2025 © Milford Asset Management Limited Privacy Policy Terms & Conditions Disclosure Statement

Replacement Product Disclosure Statements are available here or on the relevant scheme’s offer register entry at the NZ Companies Office

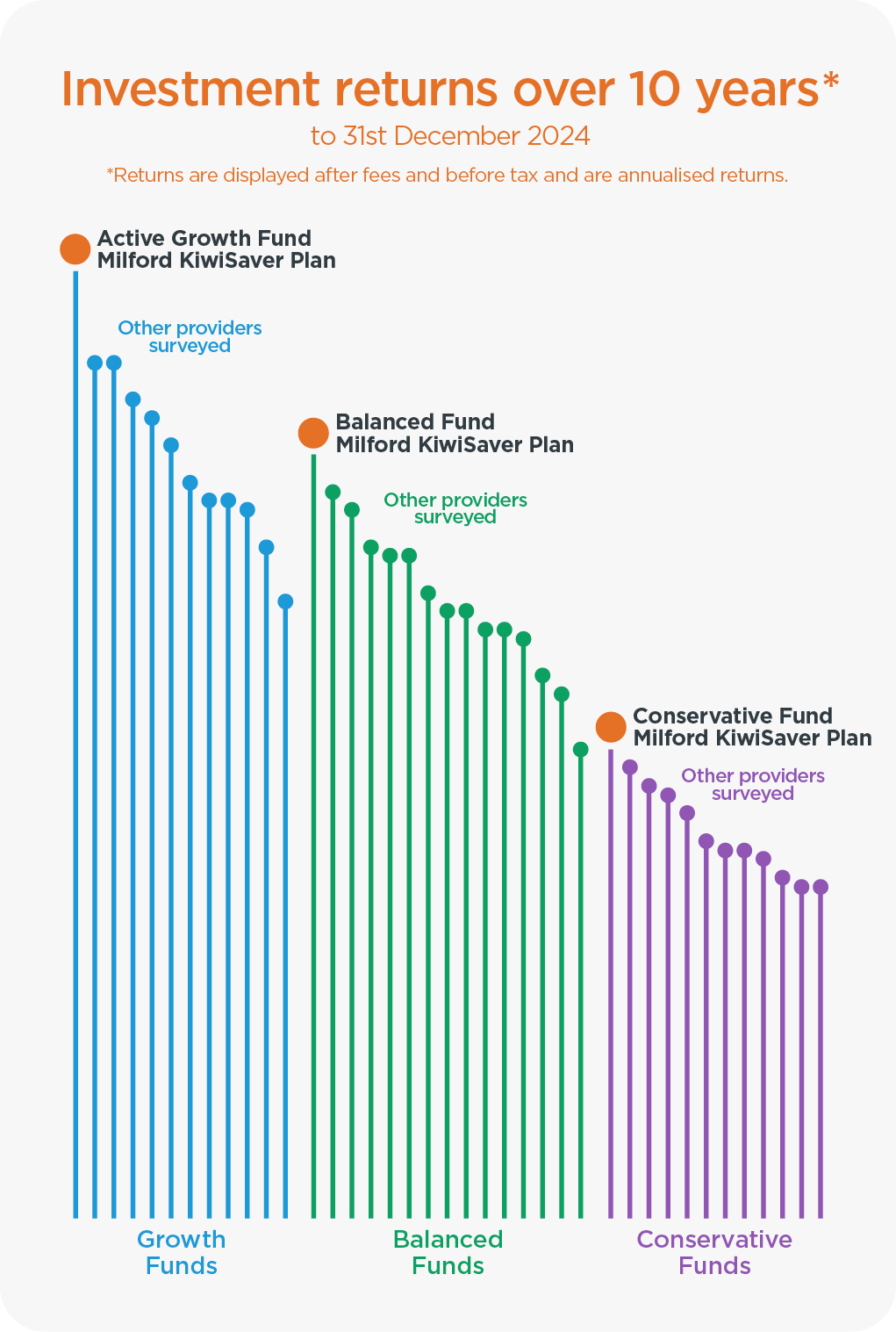

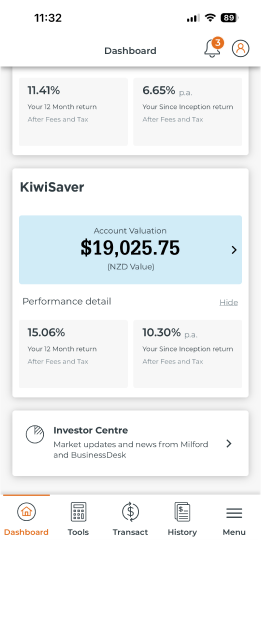

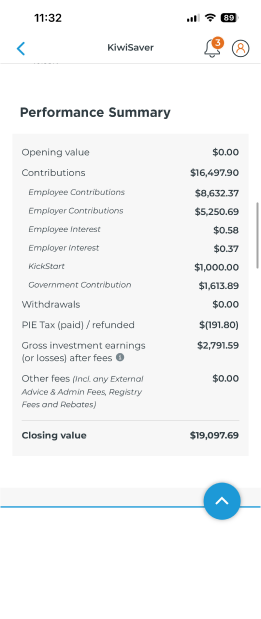

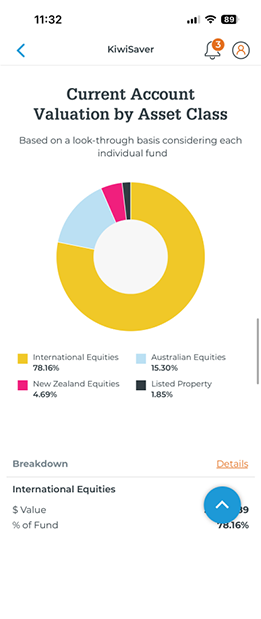

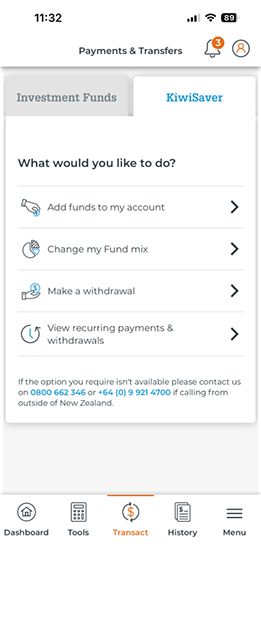

Milford Funds Limited is the Manager and Issuer of the Milford KiwiSaver Plan and the Milford Investment Funds