Cash – the word evokes images of vaults stacked to the ceiling with 50-dollar notes. It’s safe, tangible, reliable.

However, in the world we’re all experiencing today, it’s increasingly difficult to justify keeping large portions of our wealth in this asset.

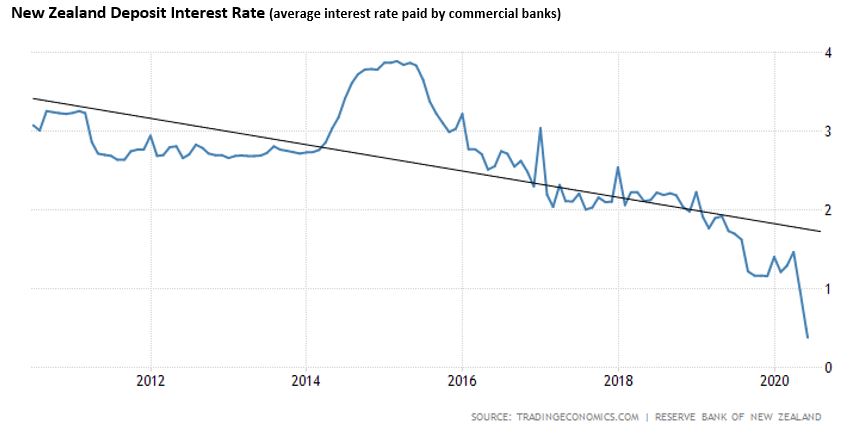

Since early 2020 the world has been watching the development of, what is now, COVID-19 turn into a global pandemic. Businesses and borders around the world have been closed leading to a sharp downturn in economic activity and the expectation of contracting Gross Domestic Product (GDP) over the coming quarters. The estimate of GDP globally, has already been cut by US$10 trillion so far in 2020. Governments around the world have been quick to respond with policy stimulus of US$18 trillion provided to date to keep economies going. Central banks have also come to the party with cash rate cuts. Here in New Zealand the RBNZ slashed the OCR (Official Cash Rate) in March to its current level of 0.25%. The RBNZ has also flagged that a negative OCR is a real possibility.

The OCR is a wholesale rate that banks receive or, when negative, pay to the Reserve Bank to hold their overnight reserves. While it is highly unlikely the retail interest rates offered to savers by our banks would turn negative it will ultimately lead to very low deposit rates. Our estimate for 12-month term deposit rates is as low as 0.60% per annum should the OCR get to -0.25%.

To put this into context – consider our NZ retirees that have saved over a lifetime to build a nest egg of $1m to provide income for a comfortable retirement. In the case of a 12-month term deposit at 0.60% pa they will earn a gross return of $6,000 per annum. Assuming a 17.5% tax rate, they receive a net return of $4,950. There is also inflation to factor into the purchasing power of our retirees and the recent RBNZ Survey of Expectations has participants anticipating inflation in the next year to run at 0.74%, meaning our savers will be losing ground on their spending requirements.

Back in August 2019 the RBNZ made a surprise cut to the OCR bringing it down to 1.00%. At the time Governor Adrian Orr stated, “When you have lower interest rates you have to be thinking much harder around the form of investment,” to Parliament’s finance and expenditure select committee.

“The form of investment means putting your capital more to work, which is about creating real investment rather than just sitting in the bank account with all of the returns going to the owners of the bank,” he said.

With the current OCR at 0.25% and potential term deposit rates well below 1.00% pa this is even more important yet there is currently $192bn* of household money in bank deposits in New Zealand.

Putting capital to work for current depositors may mean they explore the possibility of investing in bond, share or property markets either directly or via managed funds. As investors think about moving across into other investments, they need to consider some important differences.

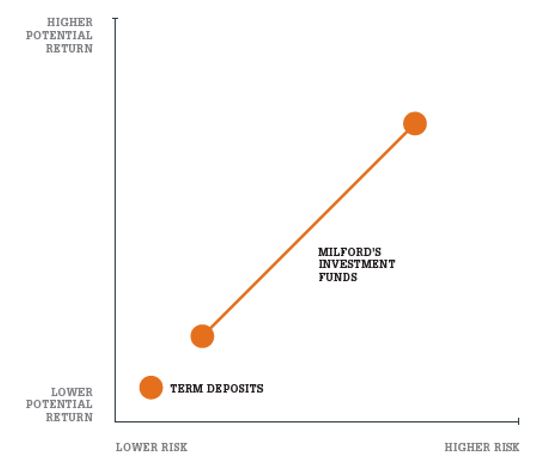

A bank term deposit is generally considered a form of saving rather than investing. They are a good savings tool as they offer a fixed return over a short-term fixed period, providing savers with certainty and low risk as the value of the deposit does not fall (unless there is an unlikely case of bank failure). An investment fund, like those offered by Milford, gives your money the potential to achieve higher returns by investing in company shares and bonds. The choice of these investments is made by a specialist, experienced team and actively managed through varying economic cycles. The return on these funds is not fixed and could even be negative, at times, meaning investors must understand the risk they are taking with their money and decide on the appropriate amount of risk for them as they seek out higher returns.

Are you thinking harder around the form of investment for your capital?

Milford offer a suite of investment funds that range from diversified, low risk, income focussed funds to higher risk, single strategy, equity funds. Investors need to consider their tolerance for fluctuating returns along with the minimum investment timeframes when choosing a suitable fund/s and we have an experienced team available that can talk you through the various funds.

For investors with over $500,000 to invest, the Milford Private Wealth Advised & Managed service^ offers the opportunity to partner with one of our Authorised Financial Advisers for the long-term, focusing on your situation now, and as it evolves, helping you on the journey to achieving your long-term, financial goals.