Amidst New Zealand’s challenging economic conditions and the elevated uncertainty surrounding the upcoming General Election, our Mergers & Acquisitions (M&A) market has remained surprisingly resilient during the first half of 2023, but with a substantive change in the composition of the buyer group.

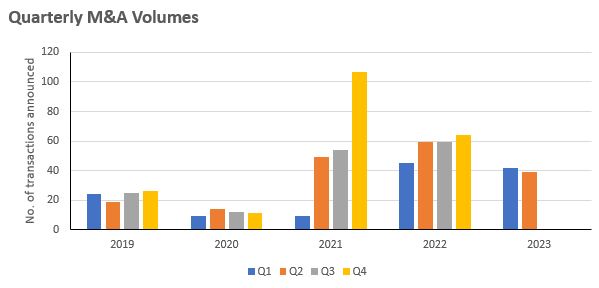

PwC reports that the number of M&A transactions in New Zealand in the first half of 2023 averaged approximately 40 per quarter. This is slightly ahead of the quarterly average observed over the past four years of 37 (which did include a significant lull in 2020 followed by a sharp recovery, or catch-up, in late 2021 and 2022).

Whilst a “flat” trend in of itself is not particularly newsworthy, the resilience against a particularly challenging economic and political backdrop, and the composition of the transaction activity, is interesting and gives reason for optimism for the coming years.

Source: PwC New Zealand M&A Quarterly Update

The first point of note is that Trade buyers are dominating deal activity, accounting for all but one deal announced in Q2 2023. A Trade buyer is when a company acquires another company, usually one in the same industry, to strengthen its existing business and/or augment growth. The alternative is a Financial buyer. This type of buyer is typically an investment fund that is acquiring companies to achieve a desired return on investment.

Trade buyers, being long-term participants in industries, typically take a longer-term view on their investments as they are free to own these assets indefinitely. This means they are less concerned with near-term macroeconomic or political volatility, as they will likely own the asset through several market cycles. Transaction activity from these Trade buyers is, therefore, a vote of confidence in the long-term prospects of their respective industries in New Zealand. Moreover, in-line with previous quarters, approximately half of these deals have involved international buyers, suggesting that New Zealand is maintaining its favourable reputation as a desirable place to conduct business on the global stage. The relative valuation of New Zealand companies globally is also benefitting from the weaker New Zealand dollar, a trend that may persist through 2023 and into 2024.

Conversely, Financial buyers appear to have almost completely withdrawn from the market. Financial buyers typically have a finite horizon for owning an asset, before they are required to return capital to their investors. This horizon is typically three-to-ten years. With a shorter ownership period, the impact on a prospective investment from exogenous macroeconomic factors or policy changes is more acute. A looming event with potentially significant (and somewhat binary) implications for different industries, would give this particular investment group reason to pause.

This year’s General Election, with its lack of a clear front-runner or timely policy announcements, creates a particularly uncertain outlook. Pleasingly though, this uncertainty will soon lift, and with that one could expect the reemergence of Financial buyers, spurring further activity from here.

The cost and availability of debt is also a significant factor in financing transactions. Whilst in absolute terms levels are not as supportive as in previous years, the outlook has certainly stabilised this year as we approach the top of the interest rate cycle. This provides greater certainty to incoming investors and improves conviction when pricing deals.

In the near-term, persistent inflation and deteriorating economic conditions will continue to challenge businesses. But there remains a healthy level of investment appetite for the right opportunities, and this should be taken as a positive signal for business owners. For those willing to take a longer-term view, capital options are likely to be available to build resilience or consolidate a market, such that the business is best positioned for the next growth cycle.

M&A activity in New Zealand: steady on in a challenging environment

Amidst New Zealand’s challenging economic conditions and the elevated uncertainty surrounding the upcoming General Election, our Mergers & Acquisitions (M&A) market has remained surprisingly resilient during the first half of 2023, but with a substantive change in the composition of the buyer group.

PwC reports that the number of M&A transactions in New Zealand in the first half of 2023 averaged approximately 40 per quarter. This is slightly ahead of the quarterly average observed over the past four years of 37 (which did include a significant lull in 2020 followed by a sharp recovery, or catch-up, in late 2021 and 2022).

Whilst a “flat” trend in of itself is not particularly newsworthy, the resilience against a particularly challenging economic and political backdrop, and the composition of the transaction activity, is interesting and gives reason for optimism for the coming years.

Source: PwC New Zealand M&A Quarterly Update

The first point of note is that Trade buyers are dominating deal activity, accounting for all but one deal announced in Q2 2023. A Trade buyer is when a company acquires another company, usually one in the same industry, to strengthen its existing business and/or augment growth. The alternative is a Financial buyer. This type of buyer is typically an investment fund that is acquiring companies to achieve a desired return on investment.

Trade buyers, being long-term participants in industries, typically take a longer-term view on their investments as they are free to own these assets indefinitely. This means they are less concerned with near-term macroeconomic or political volatility, as they will likely own the asset through several market cycles. Transaction activity from these Trade buyers is, therefore, a vote of confidence in the long-term prospects of their respective industries in New Zealand. Moreover, in-line with previous quarters, approximately half of these deals have involved international buyers, suggesting that New Zealand is maintaining its favourable reputation as a desirable place to conduct business on the global stage. The relative valuation of New Zealand companies globally is also benefitting from the weaker New Zealand dollar, a trend that may persist through 2023 and into 2024.

Conversely, Financial buyers appear to have almost completely withdrawn from the market. Financial buyers typically have a finite horizon for owning an asset, before they are required to return capital to their investors. This horizon is typically three-to-ten years. With a shorter ownership period, the impact on a prospective investment from exogenous macroeconomic factors or policy changes is more acute. A looming event with potentially significant (and somewhat binary) implications for different industries, would give this particular investment group reason to pause.

This year’s General Election, with its lack of a clear front-runner or timely policy announcements, creates a particularly uncertain outlook. Pleasingly though, this uncertainty will soon lift, and with that one could expect the reemergence of Financial buyers, spurring further activity from here.

The cost and availability of debt is also a significant factor in financing transactions. Whilst in absolute terms levels are not as supportive as in previous years, the outlook has certainly stabilised this year as we approach the top of the interest rate cycle. This provides greater certainty to incoming investors and improves conviction when pricing deals.

In the near-term, persistent inflation and deteriorating economic conditions will continue to challenge businesses. But there remains a healthy level of investment appetite for the right opportunities, and this should be taken as a positive signal for business owners. For those willing to take a longer-term view, capital options are likely to be available to build resilience or consolidate a market, such that the business is best positioned for the next growth cycle.

Month in a Minute: August 2025

Read MoreStock Story: Arthur J Gallagher

Read MoreMilford on Newstalk ZB: 3 September 2025

Read MoreDisclaimer: Milford is an active manager with views and portfolio positions subject to change. This blog is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to a Financial Adviser. Past performance is not a guarantee of future performance.