democratic Fiscal support. The Democrats need a strong counterpunch and a crackdown on competition and consolidation might well provide that.

* about 2300 calls hosted in 2Q21 to date (33% of total) Source: Bloomberg

* about 2300 calls hosted in 2Q21 to date (33% of total) Source: Bloomberg

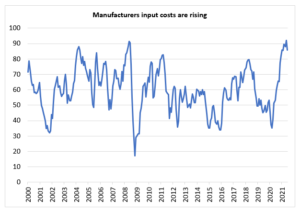

ISM Business Prices Paid Index (% respondents citing higher prices) Source: Bloomberg

ISM Business Prices Paid Index (% respondents citing higher prices) Source: Bloomberg

When investing in this ever-changing environment, a thorough and ongoing assessment of a company’s place in the value chain and the sources of its profitability is as important now as it has ever been. At Milford, we bias towards attractively valued, prosperous companies that bring value to customers and generate strong returns on capital. It’s important to us that these returns are supported by sustainable sources of competitive advantage or barriers to competition that could include scale, switching costs, access to distribution, or domain expertise, to name but a few. Hearing aids won’t be the only product, in healthcare or more broadly, that could see traditional barriers to competition reduce. Policy implications cannot be ignored and our framework for assessing quality continues to evolve.

Source: 1 “Brian Deese on Unleashing Competition”, Bloomberg “Masters In Business” Podcast by Barry Ritholtz.