Unpredictability can make even the most experienced investor worry.

It is often said that ‘the market doesn’t like uncertainty’ and as uncertainty rises, all other things being equal, you can expect stock prices to be lower. That’s simply because the cloudier the outlook, the bigger the discount investors demand. But you will often see as many shares sold by people escaping the market, as there are being bought by those seeing an opportunity.

Or as Warren Buffett may put it ‘A simple rule dictates my buying: Be fearful when others are greedy and be greedy when others are fearful.’

Investors have been riding high for the past few years and have found themselves caught off guard by the recent market movements, but these movements are a natural part of investing. Russia’s war in Ukraine is heart-breaking and has created concerns for investors, but the factors behind the selloff go beyond just the war. They include concerns about higher inflation, interest rate hikes and the slowing pace of economic growth as we navigate our way out of the pandemic.

To help maintain perspective, if you’re having concerns around volatility and negative performance, the following key points could mean the difference between reaching your financial goals or falling short.

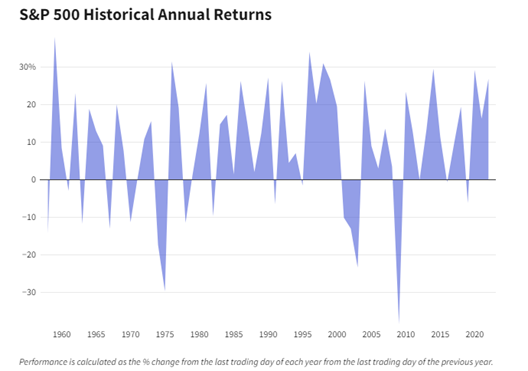

1. No one can predict consistently when market declines will happen.

It’s easy to look back today and say with hindsight that the stock market was overvalued at a particular time and due for a decline. But no one has been able to accurately predict market declines on a consistent basis. During the early part of 2020 with the Covid-19 pandemic here in New Zealand, it was predicted that markets would fall, house prices would fall, and unemployment would rise. While we did see a sharp shortfall in markets the recovery was quick (within 4 months), house prices rose on average 25% and unemployment levels fell.

Source: Investopedia

2. No one can predict how long a decline will last.

Since 1982, with few exceptions, market declines have been relatively brief. Earlier market declines have lasted longer. After the 1929 crash, it took investors 16 years to restore their investments if they invested at the market high. In 2000, it took about five years. But after the 1987 crash, it took about 23 months to get back while the Global Financial Crisis took around two years. The duration of recovery from the 9/11 attacks was 15 days, SARS 40 days, intervention in Libya 29 days, Brexit Vote 9 days. Rare, unexpected events – known as Black Swans – can have severe consequences however the markets have recovered each time. One thing is certain: selling in a decline will lock in your losses and puts you on the side-line should stocks turnaround quickly.

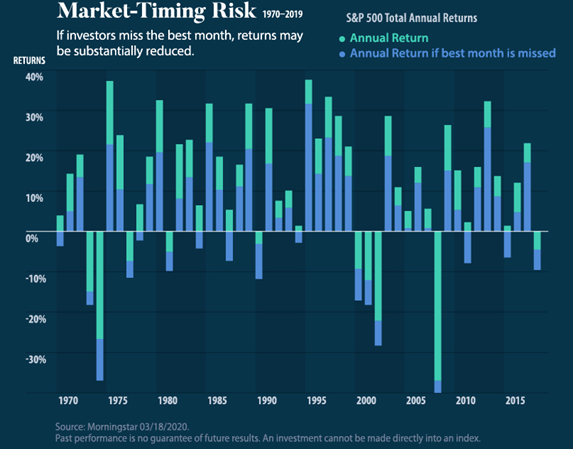

3. No one can consistently predict the right time to get in or out of the market.

Successful market timing during a decline is extremely difficult because it requires a pair of near-perfect actions: getting out and then getting back in at the right time. A common mistake investors make is to lose patience and sell at or near the bottom of a downturn. But even if you have decent timing and get out early in a decline, you still have to figure out when to get back in.

Source: Visual Capitalist

So more than anything else – focus on your goals, understand your risk tolerance, asset allocation and time frame – and try to avoid acting emotionally in times of market uncertainty.