At the time of writing this it has been exactly two weeks since Russia launched its full-scale invasion of Ukraine. It is devastating to think of people whose lives and livelihoods have been put at risk, and I have been reflecting on the Jean Plaidy quote, ‘it is the people who have no say in making wars who suffer from the consequences of them’. There is no good social outcome from this war and financially, it’s important investment strategies actively adapt to the times.

Over the last two weeks, the world has responded quickly to Russian aggression. The United States, European Union and allied countries have imposed a broad range of sanctions on Russia including: curbs on Sberbank – Russia’s largest commercial bank; cutting off a number of Russian banks from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) – making it difficult to move money internationally; freezing Russian assets held abroad; and closures of the European airspace to Russian-owned planes.

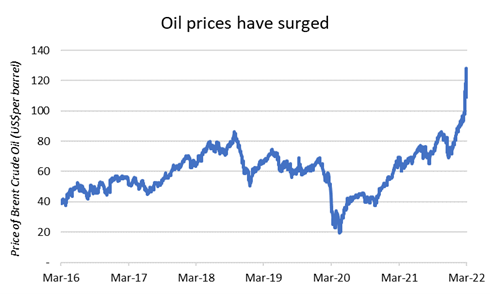

Sanctions were initially designed to avoid disruption of energy flows from Russia, as Russia is a major producer of oil globally, responsible for approximately 12% of global production1 and a significant exporter of oil, particularly to Europe (~2.77 million barrels per day)2 and China (1.67 million barrels per day)3. However, we have now seen United States President Biden announce a ban on all Russian oil and gas imports to America, and the United Kingdom government has announced it will phase out importing of Russian oil by the end of the year. The European Union did not follow suit as it is relatively more reliant on Russian oil compared to the United States and the United Kingdom, however the European Union Commission did announce plans to reduce its Russian gas imports by two thirds through the course of this year. All of this uncertainty around the future supply of oil has caused prices to skyrocket and we saw the price of Brent Crude Oil hit $139 per barrel last week, the highest it has been since 2008.

Source: Bloomberg as at 11 March 2022

There are measures that can be undertaken to alleviate supply concerns. For example, the International Energy Agency had an emergency meeting last week and subsequently released 60 million barrels of oil reserves and signalled that more could be released if needed. We have also seen volatility in the oil price around news that the United Arab Emirates is supportive of an increase in output by the Organisation of the Petroleum Exporting Countries (OPEC), which could compensate for some supply shortfalls created by disruption to Russia’s oil supplies.

Could the green transition come to the rescue? Not in the short term. Recent analysis released by the International Energy Agency demonstrated that global energy-related carbon dioxide emissions rose ~6% in 2021 to their highest ever level4. A significant transition to more sustainable energy sources is essential and it is on the horizon. For example, the European Union Green Deal has the overarching objective for the EU to become the first climate neutral continent by 20505. Experts suggest this conflict will likely accelerate the clean energy transition, as countries look to reduce reliance on Russian energy imports. However, even an accelerated transition will take time.

This means that in the near term, we now look to be facing significantly higher energy prices than we were two weeks ago. Furthermore, it is important to keep in mind that both Russia and Ukraine are also producers of other commodities including wheat, several metals and corn. A sharp rise in these prices will add to the inflationary pressures that we were already seeing and will be a drag on consumers purchasing power.

As investors, we are focussed on finding companies that will be well supported in this environment. This could include commodity producers, their equipment suppliers, or a perhaps less obvious area is the global financial exchanges, which benefit from investor activity to hedge against inflation and volatility in financial markets. We’ll continue to monitor these saddening events and adjust our portfolios accordingly. Diversification and agility are as important as ever.