Writing the Reality Cheque – What you need to consider in a lower-return environment

Investment returns from shares and bonds have been strong for several decades and these two asset classes form the core of most investors’ portfolios, examples being KiwiSaver, Retail Managed Funds and Exchange Traded Funds (ETFs). Many investors also invest directly in shares and bonds through brokers. There is no way of knowing what the future returns for these asset classes will be with any degree of certainty but investors would do well to assume that returns will moderate as we look out over the next decade and, if that’s the case, what are the implications for investors?

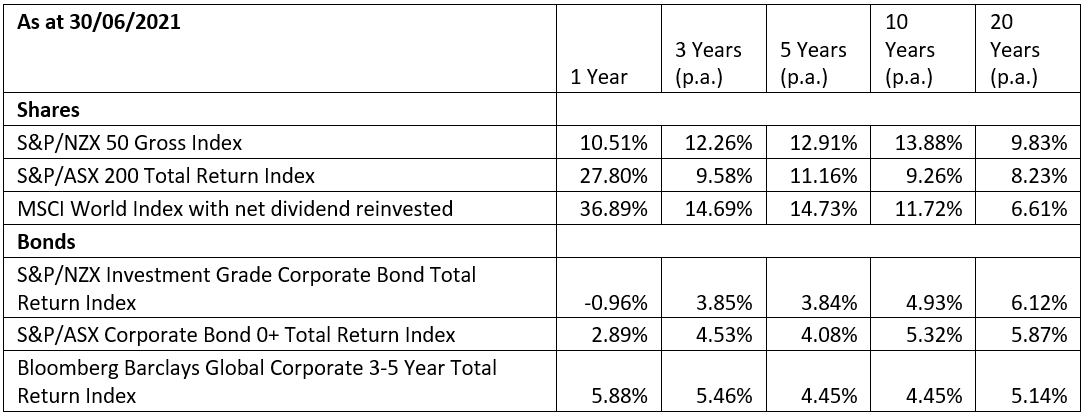

Table 1 – Historical share and bond returns

The table above shows annualised returns for a number of benchmark indices which represent NZ, Australian and global shares and bonds over the last 20 years. Looking at the annualised return from the last 10 years, it is difficult to see that being repeated over the next 10.

What are the reasons to expect lower returns from shares and bonds over the next decade?

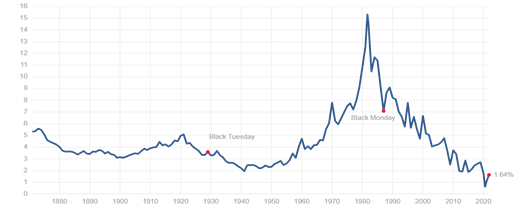

Looking at bonds, since the high-interest-rate environment of the 1980s, interest rates have been declining. As interest rates have fallen, bond prices have risen (there is an inverse relationship between bond prices and interest rates), which has been a key driver of returns. Interest rates are currently at historically low levels and although they are starting to rise in some countries, they are expected to remain low by historical standards over the next decade. As a result, there is limited upside for capital gain. The other component of returns for bonds is yield, from the coupons they pay, and this is likely to be very low by historical standards in the years ahead. We can therefore expect total return from bonds to be lower than what we have seen historically.

Chart 1 below illustrates the steep decline in US 10 Year Government Bond Yields over the last 40 years.

[Source: https://www.multpl.com/10-year-treasury-rate]

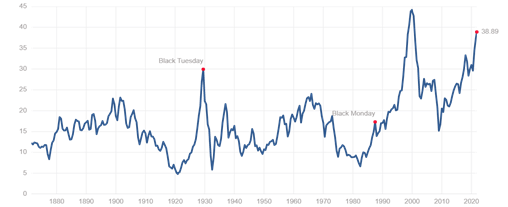

Looking at shares, valuations of most sectors of the market are stretched by historical standards. Chart 2 below shows the Shiller PE ratio for the S&P 500 which is an inflation-adjusted measure of share price compared to company earnings for 500 large US companies. It has only been higher once before and that was in late 1999 which was the height of the Dotcom bubble. As the world re-opens post the Covid-19 pandemic there is likely to be strong support for goods and services which bodes well for company earnings but unless there is a sustained proportionate increase in future earnings, returns from stocks will moderate. There is also economic growth to consider. According to Charles Schwab, consensus forecasts for GDP growth per year, on average, is 2.3% per year over the next 10 years as compared to 3.1% since 1948. [Charles Swab article]. Lower GDP will translate to lower earning for companies.

Chart 2 – Shiller PE ratio S&P 500

[Source: https://www.multpl.com/shiller-pe]

What are the implications for investors?

Investors need to moderate their long-term return expectations and factor this into their financial planning to understand what it means for them. Some investors may be inclined to try to increase their returns by taking on more risk and allocating a higher percentage of their investment portfolio to stocks over bonds. Some may go a step further and look to invest in “alternative” investments such Private Equity and Hedge Funds which offer a higher return but come with more risk. Such steps should not be taken lightly though. Moving into realms of risk beyond our tolerance and capacity often lead to emotionally charged, bad investment decisions which in turn inhibit investment returns over the longer term.

For those not wishing to take on more risk, there are other ways to potentially adapt to a lower return environment. If you’re still in the accumulation phase then increasing your savings rates may be one way of boosting the overall pot. For those living off their investments already, there may be the option to make lump-sum additions e.g., by selling an asset such as downsizing the family home. Finally, for some investors it may be a case that they’re writing cheques their investments won’t be able to cash. Spending less in retirement may be a hard pill to swallow but is a real reality that some may need to consider, even if it’s just trimming a few luxuries here and there.

For most it will be combination of factors and this is where working with an experienced Financial Adviser is key. An Adviser can assess your financial situation, goals, timeframe, tolerance and capacity for risk / loss, and work with you to create a financial plan. As part of that, realistic return expectations can be set based on the composition of the investment portfolio.

At Milford, our Advisers are helping clients navigate through these considerations at a personal level. As an active manager, Milford is also well placed to navigate investment markets with the aim of delivering returns above and beyond those available from a simple buy and hold approach in either bond or share markets. Going forward, considered stock and industry selection will be even more important to ensure the best possible returns are achieved.

And, importantly, an Adviser can help you navigate the everchanging investment landscape and the inevitable ups and downs in the years ahead, keeping you on track to achieve or even redefine your investment goals.